German Data Review: Services Inflation Slows Further?

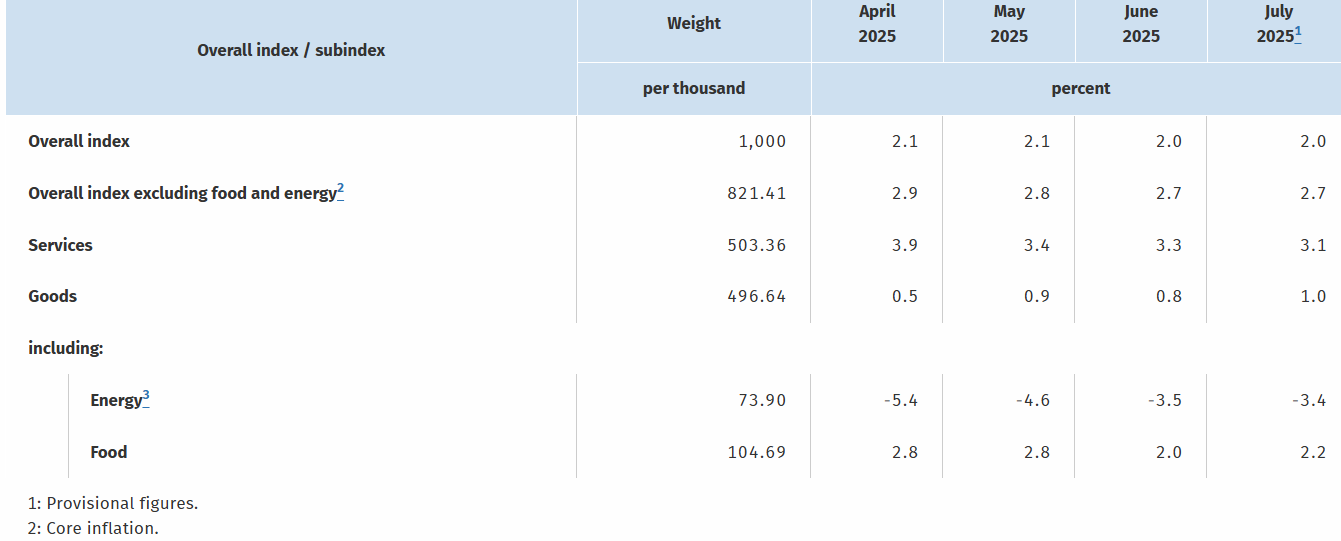

Germany’s disinflation process continues, with the lower-than-expected July preliminary HICP numbers reinforcing this pattern, with a 0.2 ppt drop to 1.8%, a 10-mth low (Figure 1)! This occurred in spite of adverse energy base effects. Regardless, there was some reversal of June’s surprise and marked fall in food price inflation alongside a small further drop in services inflation, the latter posing a downside risk as further calendar-induced base effect unwind]. Thus, the July HICP we see, comes with ‘only’ a 0.1 ppt drop in the core to 2.4% and perhaps staying at 2.5% - the CPI core counterpart was steady at 2.7%.

Figure 1: HICP Inflation Back Below Target?

Source: German Federal Stats Office, % chg y/y

The German June data were bolstered by energy prices – mainly due to fuel prices having dipped more last year than this year – and this was again the case in this time around – actually some small m/m rise seems to have occurred. Moreover, perhaps clear disinflation news may be evident in adjusted m/m data which have shown some fresh downtick in core rates, although this may not proceed discernibly further in the flash July numbers. In fact, adjusted data also suggest disinflation may have stalled (Figure 2), although this may be more a result of recent calendar aberrations than anything underlying. In fact, an unwind of a further calendar distortion could pull services and core back down in July (and not temporarily), this factor too explaining what looks like fresh price pressures in seasonally adjusted short-term m/m movements.

Regardless, these HICP data add to an ever-more reassuring EZ picture where the EZ HICP data (Friday) should a slight deceleration of one notch to 1.9%. French figures earlier today showed price gains of below 1% for a sixth month, while Italy’s rate dropped to 1.7%, albeit partly offset by Spanish inflation which accelerated more than expected to 2.7%. But the EZ July flash may show a further fall in services inflation, thereby calming some of the price-related worries of the ECB hawks.