Eurozone Outlook: Running to Keep Fiscally Still?

· Amid what may still be tightening financial conditions and likely protracted trade uncertainty, we retain our below consensus activity forecast for 2026 but see a fiscally driven pick-up into 2027. However, the picture this year appears to be slightly better but the economy has actually been growing below-par on an underlying basis.

· This continues to reflect from late 2026 the competing forces of planned defense and infrastructure-induced fiscal expansion in the EU against the activity and a lingering tariff threat from the U.S. This contrast of near terms risks and medium-term hopes has persuaded the ECB to pause, if not end its easing, but we still forecast two more cuts in this cycle to a 1.5% ECB deposit rate, now more deferred than previously thought.

· Details of the well-flagged fiscal expansion are still unclear but we feel it may be less sizeable, take longer to exercise and be less broadly spread across the EZ especially given challenging fiscal positions in many EZ economies. A fiscal crisis is not a given but financial conditions may remain tighter for longer than otherwise!

Forecast changes: Compared to the last outlook, we have on balance made no net change to the overall EZ growth outlook, but pencilled in a higher but fiscally driven more trend-type 2027 projection. As notable then is the hardly-revised and still-soft EZ HICP inflation outlook in which the target is undershot on a sustained basis into early-2026 and now into and through 2027.

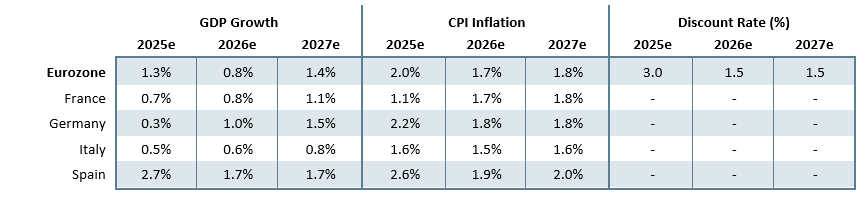

Our Forecasts

Source: Continuum Economics, Eurostat

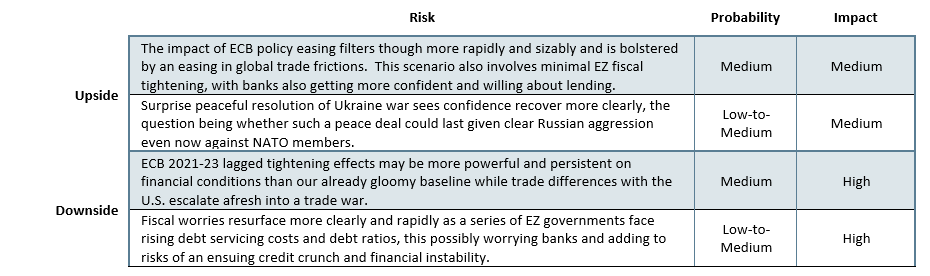

Risks to Our Views

Source: Continuum Economics

Eurozone: Fragility Continues

We remain somewhat sceptical about the apparent resilience, if not robustness, some are asserting about the EZ economic backdrop and even outlook. For a start, for an economy that has seen repeated upside GDP surprises, and apparently above trend growth, now some 1.4% in the year to Q3, GDP data do not seem to have much impact in derailing disinflation. Indeed, we continue to see sub-2% target inflation now through into 2027 and where the projection for the latter may be too high depending on whether EU Emissions Trading System levies will be applied (they may be deferred until 2028). Moreover, HICP inflation is seen dipping clearly into early-2026, possibly to 1.5%, something flagged by business survey selling price expectations. We continue to assert that weaker price pressures of late have been mainly supply driven. Thus, with weak(er) demand ahead (household spending is seen with further growth of just over 1% in 2025 and the following two years and rising just ahead of disposable incomes) this should prolong, if not accentuate, such disinflation.

