ECB Monetary Worries Emerging as Corporate Credit Dynamics Weaken More Clearly

As a foretaste of the Bank Lending Survey BLS) due tomorrow, the ECB released two associated pieces of data today, both corroborating and continuing an ever worrying pattern, namely weakness in corporate credit. The data showed growth in later has fallen to its lowest in almost two years (Figure 1). while survey data report both a small net tightening in bank loan interest rates as well as in other loan conditions related to both price and non-price factors (Figure 2). Thus, these updates chime with the messages from recent BLS which suggest banks increasing lending standards to firms, especially those exposed to the export sectors. The question as whether this is even more tangible evidence that the threat posed by U.S. tariffs is becoming more of a reality and that the ECB therefore needs to reassess its complacent view of the backdrop, particularly regarding credit dynamics the slowing in which we see as being driven by tight(er) financial conditions if which more evidence for the latter emerging in the ECB survey today!

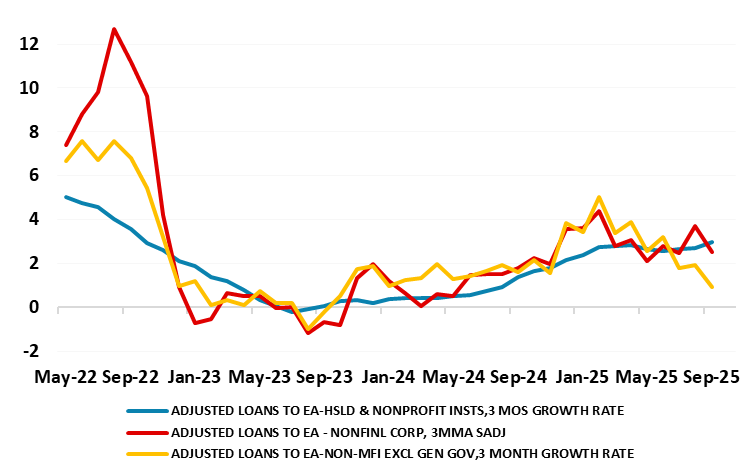

Figure 1: Credit Growth Already Softening Afresh – Notably on the NFC side

Source: ECB

Weak corporate credit dynamics are not new. Indeed, the last two BLS reports suggested that for firms with perceived risks related to the economic outlook continued to contribute to a tightening of credit standards. Indeed, July’s BLS made it clear that the tariff threat was taking a toll on banks’ willingness to lend and firm’s appetite to borrow even in March, ie well before the possible scale and breadth of the tariff threat emerged.

Banks Getting Warier?

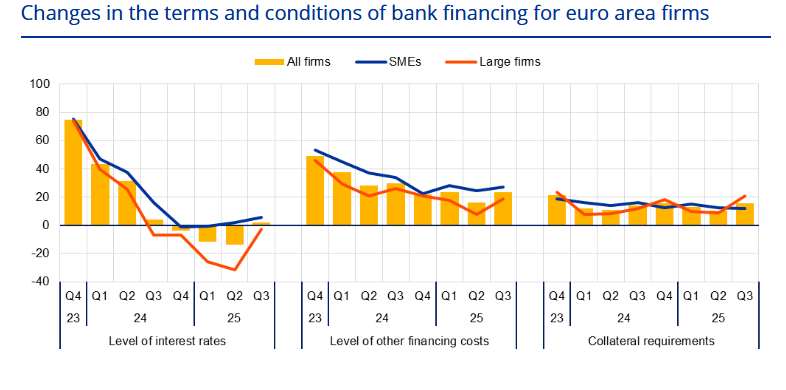

Indeed, it does seem as if what credit growth there is increasingly concentrated among larger and less risky firms. Indeed, results from the ECB survey on the access to finance of enterprises (SAFE) confirm that small firms have experienced a more muted decline in external financing costs than larger producers. In the most recent round published today), EZ firms reported a slight net increase in interest rates on bank loans (a net 2%, compared with -14% in the previous quarter). This increase was primarily reported by small and medium-sized enterprises, while a net 3% of large firms reported a decline in interest rates. At the same time, a net 23% of firms (up from 16% in the previous quarter) observed increases both in other financing costs (i.e. charges, fees and commissions) and in collateral requirements (a net 16%, up from 11% in the second quarter, Figure 2).

Figure 2: Credit Conditions Tightening for Firms Too

Source: ECB SAFE, net percentages are the difference between the percentage of firms reporting an increase for a given factor and the percentage reporting a decrease.

This is doubly troubling as the September Council meeting noted, banks have been de-risking by skewing their corporate lending away from risky firms towards safer ones. Thus, the decline in the observed cost of borrowing for firms could therefore partly reflect a compositional effect, which might mask true (and somewhat higher) borrowing costs – does this imply that the looming new BLS will corroborate that banks have become less willing to lend? If so, the ensuing change in borrower composition and the muted risk appetite of banks point towards the risk-taking and balance sheet channels of monetary policy operating less strongly for lower-income households and smaller firms during the easing cycle. Since these groups typically have higher marginal propensities to consume and invest, this heterogeneity in transmission may reduce the effectiveness of recent interest rate cuts in stimulating aggregate demand in the current context of high global uncertainty, this the view of ECB Chief Economist Lane.

Credit Growth Slowing – Ever More Clearly for Firms!

And importantly, any such concerns raised by banks may already be having a tangible negative impact. Indeed, while official credit growth data showed adjusted credit growth still stable at 2.8% y/y in (as President Lagarde underlined in her press conference), this masked a clear m/m softening, in both households but particularly non-financial company credit (Figure 1) the latter very much accentuated in today’s September money and credit data. Admittedly, this may be just more volatility but we (instead still) think this reflects banking wariness as highlighted in the BLS as well as what seems to be tighter financial conditions as opposed to a loosening in the latter that the ECB seem to discern, despite evidence to the contrary. This tightening in financial conditions may also reflect another worrying message evident in a recent BLS as well as in some Council comments– namely that QT is not as neutral as the ECB has been alleging. This is something we have highlighted and think will trigger an ECB response in terms of slowing QT now more likely in the new year.