EZ HICP and Jobs Review: Headline at Target as Services Inflation at Fresh Cycle-low

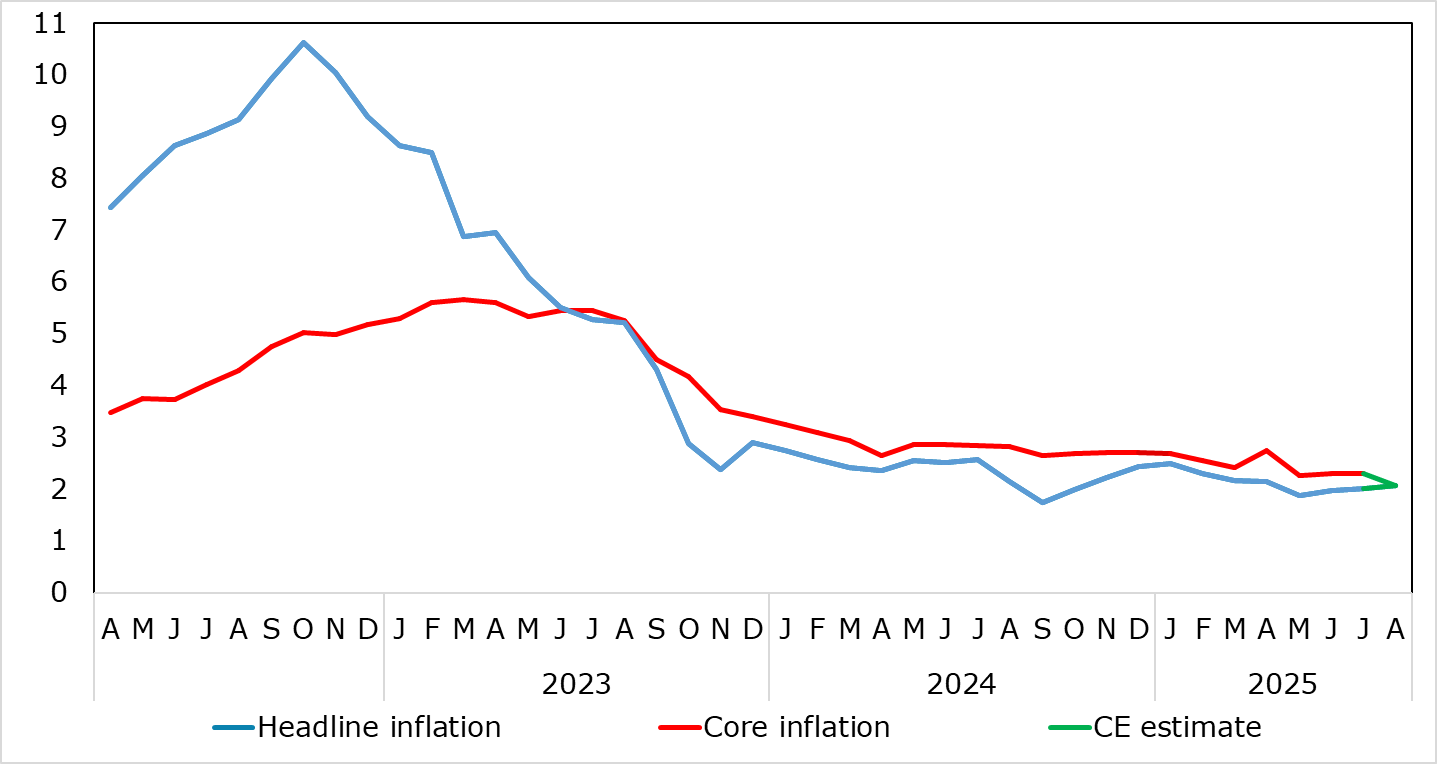

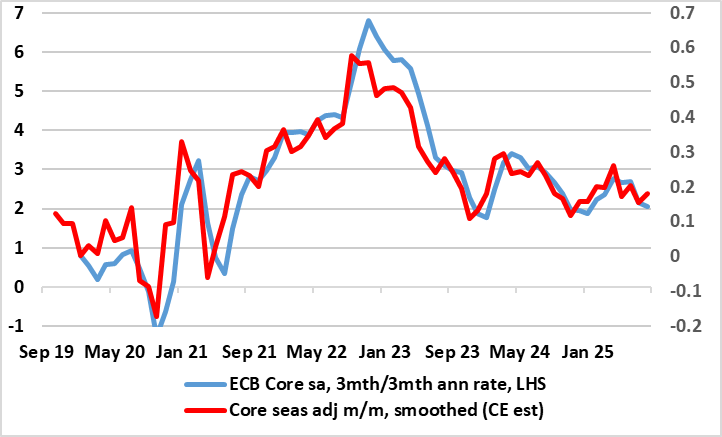

HICP, inflation – still at target – is very much a side issue for the ECB at present, albeit with the likes of oil prices and tariff retaliation and a low but far from authoritative jobless rate (Figure 3) possibly accentuating existing and looming Council divides. Regardless, despite adverse energy base effects, we correctly saw the flash July HICP staying at June’s 2.0% but up from May’s eight-month low and below-target 1.9% (Figure 1). More notably, and something to calm those hawks, having jumped to 4.0% in April, very probably due to the impact of the timing of Easter we envisaged further calendar effects taking it down to 3.1% in July - the softest since Mar 2022. Even so result, the core rate stayed at 2.3%, the lowest since Oct 2021. Moreover, as those calendar distortions unwind, what has looked like fresh price pressures in seasonally adjusted short-term m/m movements for core and services are reversing and notably so (Figure 2)!

As we have repeated of late, HICP inflation – still at target – is very much a side issue for the ECB at present, offset instead by moderate concerns whether the apparent resilience of the real economy may yet falter. This mindset will not be altered by the flash HICP data for August even given the likely 0.1 ppt rise in the headline to 2.1%, hinting that the ECB’s Q3 projection could be