All of which has made policy-makers comfortable that inflation is under control. But real activity data, not least PMI numbers, have made the ECB note how the EZ is showing resilience. We are wary about such survey numbers, with survey data that includes the recession bound construction sector telling a sorrier tale. Moreover, it is still uncertain how businesses will react to the so-called trade deal with the U.S. and/or how the banking sector will reassess risks, especially if the U.S. shifts its focus to services trade rather just goods. Notably even if the U.S. Supreme Court rules otherwise, the EZ seems locked into 15% tariffs given its trade deal. This is not as onerous as we once feared and where we have not made any adjustment for what may be a re-routing of Chinese exports to Europe, damaging EZ growth and adding to downside price pressures into 2026 – NB: import prices have already fallen in virtually every month so far this year. We see largely flat GDP growth for this and the next quarter, with a 1.4% 2025 average growth but somewhat less in 2026 at 0.8% involving 0.3 ppt upgrade for 2025 due to base effects!

Regardless, perspective is needed, perhaps more so than usual. As we have stressed before, recent GDP data gains have been predicated on both a surge in Irish GDP as well as what was seems to have been an inter-related EZ export jump in anticipation of the U.S. tariff imposition from April. Thus the 2026 outlook is actually merely an extension of the ex-Ireland EZ GDP average growth rate of around 0.2% q/q in the last 6-8 quarters.

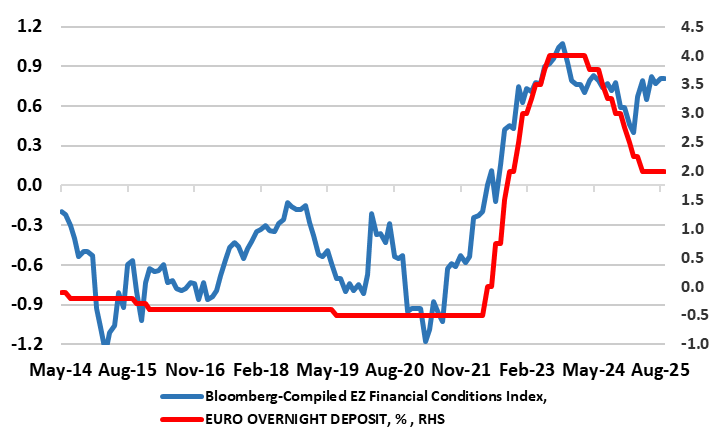

But the 2027 outlook is more encouraging as both the German fiscal stimulus and EU-wide defense build-ups take effect, this actually pointing to a gradual q/q pick-up in GDP through 2026. As for 2027 we have pencilled in a consensus-like 1.4% but still with downside risks on balance. This outlook reflects a host of uncertainties, some to do with the timing of likely fiscal and defense initiatives and some to do with to what degree they may boost EZ growth only modestly due to the likely large import content to begin with. Doubt also exists over the extent to which the economy may be tempered by what may be more sustained or protracted tightening in financial conditions (Figure 1) due to interest and exchange rates being higher than otherwise would be the case. Banks still show wariness about lending to firms, something that will add to restraint regarding capex over and beyond uncertainty. Indeed, there is also increased uncertainty emanating very much from political divides and policy paralysis in several countries (clearly France) and where, as suggested above, greater fiscal consolidation measures from several countries that will continue beyond next year. As for impact on the current account balance, the anticipated cyclical, and possibly structural, recovery in imports seen ahead, as well as what may be a weak global economy weighing on exports, will also mean that the improvement in the current account surplus last year (at around 2.6% of GDP) may reverse into 2026 and possibly even more so in 2027. This is also a headwind to GDP growth.

Figure 1: Are Tight(er) Financial Conditions Restraining Activity?

