EZ Rates: 2026 ECB Easing But 2027 French Crisis?

· Financial conditions are tighter than suggested by a 2% ECB depo rate, which will both dampen an EZ economic pick-up and cause further disinflation. We see the ECB delivering two further 25bps cuts to a 1.5% ECB depo rate, which can mean a further decline in 2yr Bund yields. However, H2 will likely see 2yr Bund yields pushing to a 20bps premium versus the ECB depo rate. 10yr Bund yields can ratchet up to 3%, with a pick-up in German issuance and ongoing ECB QT (Figure 1). 10yr Bund yields could also be capped in Q4 2026 by concerns that the May 2027 French presidential election will not prompt a move towards fiscal consolidation. This could see more French fiscal pressures in 2027 and worst case a crisis, which could paralyise the ECB!

ECB policy rates are expected to consolidate in 2026 after the 200bps easing cycle, but what are the prospects for 2 and 10yr Bund yields?

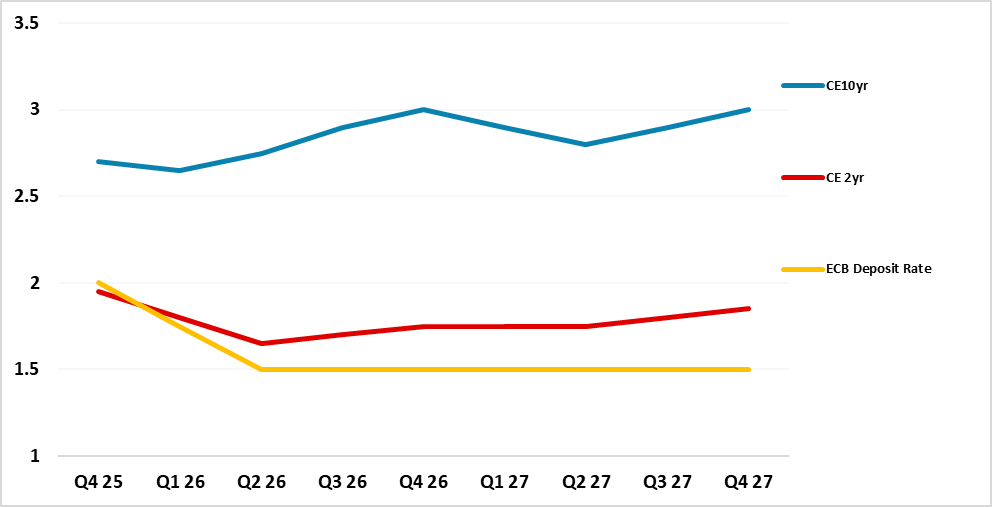

Figure 1: 10, 2yr Bund Yield and ECB Depo Rate Forecasts (%)

Source: Continuum Economics

The outlook for EZ Rates in 2026 appears at first blush to be stable ECB policy rates (with around a 30% probability of a further 25bps cut at some stage in 2026) and a gradual pick-up in German defense and infrastructure spending, with Bund yields having become somewhat becalmed over the last few months. However, we feel that the ECB is underestimating the weak monetary transmission of the 2 ppt reduction in official rates. Lending intentions and loan rejection rates, alongside still elevated lending rates mean that financial conditions are tighter than suggested by a 2% ECB depo rate (here). One of the key reasons is that the ECB exit from ultra-easy monetary policy in 2021-22 is still feeding through with a long lag to mean maturing loans face higher rates. This means no pick-up in the EZ in 2026 and more disinflation pressures. Overall, we see the hawk’s giving way to doves and delivering two further 25bps cuts in the ECB depo rate in H1 2026 to 1.5%. This likely means a further reduction in 2yr Bund yields in H1 2026 (Figure 1).

