France and Italy: Deficit, ECB QT and Foreign Debt Holders Stories

A large budget deficit in France, looking persistent given the current political impasse, combined with ECB QT means that the market has to absorb a very large 8.5% of GDP of extra bonds. Our central scenario is that persistent French supply causes a further rise in 5yr plus French government yields, which could mean a small premium versus Italy. Embarrassing but not a crisis. However, any major bad fiscal or political news could trigger a French bond market crisis given the still large non-resident holdings (54.7%) and huge supply. The most likely policy response would be a slowdown in ECB QT, as ECB TPI would cause internal divisions in the ECB and ESM instruments risk backfiring like 2010-12.

French government bond spreads in the 5yr area briefly rose above Italy recently. What are the prospects for the coming quarters?

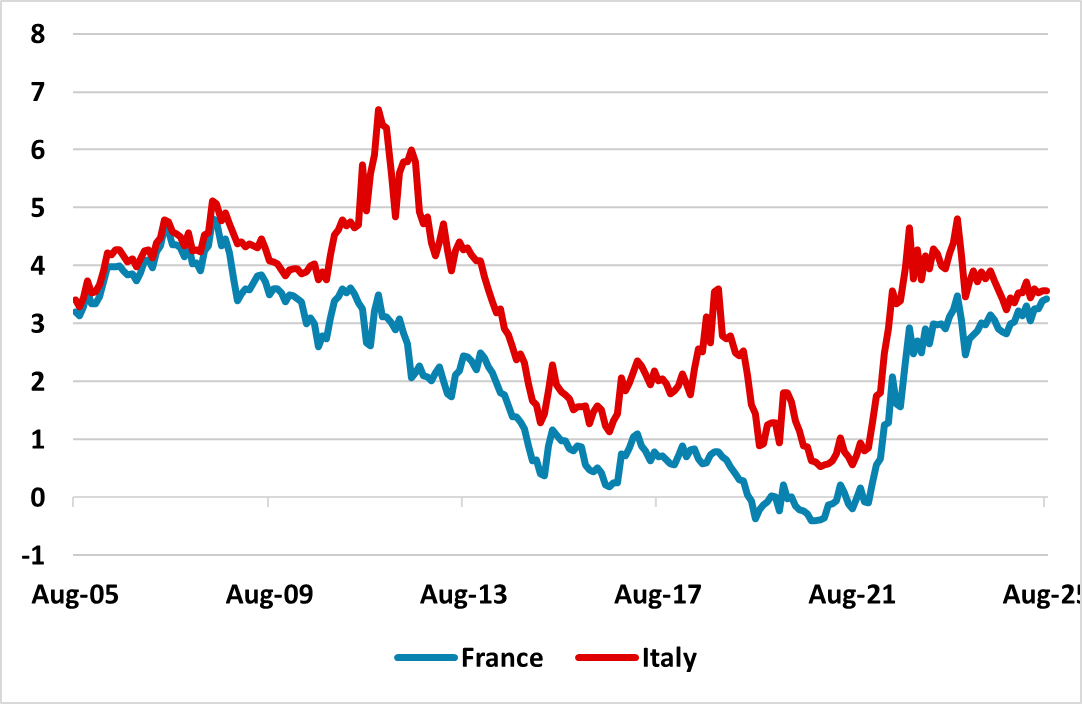

Figure 1: 10yr France and Italy Government Bond Yields (%)

Source: Datastream/Continuum Economics.