Source; Eurostat, CE, Bloomberg

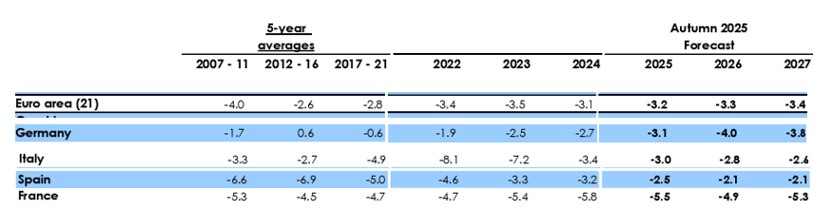

Fiscally, to suggest the backdrop and outlook is mixed would be an understatement. The overall EZ budget situation is likely to see small increases to above 3% of GDP into 2027, with the primary deficit largely stable at -1.2% and the structural gap similar to the headline numbers. But this masks marked differences among EZ members not least the Big 4 we assess in the Outlook (Figure 2). France is seeing policy paralysis; Italy running to keep fiscally still; Spain on an immigration induced-cyclical improvement and Germany a genuine fiscal swing and boost.

Figure 2: Sharply Diverging Fiscal Trends

Source: European Commission

Regardless, the fall in the EZ government debt ratio to 88.5% of GDP last year will likely soon be followed by a rise toward 91% in 2027. These fiscal divergences raise policy question and make the job of the ECB harder; it is thought the central bank may wish to be more vocal in its fiscal criticism through 2026. But this may make it harder to use its TPI tool on any credible basis if what are current fiscal problems turn into genuine crisis.

ECB: Nearing But Not Yet the End?

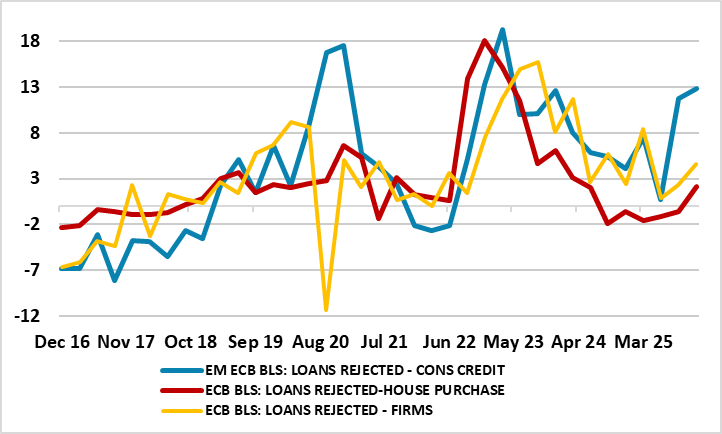

A fourth successive stable policy decision will be the almost inevitable outcome of this month’s ECB Council meeting resulting, with the discount rate left at 2.0%. The likely unanimous vote will mask splits about whether policy has troughed or not, this mainly a result of differences within the Council as to where inflation risks lie. But the ECB Council is likely to reassert that downside growth risks have dissipated somewhat, so that the current policy stance ‘in a good place’. Regardless, we think that the ECB may be overlooking a backdrop where the monetary transmission mechanism is not running as smoothly as it alleges. Indeed, even in nominal terms private sector credit growth has slowed. Moreover, we have highlighted several symptoms of a monetary policy transmission mechanism that, rather than functioning smoothly and effectively, is doing the very opposite and maybe increasingly so. These include survey evidence suggesting banks being increasingly willing to reject loan applications completely (Figure 3), something completely overlooked at the last ECB meeting!

Figure 3: Banks Now Rejecting More and More Loan Applications

Source: ECB BLS, % balance

We still see a further two 25 bp rate cuts by mid-year and policy then being on hold into and through 2027. But even if ECB easing has ended, it is hard to see any early policy reversal, not least as it is difficult to see HICP inflation picking up strongly given both weakening jobs and wage growth and both direct and indirect tariff repercussions. The ECB may also be wary that any early hiking would only accentuate fiscal plights in some countries, thereby making what are currently budget problems turning into possible fiscal crisis. It will also be wary that it could add upward pressure to the euro, already at record highs in trade weighted terms, this clearly seen as disinflation issue for the ECB. Some hawks maybe inclined to an eventual shift back up to 2%, but overall ECB communications will likely lean against any early talk of normalisation throughout 2026 and probably 2027. Additionally, alongside ECB rate cuts in 2026, we see the ECB slowing APP and PEPP QT to try to reduce the damage to the monetary transmission mechanism.

