Eurozone: Data Disappointments Off the ECB Radar

Although not fully high-profile,and mostly off the radar that the Council focuses on. the last few days have brought a series of data releases that will disappoint the ECB, certainly the hawks. These range from weak services production data, further signs of a loosening in the labor market and more signs of consumer caution in the form of marked rise in the household savings rate. These are all important as they conflict with the ECB’s repeated assertion regarding the resilience of the EZ economy and instead actually suggest that underlying growth (ie ex volatile Ireland) may actually have slowed from the 0.1%-0.2% q/q increase seen in the last few quarters. Moreover, the data question the ECB’s above-consensus consumer outlook into next year!

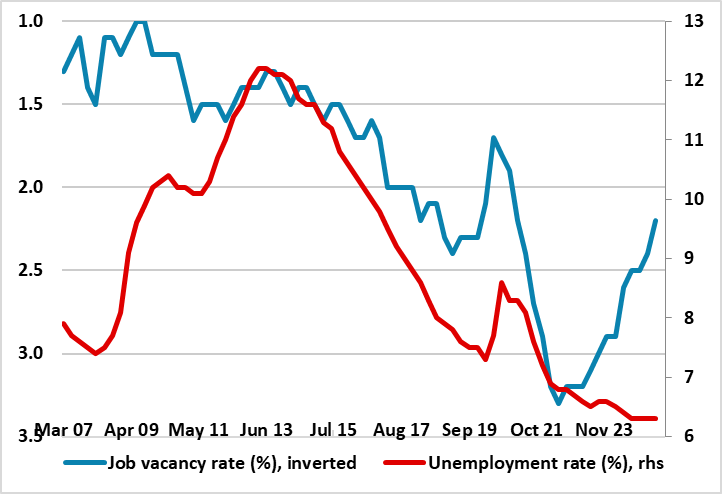

Figure 1: Vacancy Drop a Better Guide to Labor Market Conditions

Source: Eurostat, CE

It is unclear why the ECB chooses to focus on PMI data to ascertain how the EZ economy is faring. Admittedly this survey data is punctual and coincident but unlike European Commission survey covers only the major economies and far from reflects the breadth of activity in the main sectors, particularly services. In fact, while the ECB September Council meeting suggested that survey indicators suggested that both manufacturing and services continued to grow, actual official data for services have fallen in three of the last four months of data while the omens for manufacturing look ominous given the slump occurring in Germany.

The ECB also suggest the EZ enjoys a strong labor market – after all the jobless rate is near a record-low. Bu this is more a reflection of swings in the workforce that masks survey data which suggest companies are already reducing their workforces. In fact, and possibly providing a better picture of the overall tone of the labor market Q2 vacancy data fell further, a drop that conflicts with the message a superficial conclusion one might get from looking purely at the jobless rate (Figure 1).

But perhaps the main downsize surprise the ECB will have to contend with was the jump in the household savings rate in Q2, up 0.3 ppt to 15.4% of disposable income, the joint highest reading since the emergence from the pandemic and very much at odds with the downtrend (of over one ppt) built into ECB projections out to 2027. Admittedly, this projection has been met with some scepticism from some Council members and we would very much echo their misgivings. In particular, given that uncertainty about the EZ and global economy is not expected to fade any time soon (an ECB view which we share), it would be normal for households, in such conditions, to save more for precautionary reasons, rather than dis-save. Indeed, consumer surveys suggest no appetite to reduce savings rates. Moreover, there remains evidence that households’ perceptions regarding their real disposable income were still scarred by the high-inflation episode, making and positive consumption to recently increasing purchasing power to be both moderate and gradual, especially given the still resounding impact of the multitude of shocks that had hit the economy over recent years. In addition, household may have started to expect higher future taxes and lower welfare spending, as the current geopolitical situation was forcing governments to spend more on defence. This ‘Ricardian effect’ illustrated the likelihood of fiscal policy playing an important role in the future dynamics of the household saving rate and private consumption.

Thus the positive ECB view for the consumer is partly undermined by likely household saving caution, this likely to be accentuated by a labor market, already showing job weakness which may continue after that has been a clear period labor hoarding by EZ firms. Real wages are unlikely to help – unless inflation surprises on the downside – a risk we very much entertain!