France: Kicking the Fiscal Can (Again)

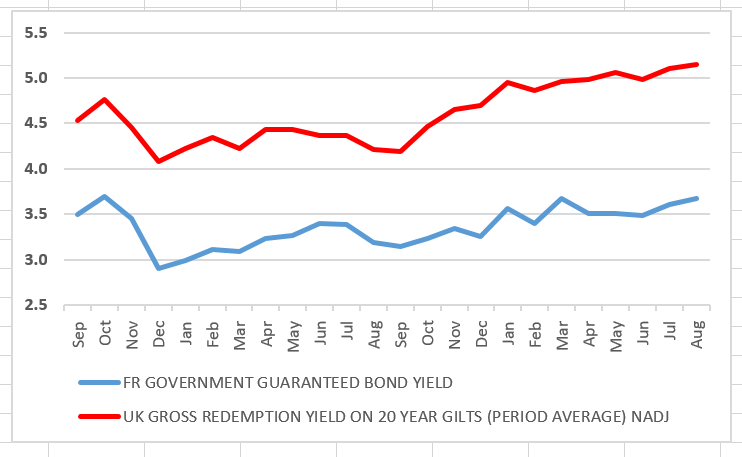

That France has seen the departure of yet another prime minister is no surprise, hence why financial markets took the confidence vote in its stride. Admittedly, French sovereign spreads and yields have risen in the last month, but even so the actual level of bond yields remains well below that of the UK (Figure 1) despite higher debt and deficit in France. We suggest this is largely a result of France being part of the EZ and where the ECB offers some protection – albeit where France’s current politics-driven fiscal woes suggests the much vaunted TPI tool is highly unlikely to be used.

Figure 1: More Troubled Markets?

Source: Datastream

Instead, it is the current low level of ECB policy rates that is cushioning the French market on a relative basis. Thus with policy rates still likely to fall further, whatever surfaces as the next French government can afford to kick the fiscal can further down the road. However, this may be only for the time being as when the ECB starts to tighten afresh, market scrutiny of France will intensify, especially as this may coincide with heightened French political uncertainty in 2027 related to the then-likely presidential election.

France political deadlock took a fresh turn with the defeat of Prime Minister Francois Bayrou at a confidence vote in the National Assembly after he staked his government on an emergency confidence debate centred on the question of deficits and debt. The defeat means that President Macron must now decide how to replace him. Macron’s office said this would happen in the coming days; the now plausible option of fresh parliamentary election is unlikely to be used, not least as it may again leave the Assembly’s three way divides largely unchanged. France is thus likely to see its fifth prime minister in less than two years, something that underscores the disenchantment that have marked President Macron’s second term.

Some have speculated that Macron would turn now to a left-wing prime minister, having failed with the conservative Barnier and the centrist Bayrou. However, with mayoral election looming in early 2026, neither the left nor right will wish to be associated with either the unpopular Macron or austere policies. It therefore seems likely Macron will have to resort to another figure from within his own camp, meaning that effectively macron will be kicking the political and fiscal can further down the road.