Germany: No Fiscal Blank Cheque

Germany has suffered seemingly persistent paralysis, with tariffs, the stronger exchange rate, political tensions and uncertainty all hurting its aging and out-dated economy. In perspective, the German economy has on average, shrunk by 0.1% in every single quarter since end-2022. But the question is not just whether the planned landmark fiscal expansion will end this adverse run but if it will do so a sustained basis driven by a gradual but lasting acceleration of domestic investment and consumption. In this regard, Germany’s leaders have an array of factors to consider not least on the downside by clear and continued stagnant workforce aging and subdued productivity growth. Thus the key is how the intended fiscal space can be utilised to boost the economy’s longer-term productive capacity which even with some inclusion if fiscal developments the European Commission still see at nothing more than around 0.6% even into 2027.

The 0.1 ppt upgrade to 0.3% of the GDP growth picture this year still implies a large output gap of up to 2% of GDP that makes us even more confident of continued disinflation. Indeed, we retain our below consensus 2026 CPI picture, this reinforced by an unrevised 2026 GDP projection to 1.0%. This partly reflects the now more clarified and slightly reduced, but still onerous, U.S. tariff threat (and possibly protracted) uncertainly. Regardless, the hopes for marked fiscal expansion alongside a distinct defence build-up remains more a story for late next year and into 2027 where we are pencilled in a GDP outcome of 1.5%. Even so, it would be wrong to overstate the impact of the planned German debt surge. Multiple challenges will impede the government’s spending plans. First, there is the (In)famously slow procurement process for military equipment widely regarded as overly bureaucratic. Secondly, there are the existing capacity constraints in the German and European defence sector. Similar constraints may also hamper infrastructure investment so we suggest the fiscal reforms need to be accompanied by administrative reforms which may be drawn out by coalition differences. Finally, there is the weakness, if not divides, within the coalition government now emerging, even within Merz’s own party. This is unlikely to lead to an early election as neither of the two incumbent parties will want to contend with the right-wing AfD, currently leading in some polls.

The bottom line is that a German budget gap that otherwise looked to be around 2% of GDP could turn into one of well over 4% (both headline and structural) probably not this year but into 2027. As a result, the government debt ratio would rise from its current 63% of GDP toward 80% over the next decade possibly without negative repercussions – not least as Germany has already suggested EU-wide fiscal rules (which this initiative compromises) need to be relaxed. But added government spending will boost imports. As a result, it looks very likely that the circa-6% of GDP current account surplus seen this year will be reduced down towards 4% in 2026 – both helping growth elsewhere and politically speaking addressing the source of what may be persistent trade tensions.

But added uncertainties include the stronger euro adding to already deteriorating competiveness (particularly perturbing the Bundesbank), helping explain the current economic weakness that forward looking indicators (ie orders) suggest will persist in both industry and the equally recession-bound construction sector. Into 2026, tariffs and high global uncertainty are expected to continue weighing on investment and exports. However, these effects are counterbalanced by higher public spending, which will support consumption and overall investment particularly into 2027, the former helped by an assumed decline in what is very high savings rate. Residential construction activity is expected to begin recovering from 2026 onwards, as indicated by an emerging increase in building permits and orders. But with the labour market is likely to remained weak and joblessness on the rise little further pick-up is in store for 2026.

France: Joining the Peripherals?

It is said that time is the great healer. But for what are currently somewhat patient French financial markets the likelihood is that as the current political and fiscal deadlock - even looks like extending into 2027 - then matters may change. Indeed, as we start formally to look into 2027, ie when the next presidential election is scheduled, the risks are very much that what are currently merely French fiscal and political tensions could turn into a genuine crisis. The French political system is partly to blame; the two stage process of French elections means that parties of the left and of the centre will likely rally to stop National Rally candidates (currently ahead in the polls) winning. This implies more parliamentary deadlock. Further credit agency criticism and even downgrades may be the result as will economic weakness, the latter both exacerbated by fiscal policy consolidation and greater budget problems.

