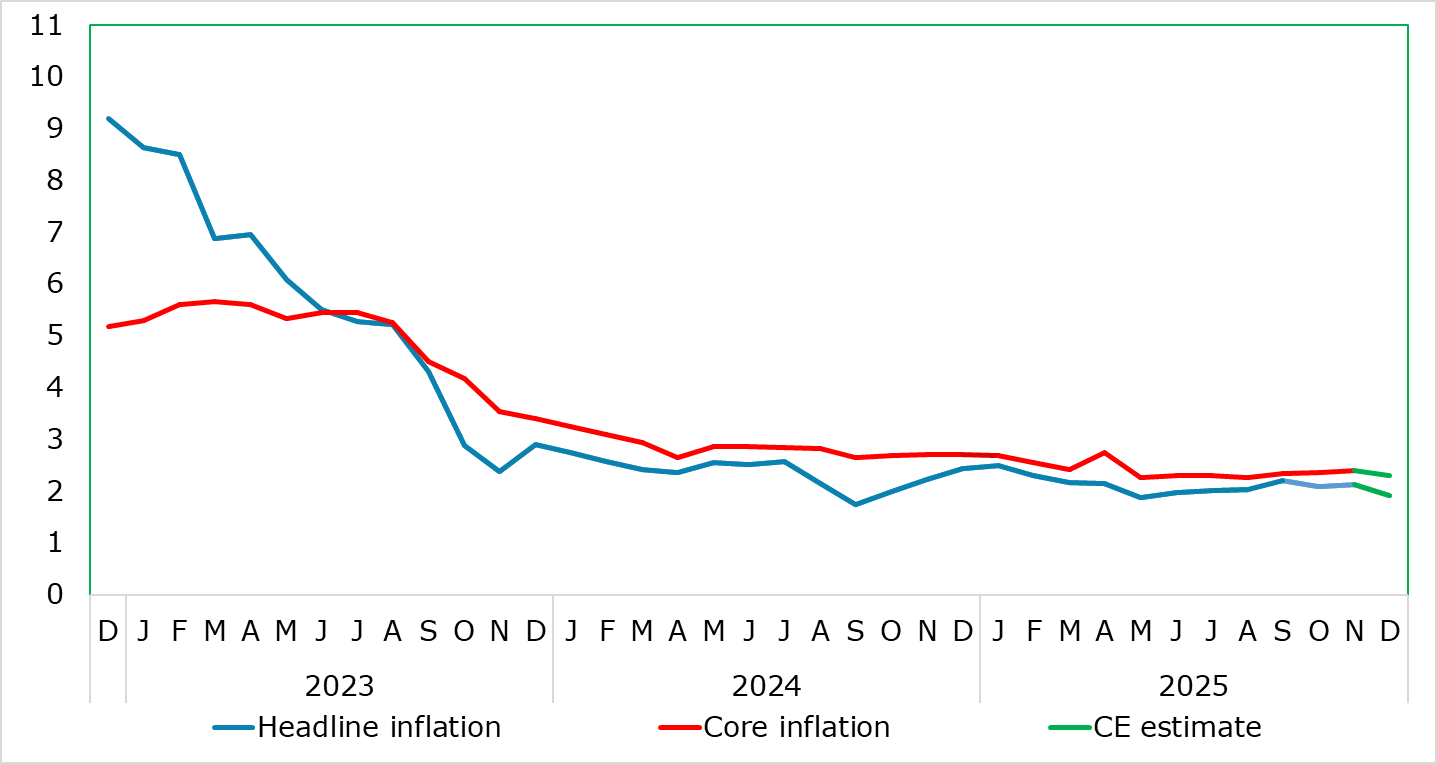

EZ HICP Preview (Jan 7): Is Services Inflation Problematic?

HICP inflation has been range bound for the last 5-6 months between 2.0% and 2.2% with the November and October numbers in the middle of that range. But we see the headline rate falling out of that range in December to 1.9%, this preceding what may be a short-lived fall toward 1.5% in H1 2026. Some of this may be energy related but a correction back in services may bring the core down a notch to a new cycle low of 2.3%. The ECB latest projection is more consistent with no change in the headline in December but with small fall in the core.

Figure 1: Headline and Services To Fall?

Source: Eurostat, CE

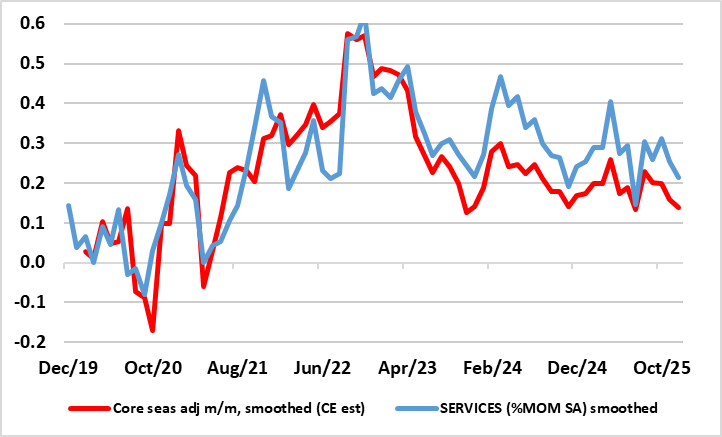

With what were previously unfavourable energy-related base effects reversing, EZ inflation edged down 0.1 ppt to 2.1% in October, largely in line with consensus thinking, but with the main core rate stable at 2.4%. This reversed in the flash November numbers but which were later revised down to match the October outcome. But the diehard hawks at the ECB will have focused on the small further rise in services inflation to a seven month high of 3.5%, a shift higher echoed by less favourable, but still target-consistent, adjusted m/m data. Even so, this seems to have reverberated within the ECB and seemingly has prompted the upward revisions to the 2026 HICP outlook.

Figure 2: Core & Services Inflation Still Around Target in Shorter-Term Dynamics?

Source: Eurostat, ECB, CE

If so, this may be an excessive reaction as the higher services inflation is purely due to base effects in regard to recreation, as the latter saw ‘only’ a 3.6 ppt fall in the last three months – hardly a sign of price pressures still! Furthermore, despite this 0.3 ppt rise in y/y services, it still seems to be belatedly following in the footsteps of lower wage pressures. Moreover, recent labor market data are showing a still clear rising workforce which may explain such weaker cost pressures. Regardless, core inflation stayed at 2.4% (Figure 2) still supporting an ECB view for core inflation staying below 2% out to 2027.

I,Andrew Wroblewski, the Senior Economist Western Europe declare that the views expressed herein are mine and are clear, fair and not misleading at the time of publication. They have not been influenced by any relationship, either a personal relationship of mine or a relationship of the firm, to any entity described or referred to herein nor to any client of Continuum Economics nor has any inducement been received in relation to those views. I further declare that in the preparation and publication of this report I have at all times followed all relevant Continuum Economics compliance protocols including those reasonably seeking to prevent the receipt or misuse of material non-public information.