EZ HICP Preview (Oct 31): No Halloween Horror from HICP Update

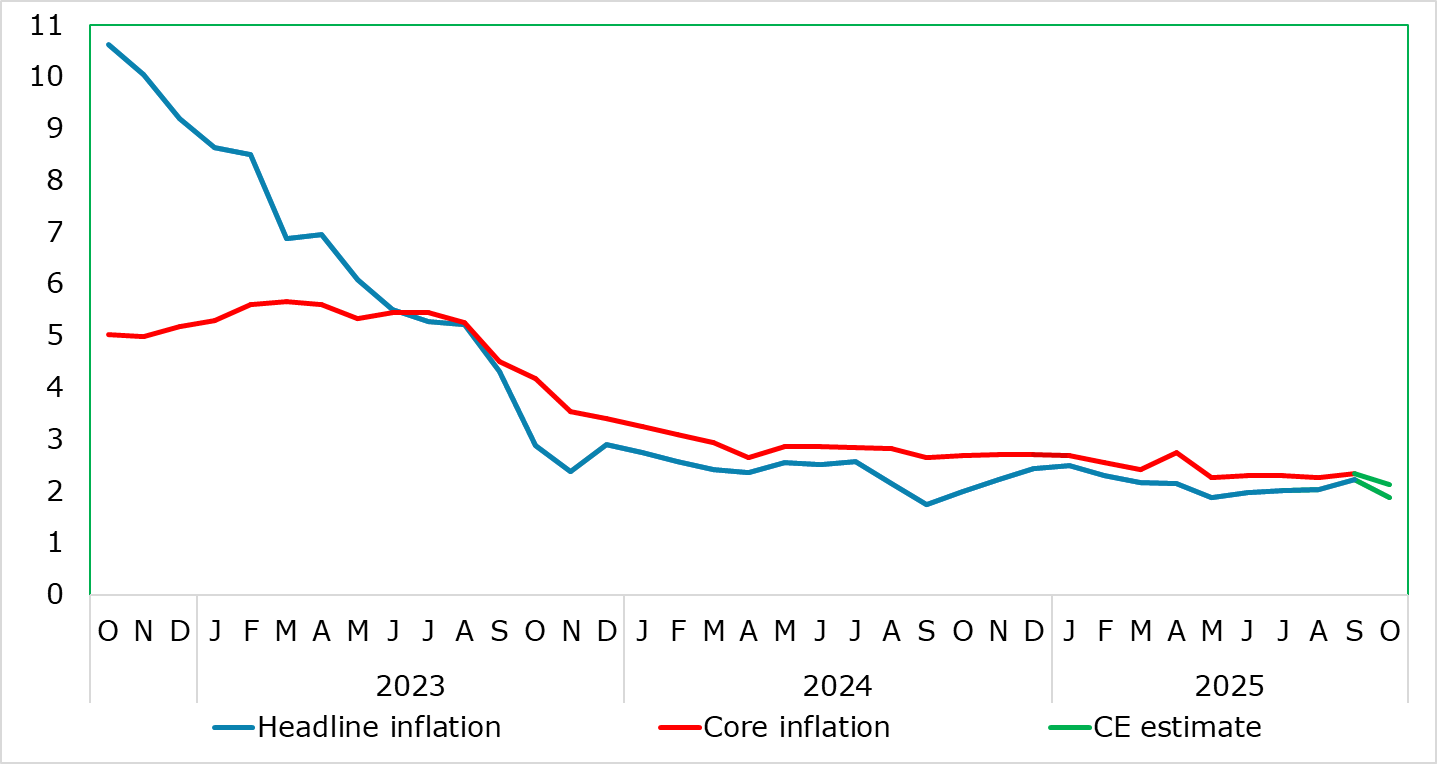

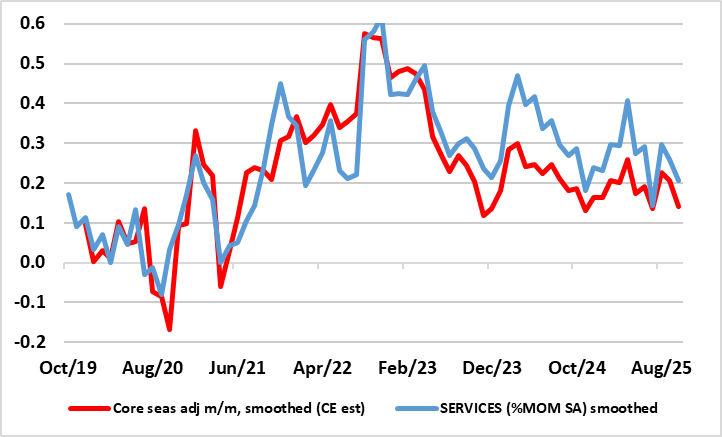

Mainly due to unfavourable base effects, EZ inflation has edged up in the last few months, but we think that this is temporary and that a fresh fall, possible to below the 2% target may occur in the October flash numbers – with a formal forecast of a 0.3 ppt drop to 1.9% and the core falling almost as much. This will be a contrast to the HICP data for September which saw the further but largely as-expected 0.2 ppt rise in the headline to 2.2% (Figure 1) – NB; this still meant that the ECB’s Q3 projection for both the overall and core figures in Q3 were met. This rise in the headline was again food and (largely) energy base effect driven but also with services, almost solely due to travel related base effects, these likely to reverse in October. But highlighting still soft core inflation, adjusted m/m data (Figure 2) still show reassuring signs that suggest the ECB view for core inflation staying below 2% out to 2027 is very plausible (Figure 3).

