ECB Council Meeting Review: Complacency Rules the Day!

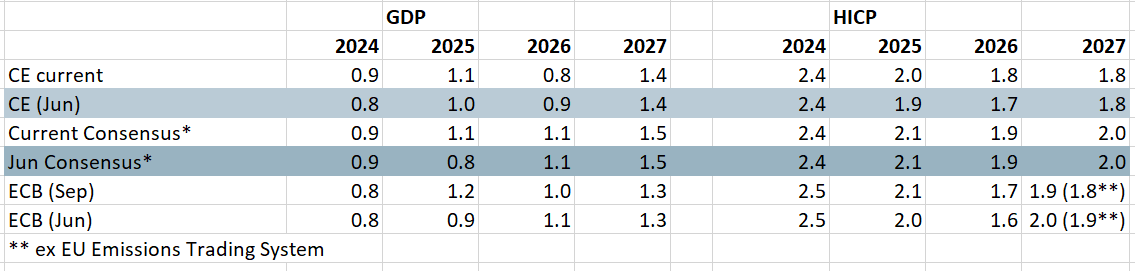

A second successive stable policy decision was the almost inevitable outcome of this month’s ECB Council meeting resulting in the first consecutive pause in the current easing cycle, with the discount rate left at 2.0%. Also as expected, the ECB offered little in terms of policy guidance; after all, in July the Council suggested it would be ‘deliberately uninformative about future interest rate decisions’. Little may be gleaned either from updated economic projections (Figure 1) which only goes to show that an upward revision to the growth picture can be associated with a drop in underlying price pressures. All of which implies that even with growth risks seen as more balanced, this does not mean that disinflation cannot continue (irrespective of what President Lagarde suggested – possibly again speaking somewhat out of kilter compared to Council thinking). The ECB may now be in mode in which something will now have to trigger further easing, but we think this will occur given tariffs and what are still tight financial conditions likely to mean an undershoot of ECB growth thinking. Thus, data dependence will probably trigger two more 25 bp cuts, probably late this year and early next!

Figure 1: The EZ Economic Outlook – Alternative Perspectives

Source; ECB, Bloomberg, CE

If there was guidance in the pre-prepared statement (as opposed to the Q&A) it was more implicit in suggesting an undershoot of core inflation into 2026 and (a slightly larger one) in 2027. This is not so much about the likelihood of further cuts over but, if policy easing has ended, it will be some time before hiking occurs – this possibly an implicit rebuke to markets which have started to price in rate increases from H2 next year.

Admittedly, if the ECB sticks to being data dependent, it cannot completely rule out market thinking, such market pricing would need clear economic swings. It is hard to see HICP inflation picking up strongly given both weakening jobs and wage growth and both direct and indirect tariff repercussions. The ECB may also be wary that any early hiking would only accentuate fiscal plights in some countries, thereby making what are currently budget problems turning into possible budget crisis. It will also be wary that it could add upward pressure to the euro already at record highs in trade weighted terms; NB it is unclear how the euro strength has partly triggered a softer inflation picture given that the currency is largely unchanged from recent months.

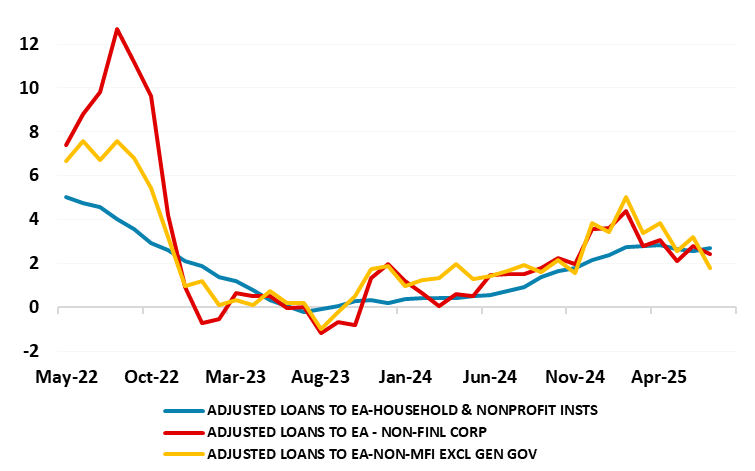

Figure 2: Lending Growth Starting to Ease Afresh

Source; ECB (3-mth ann rates, % chg)

But perhaps the clearest rational for not hiking at anything like the timing markets have started to contemplate is the mere fact that existing easing has yet to feed through fully to either households and particularly firms. Indeed, it is worth noting that while the ECB policy rate has fallen by two ppt, the effective rate for households has fallen by 1.7 ppt but that for firms by a meagre 75 bp (something Lagarde failed to note in her discussion on the topic). In fact, effective borrowing rates may now even be rising afresh given the rise that has occurred in market rates across all maturities. All of which raises the issue of how restrictive are current financial conditions. The idea that policy is neutral and conditions mellowing is something we would challenge given that real credit growth is still negative and where nominal growth rates have slowed clearly of late (Figure 2) amid what still seems to be wariness from banks about lending, particularly to export orientated firms and where the QT program is still having an ill effect. This, alongside the tariff impact (direct and indirect) is the key factor behind out still below consensus real economy outlook and where even if GDP surprises us to the upside, this does not end disinflation (as other factors such as wages and the exchange rate as cited by the ECB) can temper price pressures.

As suggested above, while the ECB may now be in mode in which something will now have to trigger further easing, we think this will occur given what are still tight financial conditions likely to mean an undershoot of ECB growth thinking. Thus, data dependence will probably trigger two more 25 bp cuts, probably late this year and early next, with at least one such move consistent with the ECB’s modest medium-term projected inflation undershoot of target!

.

I,Andrew Wroblewski, the Senior Economist Western Europe declare that the views expressed herein are mine and are clear, fair and not misleading at the time of publication. They have not been influenced by any relationship, either a personal relationship of mine or a relationship of the firm, to any entity described or referred to herein nor to any client of Continuum Economics nor has any inducement been received in relation to those views. I further declare that in the preparation and publication of this report I have at all times followed all relevant Continuum Economics compliance protocols including those reasonably seeking to prevent the receipt or misuse of material non-public information.