EZ Inflation Outlook: The Deeper Debate About 2028?

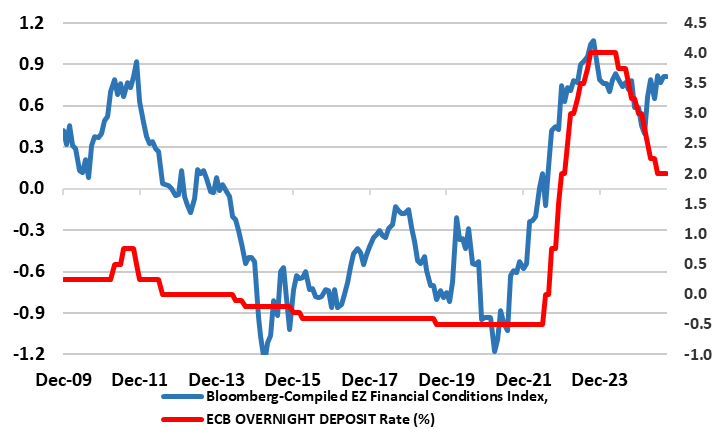

The ECB is clearly split about whether policy has troughed or not, this mainly a result of differences within the Council as to where inflation risks lie. Hawks perceive upside risks emerging while the dovish camp feels the opposite. These divisions are likely to magnify when the ECB updates its projections again in December as this will include the first glimpse for 2028 where the outlook is even more uncertain that usual, complicated further by (necessary, tenuous and possibly revised) assumptions about planned energy tariffs. These could actually take headline inflation back below 2% in 2028, albeit due to possible one-off base effects that would only stir deeper divisions with the Council. We, however, suggest that basing policy on the spurious accuracy of forecasts three years out is both misleading and counter-productive. Instead, our continued call for still-lower ECB rates is based around the fact that financial conditions have tightened since the last ECB rate cut, both because of market swings (including what may now be unfolding equity wise) but also by what may be banks being more cautious.

Figure 1: EZ Financing Conditions Tightening Despite Policy Easing

Source; ECB, Bloomberg, CE

Are Effective Borrowing Rates Falling Still?

Indeed, final September HICP numbers confirming a second successive upside surprise is unlikely to make inflation any more of a divisive issue for the ECB than it is at present. Instead, moderate concerns whether the apparent resilience of the real economy may yet falter should remain the order of the day, this possibly a result of a still somewhat unresponsive transmission mechanism (effective borrowing rates have failed to match the drop in the ECB policy rate) and where financing conditions have actually risen since the last official rate cut in June. In fact, the financing conditions gauge in Figure 1 may understate the extent to which conditions have tightened, as past interest rate cuts fail to feed into lower corporate borrowing costs overall – NB: the average interest rate on new loans to firms had declined to 3.5% in July, from 3.6% in June, while the cost of issuing market-based debt and new mortgages had been unchanged, at 3.5% and 3.3 respectively.

However, as the September Council meeting noted, these effective rates were offered by banks that have been de-risking by skewing their corporate lending away from risky firms towards safer ones. Thus, the decline in the observed cost of borrowing for firms could therefore partly reflect a compositional effect, which might mask true (and somewhat higher) borrowing costs – does this imply that the ECB has seen hints that banks have become less willing to lend even before the latest bout of worries about the health of regional banks – something that may show up afresh in the updates bank lending survey due two days before the next Council meeting due Oct 30?

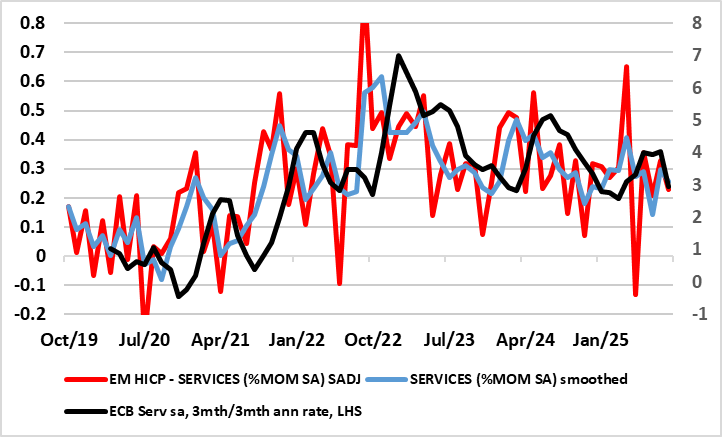

Figure 2: Core and Services Inflation Around Target in Shorter-Term Dynamics?