Figure 1: Headline Moves Back Below Target as Core and Services Edge Back Down?

Source: Eurostat, CE

In contrast to food inflation in neighbouring economies, that for the EZ seems under control, actually slipping back last month despite some adverse weather of late. Admittedly, services inflation, at 3.2% in September, moved up a bare 0.1 ppt from what was the lowest since March 2022 but despite this rise, it not only matches ECB thinking for the last quarter but still seems to be belatedly following in the footsteps of lower wage pressures and where survey data for the sector also shows weaker price pressures. As a result, this trend and noise could bring the headline and core rate are seen dipping below 2% in Q4 with base effects pulling the headline down toward 1.5% in Q1, especially if demand weakness starts to accentuate what have largely been supply factors driving the disinflation process hitherto (see below). Notably, as recent calendar distortions unwind, what has looked like fresh price pressures in seasonally adjusted short-term m/m movements for core and services have reversed and are consistent with on-target inflation (Figure 2)!

Figure 2: Core and Services Inflation Around Target in Shorter-Term Dynamics?

Source: Eurostat, ECB, CE

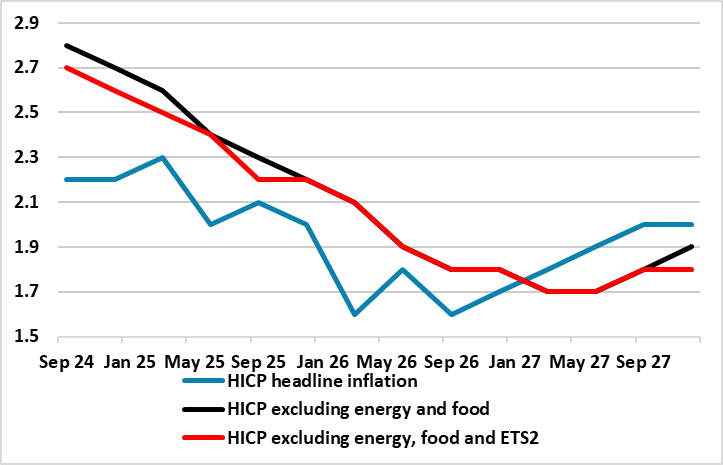

This near-term outlook is actually shared by the ECB, which envisages headline HICP moving below and then staying below 2% target until H2 2027 but that the underlying rate (ex energy tariffs) nestling around 1.8%. Despite this benign outlook, the last Council meeting saw a clear(er) debate about the inflation outlook, where to many members the inflation outlook had softened slightly, because headline HICP is now seen undershooting the target not only in 2026 but also in 2027, and by an even wider margin when accounting for the upward effect on inflation from the introduction of the likely widening of the EU Emissions Trading System in 2027, the so-called ETS2.

Figure 3: ECB Medium-term On Target Inflation Projection Based on Energy Tax Rise Assumption

Source: ECB Sept Macro Forecast, CE

As Figure 3 shows, and as we have highlighted already, according to current ECB thinking, ETS2 may add 0.2 ppt to inflation through 2027, this causing the pick-up in the headline to 2.0% by the end of that year – ex food and energy/ETS2 inflation stays at 1.8% by end-2027. However, at this juncture, while it is too early to assess how (and when) ETS2 would affect headline inflation over the longer term, the inflationary impact in 2027 might be short-lived, so that any one-off adjustment could unwind in 2028, pulling the headline back down to well below 2%. This is all the more important (to some extent) as in the December staff projections, the ECB forecast horizon will be formally extended to 2028, the question being to what extent this may shed better light on the way ETS2 would likely play out beyond 2027. This is important as politics suggest there is a risk that national governments might delay or only partially implement ETS2, which could lead to a more pronounced HICP undershoot in 2027 albeit with a higher-than-otherwise projection for 2028 a possible result.

As suggested above, basing policy on the spurious accuracy of forecasts three years out is both misleading and counter-productive, especially given precarious assumptions about energy tariffs. Instead, our continued call for still-lower ECB rates is based around the fact that financial conditions have tightened since the last ECB rate cut, both because of market swings but also by what may be banks being more cautious. In addition, any downside surprise to the clearer undershoot of the 2% target seen into early 2026 may add to calls for fresh easing.

I,Andrew Wroblewski, the Senior Economist Western Europe declare that the views expressed herein are mine and are clear, fair and not misleading at the time of publication. They have not been influenced by any relationship, either a personal relationship of mine or a relationship of the firm, to any entity described or referred to herein nor to any client of Continuum Economics nor has any inducement been received in relation to those views. I further declare that in the preparation and publication of this report I have at all times followed all relevant Continuum Economics compliance protocols including those reasonably seeking to prevent the receipt or misuse of material non-public information.