German Data Preview (Aug 29): Base Effects to Pull Headline Back Up - Temporarily?

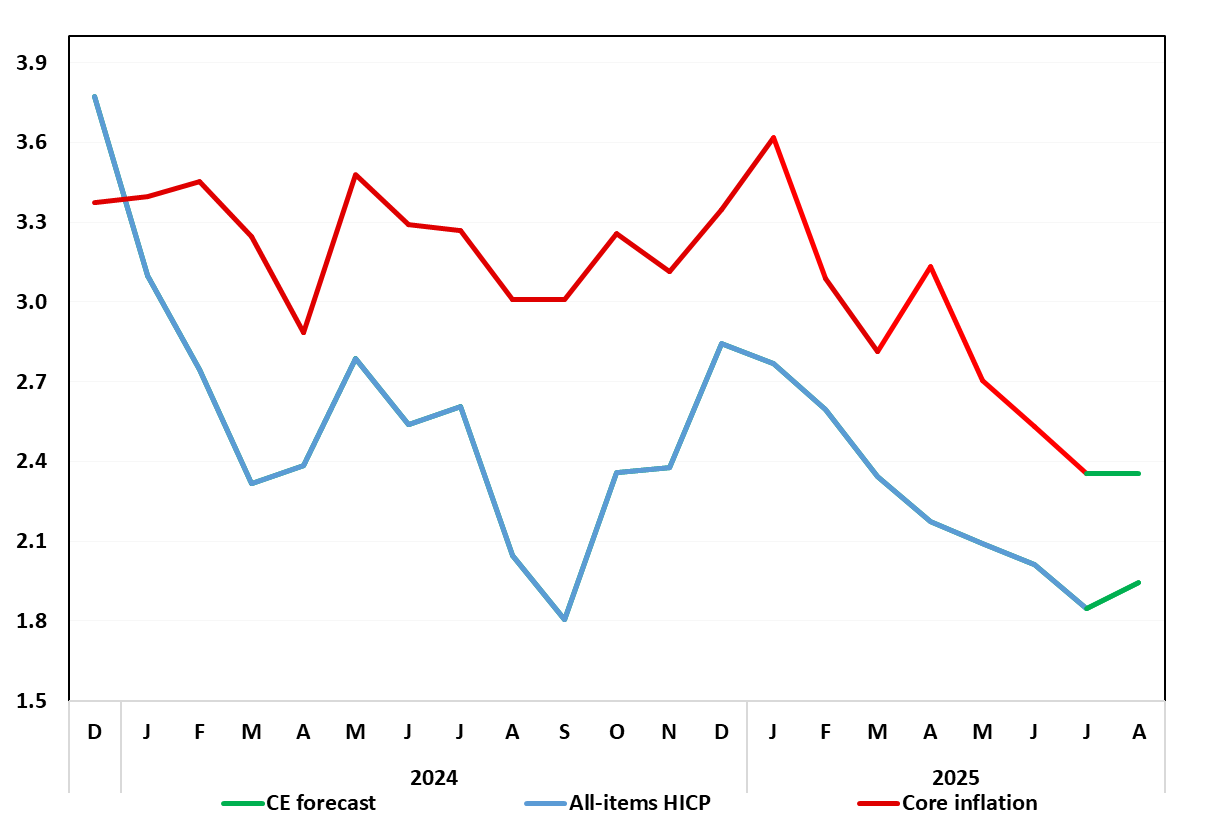

Germany’s disinflation process continued, with the lower-than-expected July HICP numbers refreshing and reinforcing this pattern, with a 0.2 ppt drop to 1.8% y/y, a 10-mth low (Figure 1). This occurred in spite of adverse energy base effects albeit these likely to feature even more strongly in the August numbers, enough to take the headline back toward, if not actually to, 2.0% - food prices pose upside risks. Regardless, last time around, there was some reversal of June’s surprise and marked fall in food price inflation alongside a small further drop in services inflation, the latter likely to reoccur in August. Even so, the August HICP we see, comes with ‘only’ a 0.1 ppt drop in the core to 2.3% and perhaps staying at 2.4%.

Figure 1: HICP Inflation Edges Back Up to Target?

Source: German Federal Stats Office, CE

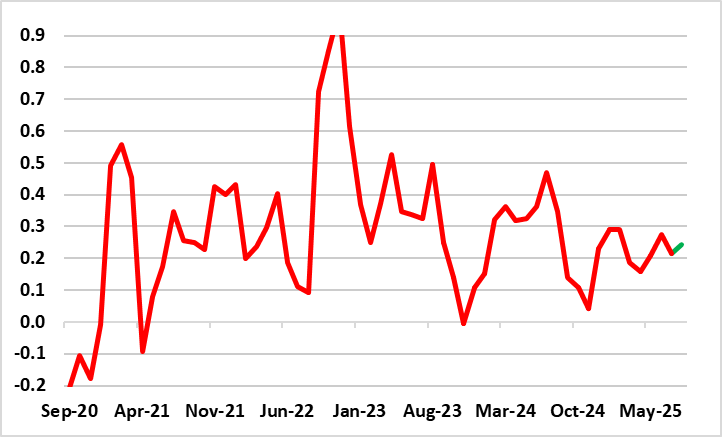

The German July data were bolstered by energy prices – mainly due to fuel prices having dipped more last year than this year – and this will again the case in this time around – actually some small m/m drop seems to have occurred. Moreover, perhaps clear disinflation news may be evident in adjusted m/m data which have shown some fresh downtick in core rates, although this may not proceed discernibly further in the August numbers. In fact, adjusted data also suggest disinflation may have stalled (Figure 2), although this may be more a result of recent calendar aberrations than anything underlying and even if so, the data are consistent with on-target inflation. Admittedly, base effects could pull the headline a little higher in September, before a fresh fall resumes in Q4!

Figure 2: Adjusted Core Rate Flattening Out?

Source: German Federal Stats Office, CE, % chg m/m seasonally adjusted and smoothed