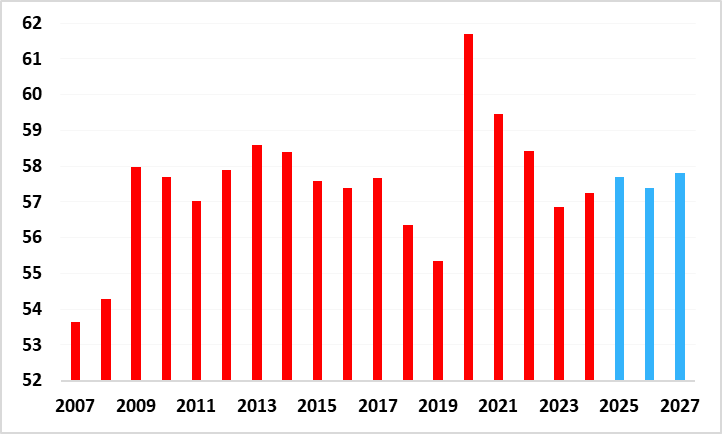

Admittedly there are other, often conflicting considerations. Unlike the GFC of a decade ago, the channel of contagion from the banking system to the real economy is much weaker in France as French government bonds account for roughly 2% of major internationally focused French bank assets, thus limiting the risk of a “doom loop”. It is also the case that France’s fiscal woes are not a question of economic imbalances as France is running a (modest) current account surplus which we see persisting out into 2027. But it is still the case that France is penned in by the fact that overseas investors are significant holders of French sovereign debt, with non-residents holding over half of France's sovereign debt. It is also notable that French public spending is the(second) highest in the EU and seems set to rise (Figure 4).

Admittedly, French sovereign spreads remain well below that of the UK despite higher debt and deficit in France. We suggest this is largely a result of France being part of the EZ and where the ECB offers some protection – albeit where France’s current politics-driven fiscal woes suggests the much vaunted TPI tool is highly unlikely to be used. Instead, it is the current low level of ECB policy rates that is cushioning the French market on a relative basis. Thus, given our view that policy rates will still likely fall further, the latest French government can afford to kick the fiscal can further down the road. However, this may be only for the time being as when the ECB starts to tighten afresh (or even visibly contemplate this), market scrutiny of France will intensify. The question is whether French fiscal fragility may act to dissuade the ECB from early tightening, this also being a key question and issue for 2027!

Yet again, we have made little change to the already soft and fragile French economic outlook for this year or next, albeit seeing GDP growth a notch higher this and next year to 0.7% and 0.8% respectively. Notably we see a pick-up is 2027 to 1.1% on the back of fiscal expansion in Germany and better net exports partly related to increased EU defence sending (France’s large defense industry provides almost 10% of global arms exports). But the risks are clear from the above analysis, hence the revision down 0.2 ppt 2026 (to 0.7%). Notably, we do not see France being a major part of any clear defense-based fiscal expansion given its adverse budgetary backdrop and outlook. Indeed, the European Commission has made clear that countries should consider ramped up defense spending – ‘if they have the fiscal space’. And even with what may soon be watered down EU fiscal rules, a French budget gap (both headline and structural) that may be over 5% of GDP even beyond next year risks seeing the debt ratio rise even further on the back of a high primary deficit, rising interest payments and soft nominal growth (likely to rise toward 120% of GDP maybe as soon as next year).

However, the soft growth outlook will reinforce the broad disinflation already very much evident in our unrevised projections. In fact, CPI inflation at 1.1% this year may rise possibly amid some fiscal measures but is likely to stay under 2% through to 2027. This inflation picture reflects a continued reining in of pricing power and a rise in the unemployment rate back above 8% into 2027 and where companies are likely to see profit margins fall further!