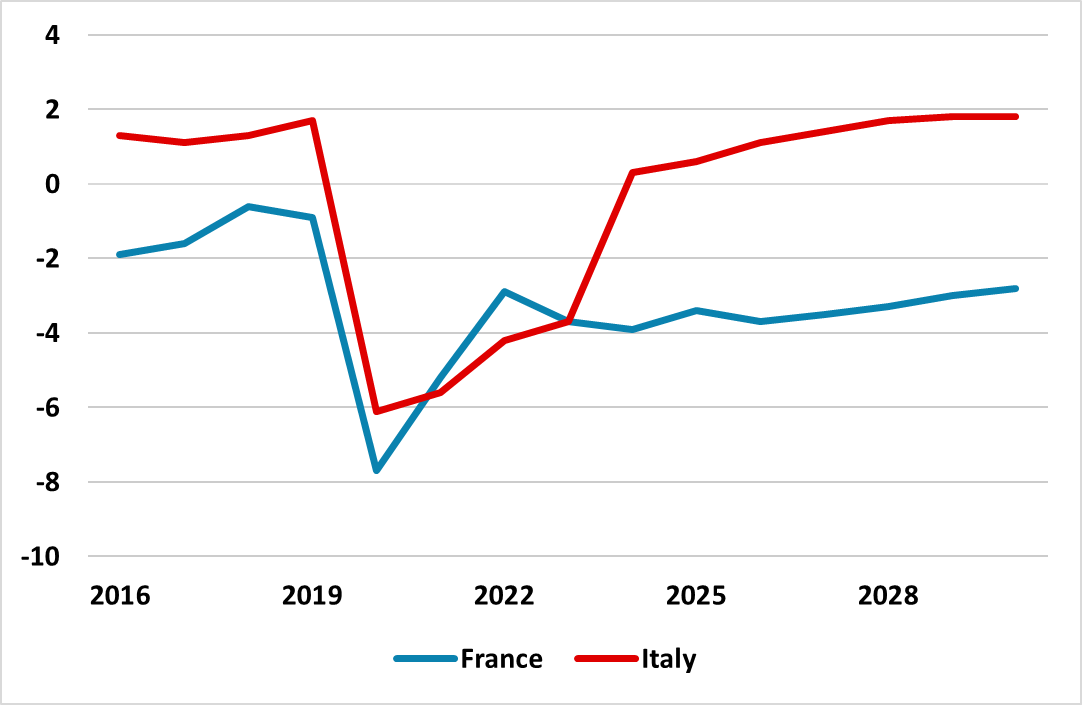

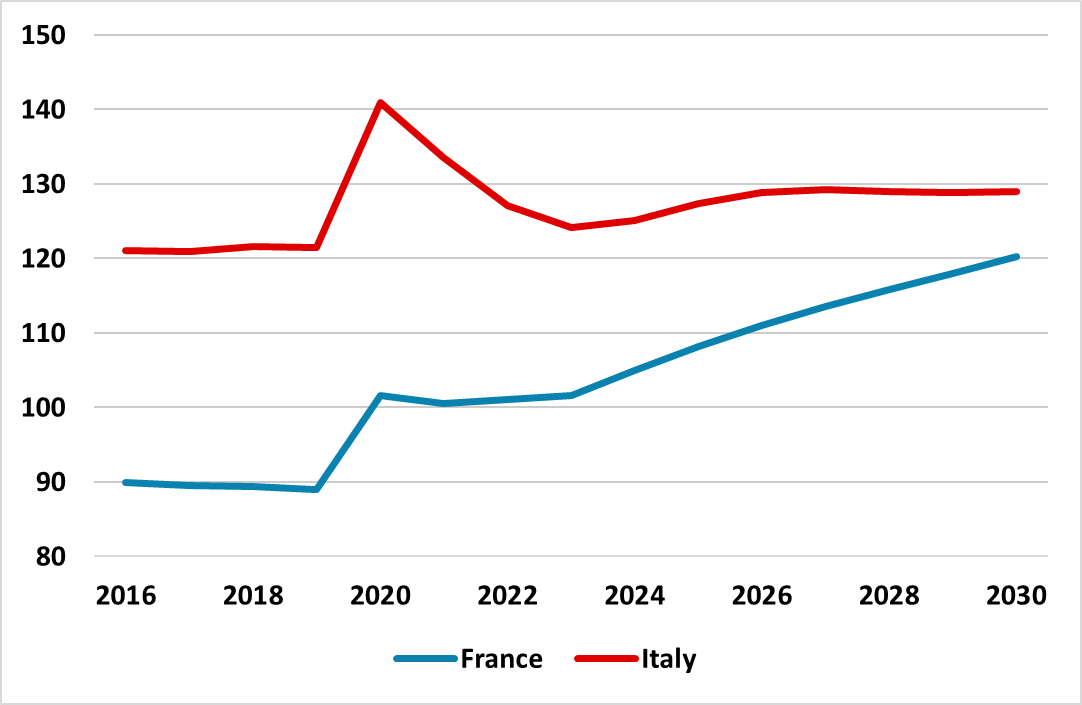

The French yield gap to Italian government bonds has consistently narrowed this year, partially on a hunt for yield and perception of a relatively stable Italian government and fiscal situation. However, two considerations have also put France under supply pressure. Firstly, France’s overall budget deficit is projected at 5.6% of GDP, as the minority government has been unable and unwilling to take aggressive action to narrow the budget deficit. This situation is unlikely to change until the 2027 presidential election, with President Macron concerned that another parliamentary election before then could polarize parliament still further and potentially help the right wing National Rally. This means drama will surround the passage of the 2026 budget deficit throughout the autumn, starting with the surprise non confidence vote on the budget September 8. In contrast, Italy had been able to reduce the budget deficit more quickly and PM Meloni’s stability is a multi-quarter comfort with the next Italian election only due by September 2027. Looking at the primary budget balance (i.e. which excludes interest payments) shows an unhealthy French picture (Figure 2). This is the principal driver on the ongoing rise in the net government debt/GDP ratio (Figure 3). The situation is bad enough that a risk exists of a further French rating downgrade in the autumn, given the negative outlooks from two of the rating agencies. Fitch on September 12 and S&P on November 28 will be watched closely.

Figure 2: General Government Primary Balance (%)

Source: IMF Fiscal Monitor

Figure 3: France and Italy Net General Government Debt/GDP (%)