overshot, especially given the possible further rise that could occur in September. But this is largely food and energy base effect driven as the core rate in August may drop from 2.3% to a fresh cycle low of 2.1% (Figure 1), in turn suggesting an undershoot of ECB underlying inflation forecast for Q3, something already evident in adjusted m/m data (Figure 2). As a result, the headline and core rate could both dip below 2% in Q4 with base effects pulling the headline down to around 1.5% in Q1, especially if demand weakness (Figure 3) starts to accentuate what have largely been supply factors driving the disinflation process hitherto (Figure 4).

Figure 1: Headline Edges Above Target as Core and Services Hit Cycle-Low

Source: Eurostat, CE

Despite adverse energy base effects, July HICP inflation stayed at June’s 2.0% but was still up from May’s eight-month low and below-target 1.9% (Figure 1). More notably, and something to calm ECB hawks, having jumped to 4.0% in April, very probably due to the impact of the timing of Easter, further calendar effects took services inflation down to 3.1% in July - the softest since Mar 2022; this masks a clear(er) underlying slowing that has also helped pull the core rate down on a smoothed adjusted m/m basis. . Moreover, as those calendar distortions unwind, what has looked like fresh price pressures in seasonally adjusted short-term m/m movements for core have reversed and notably so (Figure 2)!

Figure 2: Core Inflation Around Target in Shorter-Term Dynamics?