Figure 4: France’s Already High Government Spending Set to Rise Further (% of GDP)

Source: INSEE, (European Commission forecasts for 2025-27 in blue)

Italy: Running to Keep Fiscally Still?

For a third successive Outlook, we see little rationale to alter our growth projections which are now consensus-like. GDP data of late have been moving sideways and even with a small positive increase projected in the final part of the year, GDP is forecast to grow by 0.5% in 2025. Private consumption is expected to continue expanding at a moderate pace, slightly exceeding that for GDP, this despite persistent uncertainty likely to see the savings rate stay above 12% of disposable income through the forecast horizon. Into 2026, fixed investment is set to accelerate, buoyed by EU RRF-backed non-residential construction projects, this offsetting a housing investment outlook still retreating, as the phasing out of tax credits is only partly offset by privately funded works. Investment, still propped up by the RRF, is set to continue growing, mainly thanks to construction activity. Net external trade is still forecast to weigh on GDP growth in 2025 and 2026, as exports recover less than imports (which are pulled by relatively strong domestic demand). But by 2027, household consumption, helped by a solid labor market (featuring record-high labor force participation) and actual real wage growth of 1%-plus, may be the main growth driver, as investment slows down following the end of the RRF. Based on an expected moderation in import growth, this points to GDP growth of 0.8% in 2027, 0.2 ppt above our unrevised 2026 forecasts. As a result, we see the current account surplus staying just over 1% of GDP to 2027 but with upside risks at time goes by as Italy’s large arms exports (5% of the global market) benefits from rising EU defense spending and where import prices may continue to drop.

Even so, bank lending is showing barely any positive growth in the corporate sector – this possibly as much a result of bank wariness amid stubborn non-performing loans of firms. Another downside risk is that the wind-down of the Superbonus actually triggers a larger and more persistent contraction in housing investment, the latter having been a key source of growth over 2021-23.

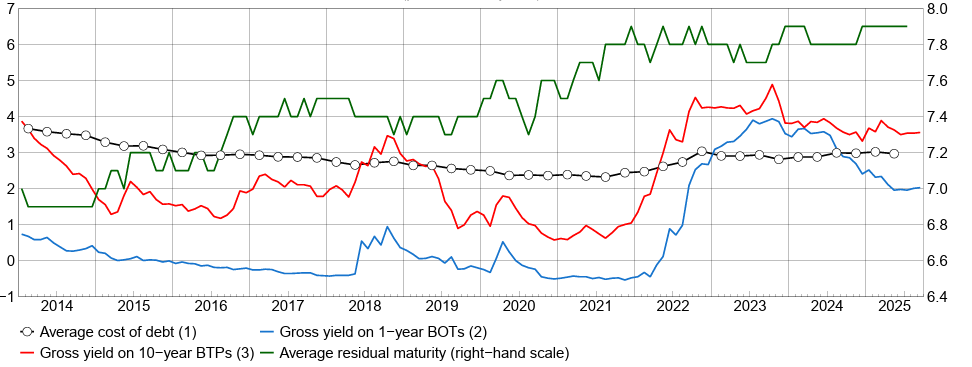

Figure 5: Public Debt Average Cost Rising Afresh

Source: Bank of Italy

Lastly, fiscal worries seem contained but they are far from resolved. Partly this reflects genuine fiscal improvements, albeit largely a one-off result of the unwind the Superbonus scheme. But with the budget gap likely to drop below 3% of GDP this year and inch lower through into 2027, the government debt ratio is set to rise 2-3 points to over 137% by the end of 2027. The expected primary surpluses (likely to reach over 1%) will still be insufficient to prevent this amid now-rising fresh debt-servicing costs outpacing expected nominal growth of 2%-plus (Figure 5). The debt outlook is accentuated also by off balance sheet adjustments related to the housing renovation tax credits. After a contractionary fiscal stance in 2024-25, fiscal policy is set to be neutral in 2026 but become contractionary again in 2027 also due to the end of the RRF. All of which suggest that fiscal consolidation will be needed even if this is holding back real growth. While hardly in a fiscal vicious circle, budgetary dynamics are hardly friendly and that is without the added formidable challenges in meeting Italy’s NATO defence spending commitments (which at face value could ramp the debt ratio much higher and much earlier!)

