Eurozone: ECB Feels it Has More Reason to ‘Wait and See’?

To suggest that recent EZ real economy indicators, such as today’s August PMI flashes, have been positive would be an exaggeration. But, at the same time, the data (while mixed and showing conflicts - Figure 1) have not been poor enough to alter a probable current ECB Council mindset that the economy is showing ‘resilience’. This the Council will largely be of the view so that it can and should wait for more data before considering any further policy easing. This is backed up by signs that the disinflation process may have bottomed out, albeit with price pressures consistent with targeted inflation. As a result, we no longer envisage the ECB cutting rates again next month. However, still concerned about economic fragility ahead, we still adhere to a view where further policy easing will occur, just that the probable further 50 bp cumulative cuts will arrive in two steps, but now 2-3 months later than previously thought, ie now Q4 and then the first quarter of 2026.

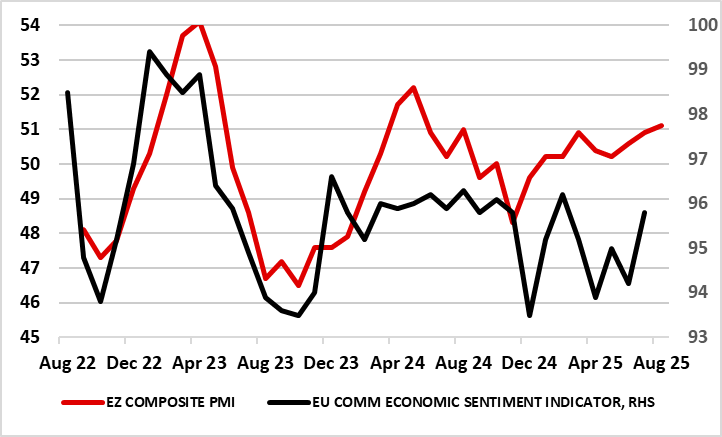

Figure 1: Divergent Business Survey Complicate EZ Economy Outlook?

Source: European Commission, Markit, CE

As for the composite PMI numbers, and unlike ECB Council thinking, we do not feel the data are authoritative, not least as while purporting to be a guide to the private sector, they do no include key and volatile sectors such as finance, retail and construction. Indeed, if an aggregate PMI is computed which encompasses construction, it is likely to be consistent with on-going contracting real activity, unlike the composite. And as for the latest PMI flash, we are puzzled by the complete omission of any mention of the tariff impact – actual or projected - this despite the recent ‘deal’ with U.S. having resulted in a worse overall scenario for the EZ than was largely expected and where uncertainty remains ahead given the lack of any detail as to what may occur regarding pharmaceuticals – the EZ’s main export to the U.S.

In fact, whatever message these PMI numbers do provide, offers little guidance to the months and quarters ahead where we think the U.S tariff reality looms large and threateningly, as European Commission survey data very much highlights. Indeed, this alternative business survey reading offers diverging signals to the PMI (Figure 1), the Commission data very much undermined by a weak and possibly understandable manufacturing response that very much conflicts the better factory sector signals seen in the PMI and which may have prompted the recent ECB assertion that ‘surveys point to an overall modest expansion in both the manufacturing and services sectors’. Given what is a very unfavourable trade deal with the U.S. we tend to identify more with the still sobering outlook (ie very much below par) offered by the Commission data, especially as fresh falls may be in the offing as the trade agreement takes effect! In addition, we are also wary of the weaker services signals that all surveys seem to be showing, this possibly chiming with what is still fragile consumer backdrop made worse by a downturn in the labor market.

Against this backdrop, we still adhere to a view where further policy easing will occur, just that the probable further 50 bp cumulative cuts will arrive in two steps 2-3 months later than previously thought, ie now Q4 and then the first quarter of 2026.