Source: IMF Fiscal Monitor/Continuum Economics

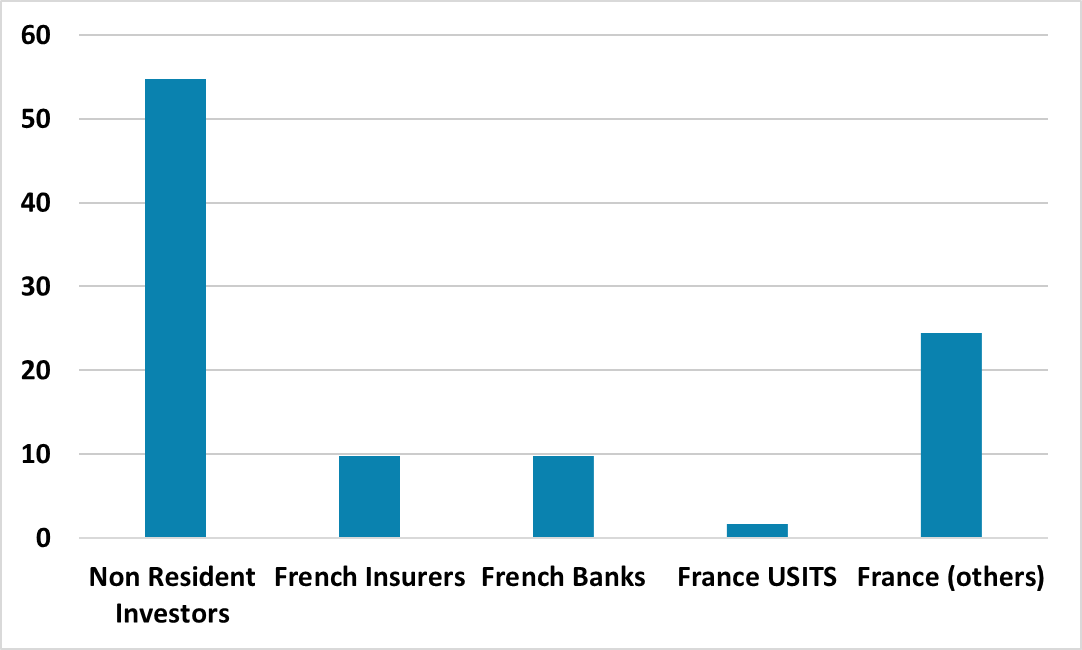

The 2nd headline for French bonds is that ECB QT is close to 3% of GDP (here) meaning net supply ex Banque De France of around 8.5% of GDP. This is a lot of extra bonds for the market to absorb. Foreign accounts love French government bonds due to great liquidity, standardization, good marketing and a sense that the ECB/EU would come to the rescue in the scenario of a French-centric Eurozone crisis. However, this now means that non-residents hold 54.7% of negotiable government debt (Figure 4) – a large portion are intra EZ holders that have no perceived currency risk but non EZ central banks are also large holders. So far, French Treasury data has not shown a reduction in the percentage of non-resident holdings, but the supply situation is so large that they need to keep on buying at a fast pace to sustain their proportion. Our central scenario is that persistent French supply causes a further rise in 5yr plus French government yields, which could mean a small premium versus Italy. Embarrassing but not a crisis.

Any sign of a buyers strike from non-resident accounts would likely cause French bond yields to leap above Italy in the 5-10yr area of the curve and could produce a French government bond market crisis. This could be a failure of the 2026 budget or a decision to hold another, and likely indecisive, parliamentary election, which is not our baseline scenario. Domestic French banks and insurance companies are unlikely to absorb all the new supply in this alternative scenario, which would force yields higher. What would the ECB and EU do?

Figure 4: French Negotiable Government Debt By Holders (%)

Source: French Treasury Q1 2025

France is unlikely to ask for a package from the EU European Stability Mechanism (ESM), as it’s financial assistance instruments (here) would require faster fiscal consolidation that France is not sure of delivering politically. Currently French politics, featuring three very much dived camps, argue against a government of national unity like Italy in 2011. The 2010-12 experience with ESM instruments also caused a flight on non-resident accounts from government bond markets, which given France high starting bond could turn a bond market problem into the 2nd EZ debt crisis.

The ECB Transmission Protection Instrument (TPI here) could be used to buy French government bonds in this scenario on the basis that the French yield movements were impacting the transmission of monetary policy in France and the EZ. The fact that the ECB is waiting to see the impact of the 200bps of official rate cuts adds support in the next 6-12 months, especially as we feel that the disinflationary process argues for an extra 50bps of official rate cuts (here). The problem is that one criterion for the TPI is sound and sustainable fiscal and macroeconomic policies. ECB hawks will likely worry that France’s fiscal position is not sustainable and that TPI for France would only undermine the ECB long-term and lead to questions of fiscal dominance. The IMF July 2025 Article IV (here) argues strongly for extra fiscal consolidation and moderate risks in the debt sustainability analysis (p41 onwards). But notably the divided French political situation is very much in conflict with the IMF’s understandable assertion regarding the importance of building consensus to advance fiscal and structural reforms.

An alternative option is to reduce the pace of ECB APP and PEPP QT, which we feel is a real option in the next 12 months. The chance is that until H2 2026 the ECB easing cycle is unlikely to have ended, which means that the ECB can review and reduce QT to make it compatible with overall monetary policy needs. The Fed have already done this and the BOE is set to follow in September (here). A 3rd option is that the ECB suspends QT on a temporary basis like the BOE did in 2022, but this is less powerful than a Fed style slowdown in QT that alters the supply picture more persistently.