ECB Council Meeting Preview (Sep 11): No Change and Little Guidance

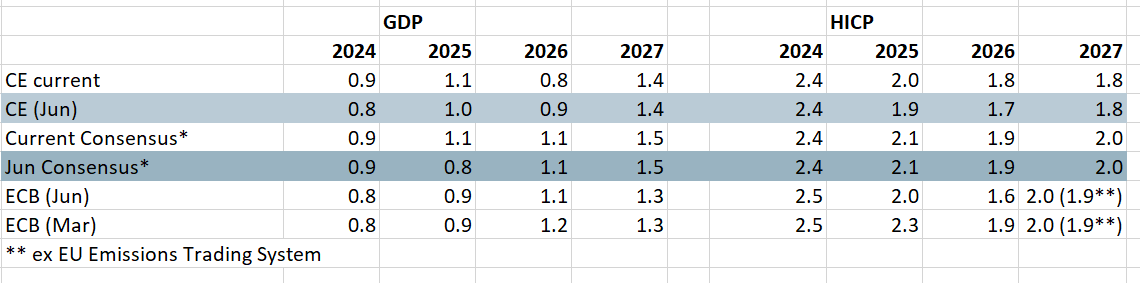

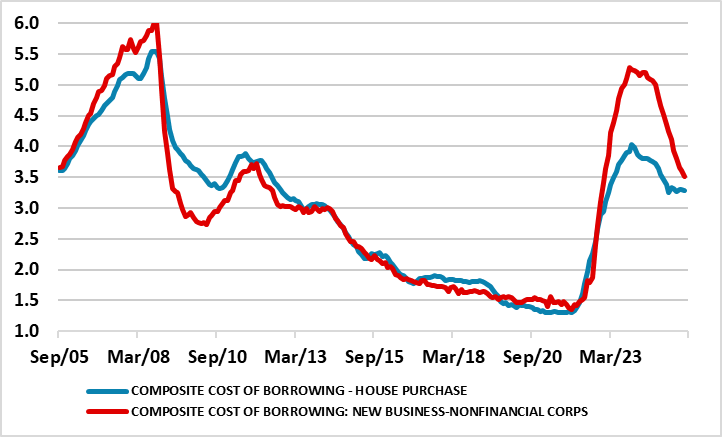

A second successive stable policy decision is very likely at next week’s ECB Council meeting resulting in the first consecutive pause in the current easing cycle, with the discount rate left at 2.0%. We see the ECB offering little in terms of policy guidance; after all, in July the Council suggested it would be ‘deliberately uninformative about future interest rate decisions’. Little may be gleaned either from updated economic projections (Figure 1) which may see little impact from what has been both a higher tariff outcome than was assumed three months ago and what are still tight, if not tighter, financial conditions (Figure 2). Instead, data dependence will remain the main message, something that we think given what are still headwinds facing the EZ economy will trigger two more 25 bp cuts, probably late this year and early next!

Figure 1: The EZ Economic Outlook – Alternative Perspectives

Source; ECB, Bloomberg, CE

The account of the July 23-24 ECB Council meeting saw some discussion about cutting at that juncture but with no immediate pressure to change policy rates what was then exceptional uncertainty added to arguments for keeping interest rates unchanged. It was suggested that by September, a better understanding of how the economy was responding to economic challenges would be possible, and to us this looks very much like keeping policy on hold this month not least given that the Council member focus on recent (less downbeat) PMI data may only reinforce the Council’s assessment of current EZ economic resilience highlighted in the account. This may be one reason why the ECB projections both real and inflation – may be little changed, thereby contrasting with our weaker 2026 growth picture. This divergence reflects several factors.

For a start, in assessing economic resilience we think the ECB focus on PMI data is somewhat excessive and misplaced, especially as alternative survey data from the European Commission are telling a more sobering story, especially for the more export sensitive manufacturing sector

Then there is the issue of how restrictive are current financial conditions. In this regard, this September meeting will see some informal divisions, but largely echo the July tone which suggested that Council thinking had moved from the speed at which interest rates should be normalised, to potential (more) marginal adjustments for the remainder of 2025. However, with the main policy rate at 2.0%, even some of the more dovish Council members will continue to suggest that the monetary stance is now neutral. This is something we would challenge given that real credit growth is still negative and where nominal growth rates have slowed clearly of late amid what still seems to be wariness from banks about lending, particularly to export orientated firms. Indeed, it is worth noting that while the ECB policy rate has fallen by two ppt, the effective rate for households has fallen by 1.7 ppt but that for firms by a meagre 75 bp (Figure 2).

Figure 2: Effective Retail Interest Rates Slower to Fall

Source; ECB (%)

In fact, we would suggest that compared to June, when the ECB last offered formal forecasts, the monetary stance has tightened, something evident in the 10-20 bp rise in market rates, the further rise in the trade-weighted euro and the continued reduction in the ECB balance sheet. As a result, the EZ economy may not only be facing continue headwinds but that these may have strengthened amid a) what was a higher effective tariff result in the trade deal with the U.S. – ie by around five ppt compared to the 10% forces the ECB’s June projections were based on; b) a tighter financial backdrop and c) looming fiscal consolidation to offset the rise in debt servicing costs facing EZ economies. All of which comes alongside more long-standing headwinds such as a weakening labor market made worse by recent labor hoarding and also a monetary policy transmission mechanism made weaker by both uncertainty and also by ECB balance sheet reductions – NB we think it would be appropriate for the ECB to pare back its QT program but would be surprised if this was even hinted at in the September Q&A.

Given the uncertainty overhanging policy makers worldwide, we think the ECB is under-estimating a disinflation picture reflecting still-tight, if not tighter, financial conditions which is seeing near zero real credit growth and a softer labor market. As for the current ECB message, it is a clear wait and see, with the easing door left somewhat open and where we think this toned down bias will be exercised but probably now in December and then early 2026.

.

I,Andrew Wroblewski, the Senior Economist Western Europe declare that the views expressed herein are mine and are clear, fair and not misleading at the time of publication. They have not been influenced by any relationship, either a personal relationship of mine or a relationship of the firm, to any entity described or referred to herein nor to any client of Continuum Economics nor has any inducement been received in relation to those views. I further declare that in the preparation and publication of this report I have at all times followed all relevant Continuum Economics compliance protocols including those reasonably seeking to prevent the receipt or misuse of material non-public information.