German HICP Preview (Oct 30): Headline Core To Edge Down as Disinflation Resumes?

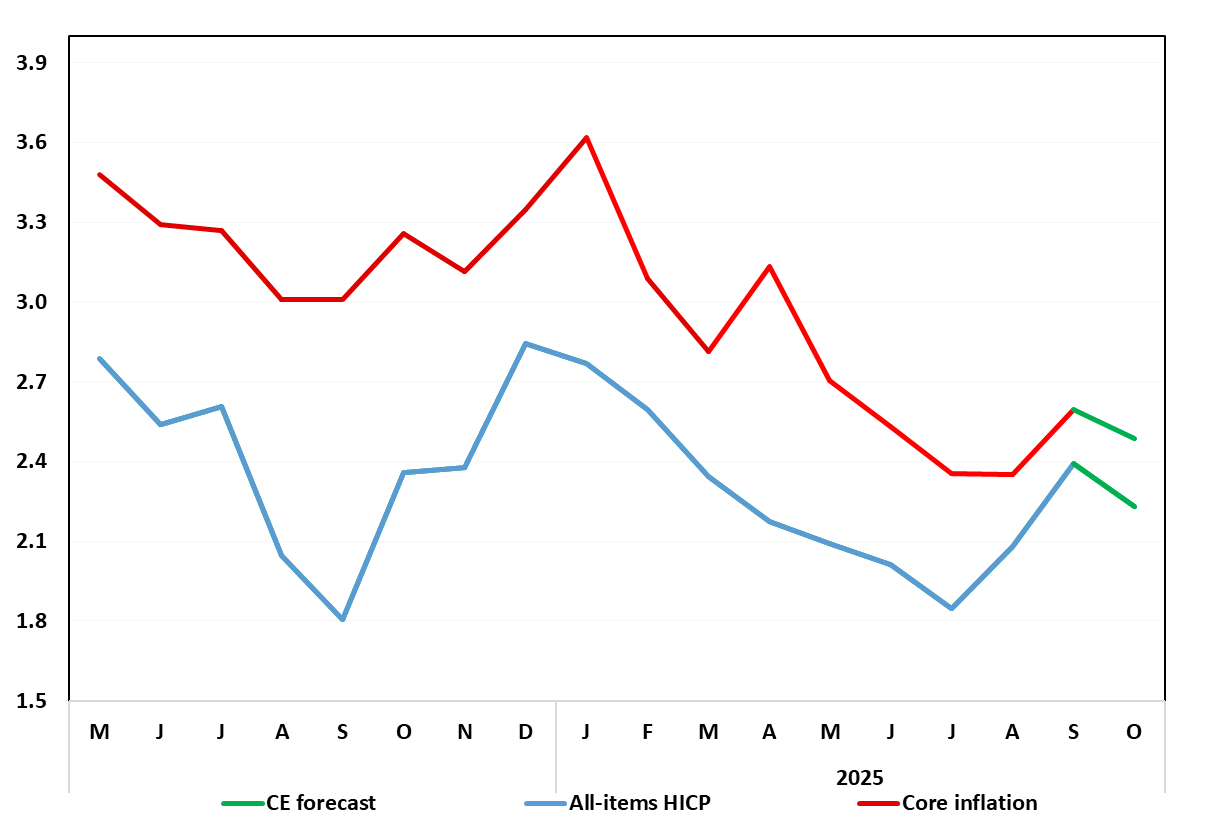

Germany’s disinflation process hit a further and more-than-expected hurdle in September, as the HICP measure rose 0.3 ppt for a second successive month, thereby even more clearly up from July’s 1.8% y/y, that having been a 10-mth low. But we see most, if not all, of this rise being reversed in the October numbers to 2.2% (Figure 1) and with more falls in the headline and core to come into 2026. This (again) may come in spite of energy base effects but with service prices this time contributing slightly to the downside – refreshing a softening trend for the latter. If so, the result would see the CPI core back down a notch to 2.5%). Regardless, as we have suggested before, core adjusted data are telling a more reassuring tale (Figure 2).

Figure 1: German HICP Inflation to Resume Downtrend?

Source: German Federal Stats Office, CE

The German August and now September data were again bolstered by energy prices – mainly due to fuel prices having dipped more this time last year than this year. However, such base effects should now start to unwind and a fresh fall should resume in Q4! The question is how aberrant is the seemingly vacation induced rise in services inflation that was evident in the September CPI figures – this all the more puzzling given survey and wage data suggesting a still weakening trend

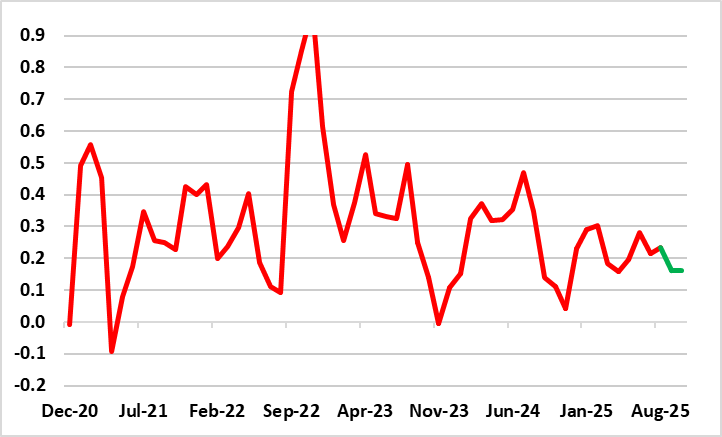

Regardless, perhaps continued disinflation news is evident in adjusted m/m data which have shown some fresh downtick in core rates even though this does not seem to have proceeded discernibly further in the August numbers. But, we think the October HICP details will continue this with a core reading between 0.1% and 0.2% in adjusted m/m terms (Figure 2).

Figure 2: German Adjusted Core Rate Drop Already at Target?

Source: German Federal Stats Office, CE, % chg m/m seasonally adjusted and smoothed

We still see German inflation moving back below 2% by year end.

I,Andrew Wroblewski, the Senior Economist Western Europe declare that the views expressed herein are mine and are clear, fair and not misleading at the time of publication. They have not been influenced by any relationship, either a personal relationship of mine or a relationship of the firm, to any entity described or referred to herein nor to any client of Continuum Economics nor has any inducement been received in relation to those views. I further declare that in the preparation and publication of this report I have at all times followed all relevant Continuum Economics compliance protocols including those reasonably seeking to prevent the receipt or misuse of material non-public information.