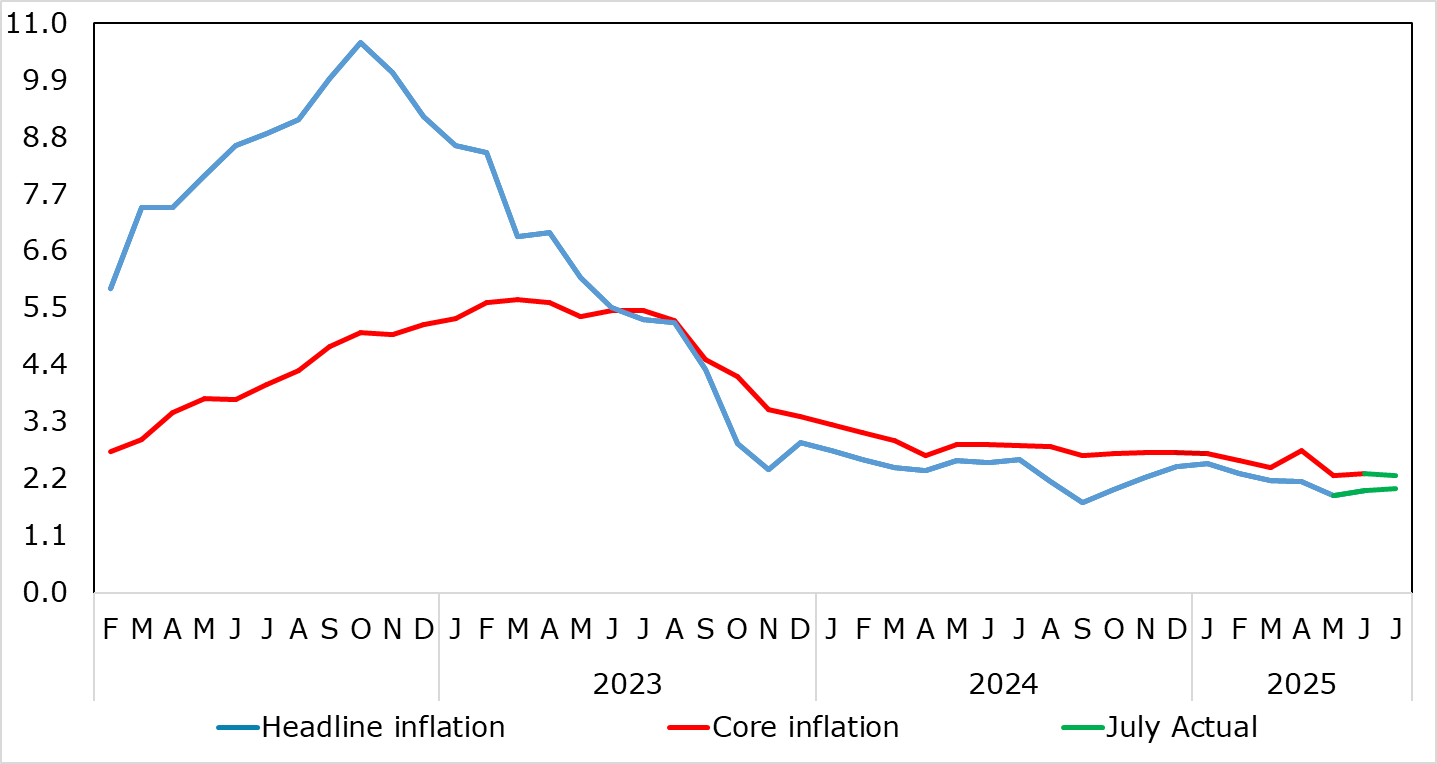

EZ HICP and Jobs Review: Headline at Target as Services Inflation at Fresh Cycle-low

