EZ HICP Review: Headline Inflation Edges Higher as Services Fall to Fresh Cycle-low

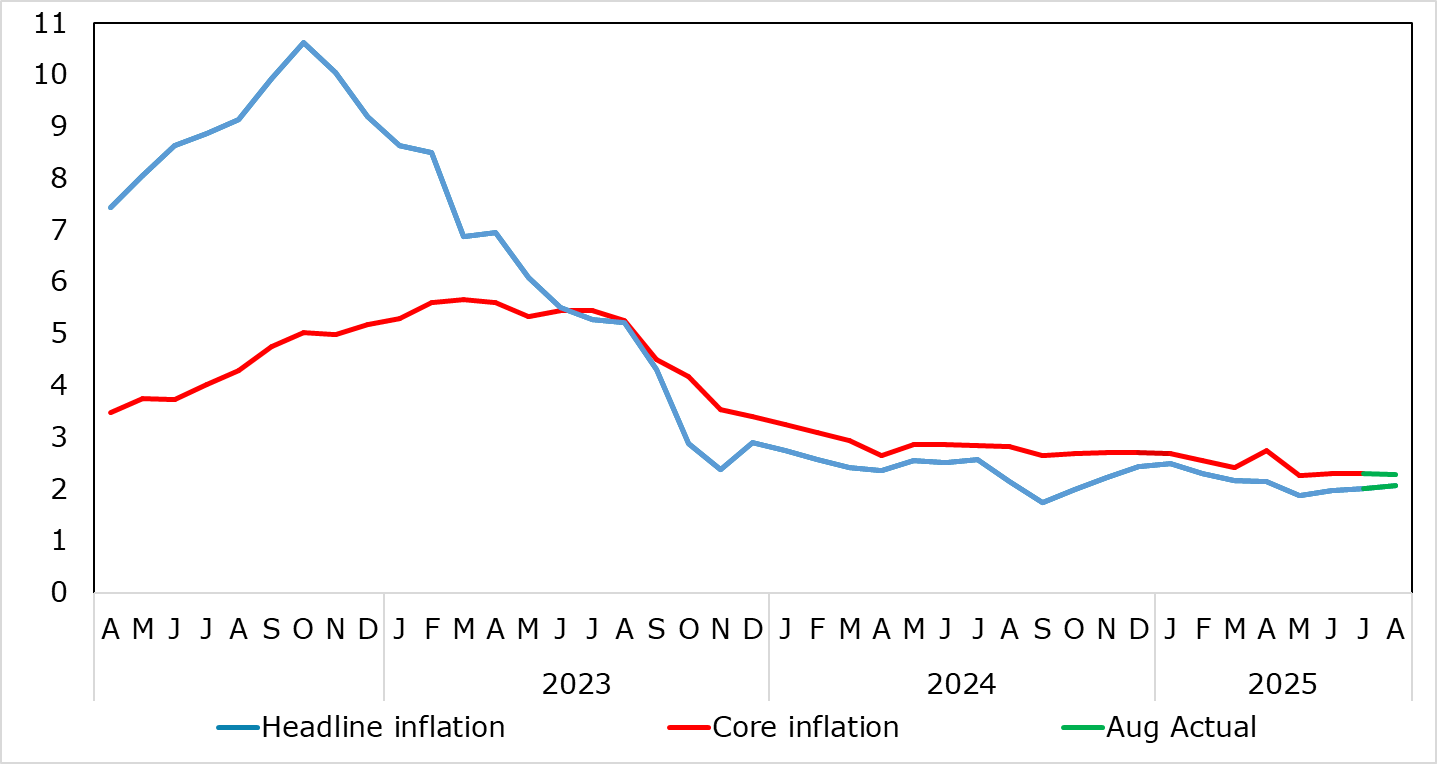

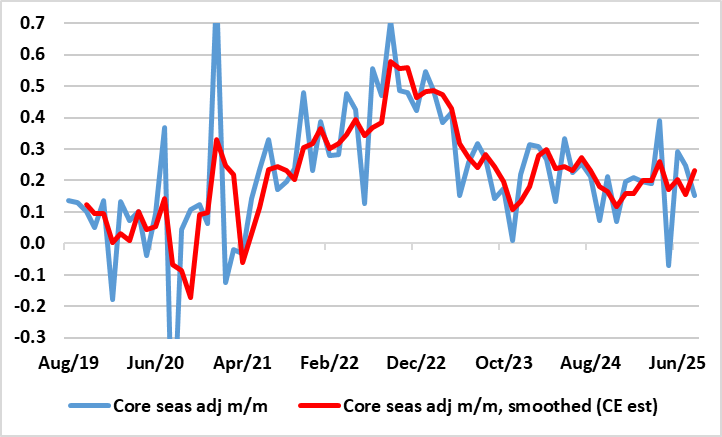

As we repeated again, HICP inflation – even now a notch above target – is very much a side issue for the ECB at present, offset instead by moderate concerns whether the apparent resilience of the real economy may yet falter. This mindset will not have been altered by the flash HICP data for August even given the 0.1 ppt rise in the headline to 2.1%, hinting that the ECB’s Q3 projection could be overshot, especially given the possible further rise that could occur in September. But this is largely food and energy base effect driven as the core rate in August stayed at 2.3% (Figure 1), chiming with the ECB underlying inflation forecast for Q3, something already evident in adjusted m/m data (Figure 2) and where services dipped a notch to new cycle low of 3.1%.

Figure 1: Headline Edges Above Target as Core and Services Hit Cycle-Low

Source: Eurostat, CE

Indeed, services inflation, at 3.1%, is now the lowest since March 2022 and does seem to be belatedly following in the footsteps of lower wage pressures. As a result, this trend and noise could bring the headline and core rate could both dip below 2% in Q4 with base effects pulling the headline down to around 1.5% in Q1, especially if demand weakness starts to accentuate what have largely been supply factors driving the disinflation process hitherto. However, the risks of a further (short-lived) 0.1 ppt rise in the headline is a distinct likelihood for September numbers, albeit again very much energy base effect (and perhaps food) driven. Moreover, as recent calendar distortions unwind, what has looked like fresh price pressures in seasonally adjusted short-term m/m movements for core have reversed and are consistent with on-target inflation (Figure 2)!

Figure 2: Core Inflation Around Target in Shorter-Term Dynamics?

Source: Eurostat ECB, CE