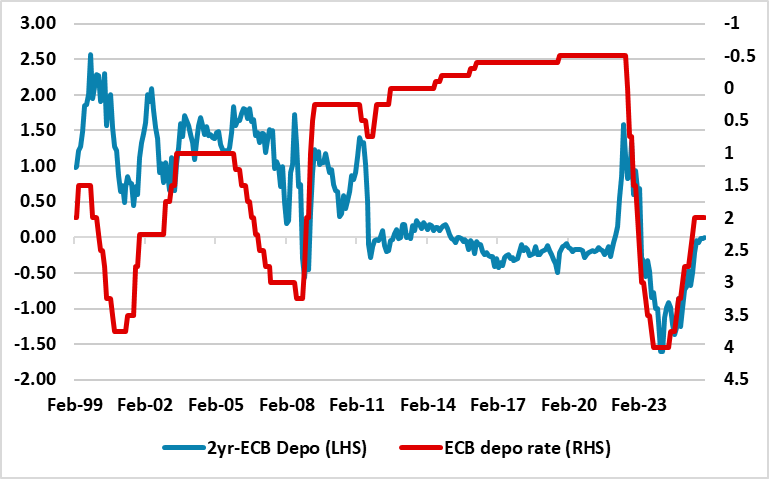

However, the market will then likely take the view that policy rates have finally bottomed, with some of the hawks likely to voice the view that any such 2026 cuts are insurance. Even so, the majority on the ECB will want to maximize the benefit of the monetary policy stance and ECB communications will likely fight ideas that 2027 could see policy rates moving back to around 2% neutral rates. As we have discussed before, neutral rates are a range (here) rather than a specific-point estimate and the ECB will need a 1.5% policy rate for some time to ensure appropriate overall financial conditions. This can limit the traditional swing of 2yr Bund yields to the ECB depo rate in H2 2026 to around 20bps, rather than the 60-140bps seen in 2003-05 (Figure 2).

Figure 2: 2yr Bunds-ECB Depo Rate and Inverted ECB Depo Rate (%)

Source: Datastream/Continuum Economics

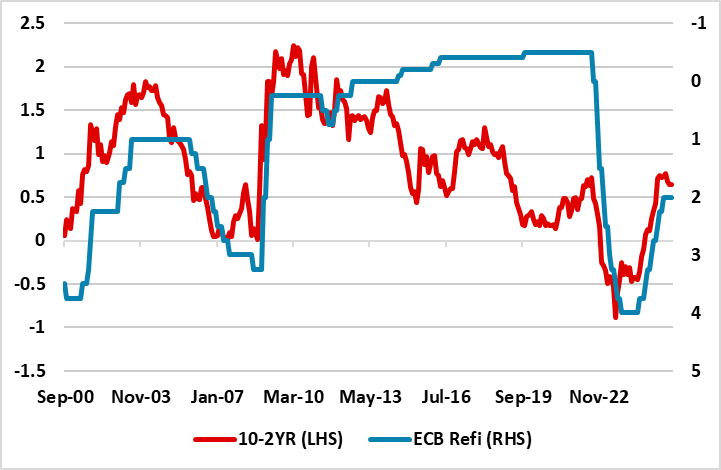

Our 10yr Bund yield forecast is for a modest increase in 10yr yields (Figure 1). The German budget deficit expansion will add to bond supply. Additionally, 10yr real Bund yields still remain low relative to the 1990-08 period and we feel that around a 3% range is more appropriate as a medium-term equilibrium. ECB QT also adds to the net bond issuance that the bond market has to digest. The 10-2yr yield curve can steepen to over 100bps, though this is not as steep as 2003-05 (Figure 3) but then into 2027 will likely flatten somewhat (Figure 1). Additionally, as part of the process of improve financial conditions, we also feel that the ECB will slow APP and PEPP QT in 2026.

Figure 3: 10-2yr Bund Yield Curve and Inverted ECB Depo Rate (%)

Source: Continuum Economics

The 2026 EZ rates forecasts are also influenced by the prospects for 2027. We shall look at this in further detail in our December Outlook due on December 19. However, it is worth mentioning that 2027 could be overshadowed by French fiscal and political tensions that could turn into a crisis. The focus is on the May 2027 presidential elections, where the two stage process means that other major parties will likely rally around a candidate (as yet unclear who this will be) to support a National Rally candidate winning. However, a new president will be faced with parliamentary deadlock and will therefore will face a choice of waiting until 2029 when they are due to hold parliamentary elections or go earlier to try to break the deadlock and get a majority for fiscal consolidation. Current opinion polls suggest that the three way split in the electorate remains and this argues against a post presidential election shift towards a government that can undertake the necessary fiscal consolidation. Further credit agency downgrades and foreign selling on French government bonds will likely be the result as will economic weakness which may only exacerbate fiscal fragility. At a minimum, fiscal tension throughout 2027 and at worst a H2 2027 French fiscal crisis! This can cap 10yr Bund yields in 2027 and as early as Q4 2026.

This is also a dilemma for the ECB. The ECB would find it difficult to tighten in such circumstances, while disinflation forces could also occur from the expected jump in global LNG exports in Qatar/U.S. and the 2028 energy tariff rejig (here). ECB President Lagarde would also be reluctant to lead arguments for tightening given her term ends October 2027 and given the importance of France to the EZ. Worse if a French budget crisis occurs then the ECB could be under pressure to use the Transmission Protection Instrument (TPI), which would split the ECB with the hawks concerned that a French government could not guarantee the necessary fiscal consolidation. The 1st step for the ECB in the scenario of a French budget crisis would likely be a further slowdown in APP and PEPP QT. The one positive political for the ECB in 2027 is that Italy’s PM Meloni will likely be reelected in October 2027 through with a rejigged coalition but still supporting fiscal consolidation.