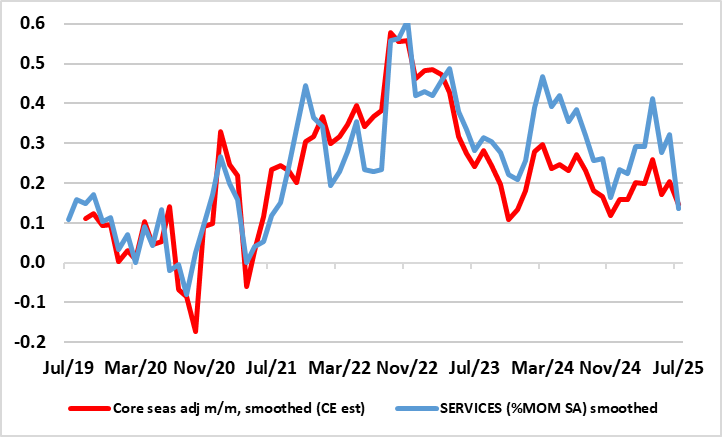

HICP, inflation – still at target – is very much a side issue for the ECB at present, albeit with the likes of oil prices and tariff retaliation and a low but far from authoritative jobless rate (Figure 3) possibly accentuating existing and looming Council divides. Regardless, despite adverse energy base effects, we correctly saw the flash July HICP staying at June’s 2.0% but up from May’s eight-month low and below-target 1.9% (Figure 1). More notably, and something to calm those hawks, having jumped to 4.0% in April, very probably due to the impact of the timing of Easter we envisaged further calendar effects taking it down to 3.1% in July - the softest since Mar 2022. Even so result, the core rate stayed at 2.3%, the lowest since Oct 2021. Moreover, as those calendar distortions unwind, what has looked like fresh price pressures in seasonally adjusted short-term m/m movements for core and services are reversing and notably so (Figure 2)!

Figure 1: Headline Back at Target as Services Hits Cycle-Low

Source: Eurostat, CE, % chg y/y

The July HICP data was dominated on the upside by higher energy (fuel) prices and food costs. This is important as such largely non-discretionary items will add to spending power problems for households. Otherwise base effects were the order of the data, this pushing up y/y non-energy industrial goods and energy, but also to some extent services. Even so, services y/y inflation slipped to new cycle low of 3.1%, but this masks a clear(er) underlying slowing that has also helped pull the core rate don on a smoothed adjusted m/m basis (Figure 2).

Figure 2: Core and Services Inflation Already Around Target in Shorter-Term Dynamics?

Source: Eurostat ECB, CE, smoothed is 3-mth mov avg

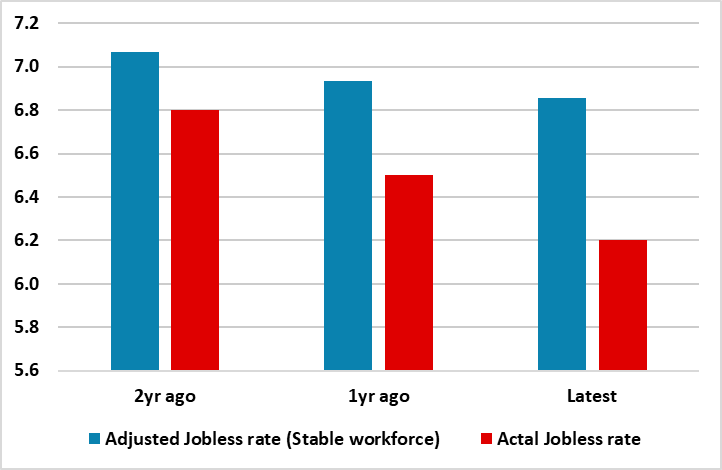

Elsewhere, alongside the HICP data came the June labor market report with the jobless rate revised back down to a record-low of 6.2%. This rate is very volatile is poor indicator of labor market tightness.

Figure 3: Record-Low Jobless Rate More Supply Than Demand-Driven

Source: Eurostat, CE

Indeed, rather than a robust labor market where the record low jobless rate is a reflection of demand, the opposite is more the case. As a Figure 3 shows, in what is purely illustrative, if the denominator in computing the jobless (ie the workforce) is left at the level seen two years ago, we see that the jobless rate falls a year and two years after would be both much smaller and less rapid. This is even more evident in Figure 2 which shows the vacancy rate that the ECB referred to relative to the jobless rate. The vacancy rate (very much a reflection of employer’s’ demand for workers) has been falling for the last two years, thereby deviating from the on-going drop in the jobless rate and further highlighting how the latter is very much supply driven.