Source: Eurostat, ECB, CE

Excessive Focus on Medium Term Forecasts

This concern is the main rationale for the further conventional policy easing we anticipate. But the ECB debate may continue to focus excessively on the intricacies of medium-term inflation projection, however, spurious they may be. This mindset will not be altered by the final HICP data for September even given the further but largely as-expected 0.2 ppt rise in the headline to 2.2%, not least as this still implies that the ECB’s Q3 projection for both the overall and core figures in Q3 were met. This rise in the headline was again food and (largely) energy base effect driven but also with services, almost solely due to travel related base effects. But highlighting still soft core inflation, adjusted m/m data (Figure 2) still show reassuring signs even in regard to apparently resilience services.

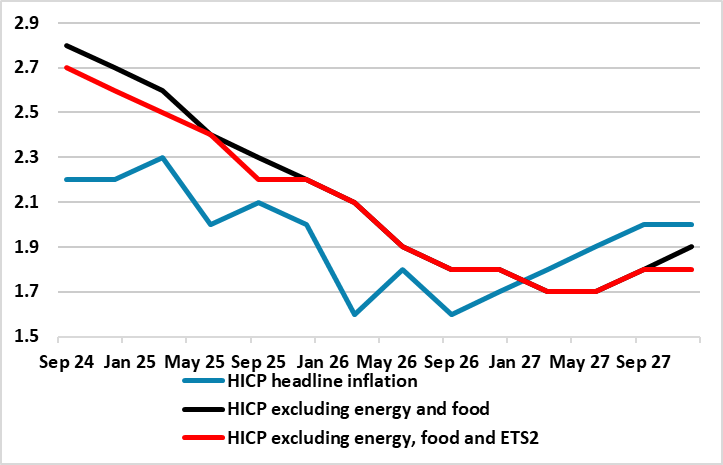

Regardless, the last Council meeting saw a clear(er) debate about the inflation outlook, where to many members the inflation outlook had softened slightly, because headline HICP is now seen undershooting the target not only in 2026 but also in 2027, and by an even wider margin when accounting for the upward effect on inflation from the introduction of the likely widening of the EU Emissions Trading System in 2027, the so-called ETS2.

Figure 3: ECB Medium-Term On-Target Inflation Projection Based on Energy Tax Rise

Source: ECB September Macro forecast, CE

Energy - A Taxing Issue

As Figure 3 shows, according to current ECB thinking, ETS2 may add 0.2 ppt to inflation through 2027, this causing the pick-up in the headline to 2.0% by the end of that year – ex food and energy/ETS2 inflation stays at 1.8% by end-2027. However, at this juncture, while it is too early to assess how ETS2 would affect headline inflation over the longer term, the inflationary impact in 2027 might be short-lived, so that any one-off adjustment could unwind in 2028, pulling the headline back down to well below 2%. This is all the more important (to some extent) as in the December staff projections, the ECB projection horizon will be formally extended to 2028, the question being to what extent this may shed better light on the way ETS2 would likely play out beyond 2027. This is important as politics suggest there is a risk that national governments might delay or only partially implement ETS2, which could lead to a more pronounced HICP undershoot in 2027 albeit with a higher-than-otherwise projection for 2028 a possible result.

As suggested above, basing policy on the spurious accuracy of forecasts three years out is both misleading and counter-productive. Instead, our continued call for still-lower ECB rates is based around the fact that financial conditions have tightened since the last ECB rate cut, both because of market swings but also by what may be banks being more cautious. In addition, any downside surprise to the clearer undershoot of the 2% target seen into early 2026 may add to calls for fresh easing.

I,Andrew Wroblewski, the Senior Economist Western Europe declare that the views expressed herein are mine and are clear, fair and not misleading at the time of publication. They have not been influenced by any relationship, either a personal relationship of mine or a relationship of the firm, to any entity described or referred to herein nor to any client of Continuum Economics nor has any inducement been received in relation to those views. I further declare that in the preparation and publication of this report I have at all times followed all relevant Continuum Economics compliance protocols including those reasonably seeking to prevent the receipt or misuse of material non-public information.