Spain: Fiscal Benefits of Solid Growth

Once again we have upgraded the current year GDP picture for Spain, revising up the growth projection by a further 0.2 ppt to 2.7%. But we retain our view that growth is slowing and this will is visible in a 2026 projection remaining at 1.7% and which we think will be followed by a similar outcome for 2027. This slowing will reflect far less solid economic activity by Spain’s key trading partners. This will dampen tourist activity - not least due to high prices, over-crowding and the growing resistance from locals. International arrivals, while up over 4% so far this year, are growing far slower than in 2024. It should also prompt a prolonged period of precautionary behaviour by the private sector, delaying corporate investment and also keeping the household saving rate well above its long-term historical average. But the main factor is our view of a more-pronounced-than-anticipated slowdown of migration flows will reduce the dynamism of the labour market, resulting in the pared back outlook we have for private consumption and investment. Indeed, migration flows may see growth of over 3% this year but give way to nearer 2% next year and something similar into 2027. This may still feed what has been strong import growth of late meaning we see the current account gap in the next two years staying at the narrower circa 2.7% we see for this year.

This demographic backdrop, almost unique to Spain within the EU, is best understood by the fact that per capita GDP growth this year may be around 1.5%, admittedly still well above the EZ average, but highlighting the extent to which population and workforce growth have been supporting activity (Figure 6) – NB productivity has been a more anaemic 0.5% which we think will persist into 2027, thereby reining back potential growth from its current circa 2.5%. Thus the 2026-27 GDP picture we have merely reflects the economy benefitting less from demographics immigration – Spain is not helped by its fertility rate which is one of the lowest in the world. But the clear beneficiary of this very solid overall GDP backdrop of recent years has been the marked swing on the fiscal side which had seen persistent budget gaps of around 7% of GDP a decade ago give way to a deficit this year that should be under 3%. But this has largely been cyclical with structural budget gap having fallen last year to around 3.5% of GDP but where it may stay above 3% for the next few years. Even so, this should mean that the government debt to GDP ratio falls below 100% in 2026 and ease a little further into 2027. However, with the virtual end of EU RRF funds by end-2026, the fiscal stance may become contractionary afresh in 2027 although electoral considerations may prevent this.

A further restraint on the real economy is that Spain is very much in the hot seat when it comes to climate change, having suffered clear damage from storms, heatwaves and droughts. However, Spain is considered to be less vulnerable to likely U.S. tariffs with less than 1% of GDP stemming from exports to the U.S., less than half the EZ average. As for the weaker 2026 picture, there is going to be no rapid defence build-up, amid an aversion to the military, all complicated as Spain may face political uncertainty and even possibly snap elections amid the current corruption scandals.

Figure 6: Strong Population and Workforce Growth - Hitherto

Source: INE, millions

As for CPI inflation, we still see an underlying trend continued consolidation. Indeed, we see inflation slowing to an average of 2.6% this year (a slight upgrade due to swings in energy prices) but with the projection of 1.9% for 2026 down a notch and something similar for 2027. This reflects some slowing in terms of services inflation, and what should be more subdued wage pressures, the latter occurring even given softer labor force growth.

I,Andrew Wroblewski, the Senior Economist Western Europe declare that the views expressed herein are mine and are clear, fair and not misleading at the time of publication. They have not been influenced by any relationship, either a personal relationship of mine or a relationship of the firm, to any entity described or referred to herein nor to any client of Continuum Economics nor has any inducement been received in relation to those views. I further declare that in the preparation and publication of this report I have at all times followed all relevant Continuum Economics compliance protocols including those reasonably seeking to prevent the receipt or misuse of material non-public information.