Source: Eurostat ECB, CE

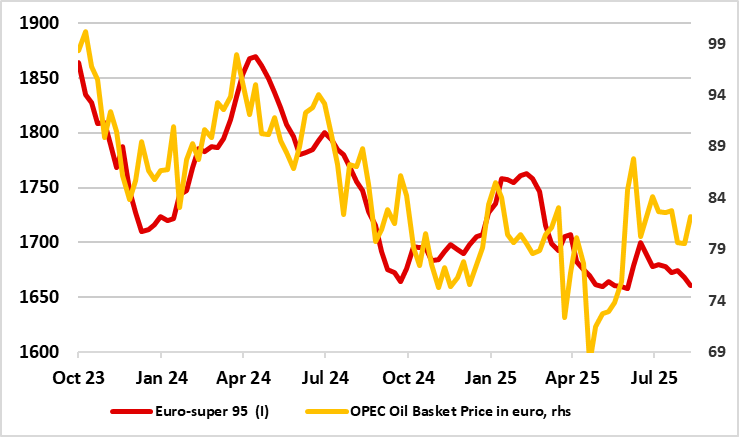

The July HICP data was dominated on the upside by higher energy (fuel) prices and food costs, the former largely base effect driven and with the August figures likely to be similarly affected – food prices pose an upside risks given recent European heatwaves possible impact on supply. This is important as such largely non-discretionary items will add to spending power problems for households which are still suffering from real wage deterioration. But there are signs that spending power constraints may be restraining price pressures to some degree – it is notable that the rise in oil prices has not prevented what has been a continued fall in the likes of fuel prices whether that be petrol or heating gas oil (Figure 3).

Figure 3: Petrol Costs Still Falling Even as Oil Spikes Higher

Source: Eurostat

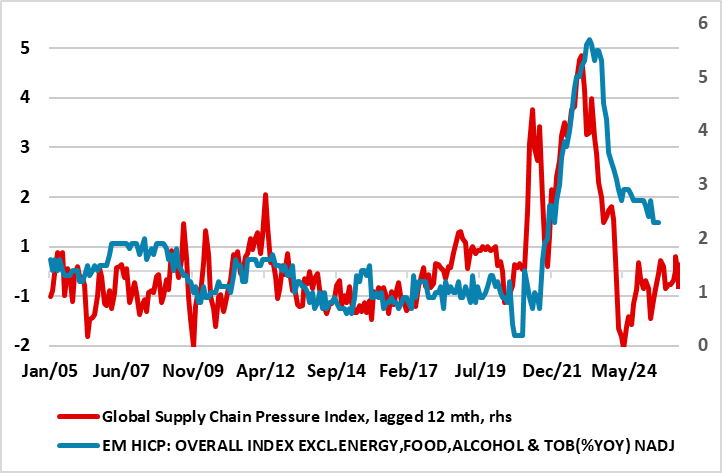

Supply or Demand?

The relevance of demand vs supply in inflation dynamics is resurfacing and was mentioned in a speech in Jackson Hole by President Lagarde. This is still a topic of big debate and disagreement, partly depending upon what part of the global economy one is more guided by. Indeed, economists at the IMF influenced more by matters-USA seem to think that inflation has been demand driven while an ECB paper suggests the opposite - as does Lagarde. Indeed, the ECB paper notes that ‘shocks linked to global supply chains and to gas prices have exhibited a much larger influence than in the past. Overall, supply shocks can explain the bulk of the post-pandemic inflation surge, also for core inflation’. This is backed up by measures of supply side pressures such as that compiled by the NY Fed. Its monthly aggregate (its so-called Global Supply Chain Pressure Index) has stopped falling but has done so only back to levels that were seen prior to the pandemic and which also suggest supply factors may yet have a further impact on EZ underlying Inflation (Figure 4).

Figure 4: Reduced Supply Pressures Largely Responsible for Softer Inflation So Far?

Source: Eurostat, Federal Reserve Bank of New York, Global Supply Chain Pressure Index, CE

This latter view is one with which we agree and can provide evidence to substantiate. Notably ECB Chief Economist Lane has very much underscored that the Persistent and Common Component of Inflation (PCCI) is the best predictor of inflation one and two years ahead and this is all the more notable as this measures have eased back to 2% of late. Given that it perhaps the best measure of price persistence, it is adding to arguments that worries about price resilience are overdone, albeit at the same time suggesting that disinflation may have largely run its course.