Latin America

View:

September 16, 2025

Succession and Strongmen Leaders

September 16, 2025 10:53 AM UTC

In the unexpected scenario of an early death, Putin and Xi have no clear successors, and any new Russia or China leader would have to spend time building domestic strength and compromising on external goals. Erdogan also has no clear successors, which could create political uncertainty. For Trump su

September 08, 2025

August 08, 2025

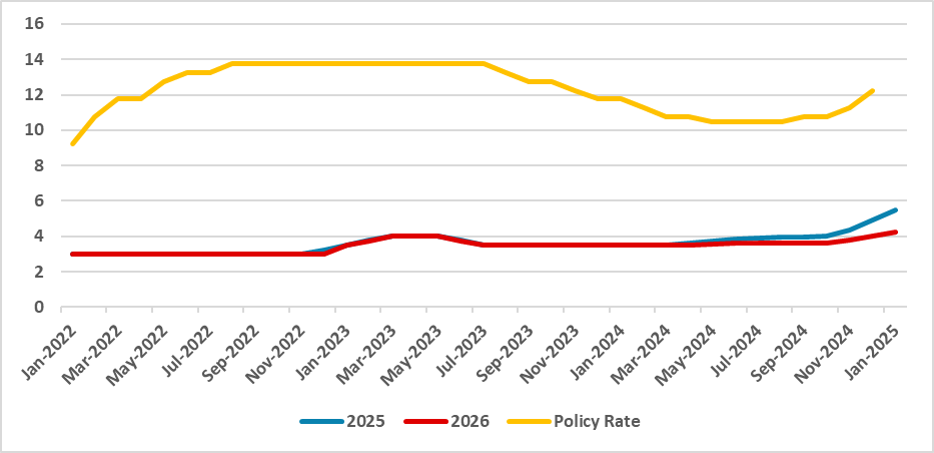

Mexico: Further 25bps Cuts Ahead

August 8, 2025 6:44 AM UTC

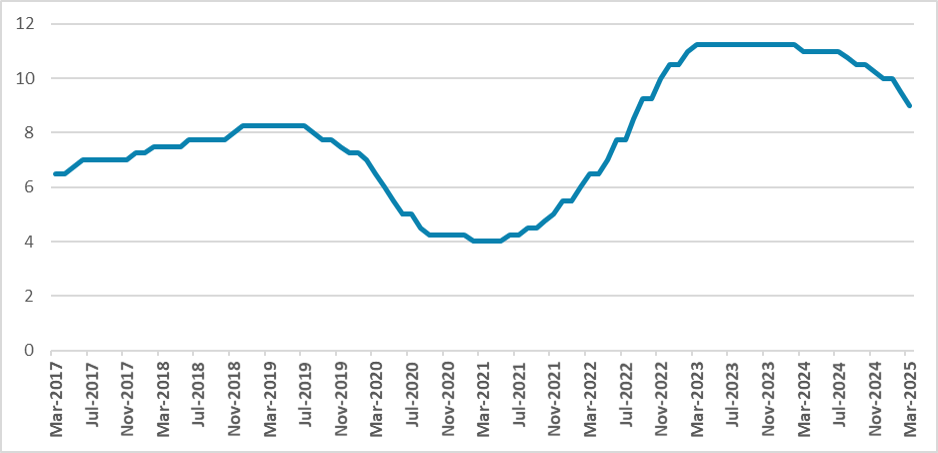

Banxico forward guidance, plus trade policy risks with the U.S. now see us forecasting an end 2025 policy rate at 7.25% with two 25bps cuts in September and December. We now feel that the risks to 2026 growth will encourage Banxico to move the policy rate down to 6.5% by spring 2026 by two 25bps rat

July 03, 2025

U.S. Assets and Valuation

July 3, 2025 9:30 AM UTC

The U.S. equity market has returned to be clearly overvalued on equity and equity-bond valuations measures and is vulnerable to a new correction in H2 on any moderate bad news (e.g. further economic slowing and corporate earnings downgrades). In contrast, U.S. Treasuries are at broadly fai

June 27, 2025

Mexico: Back Toward Neutral Policy Rates

June 27, 2025 6:56 AM UTC

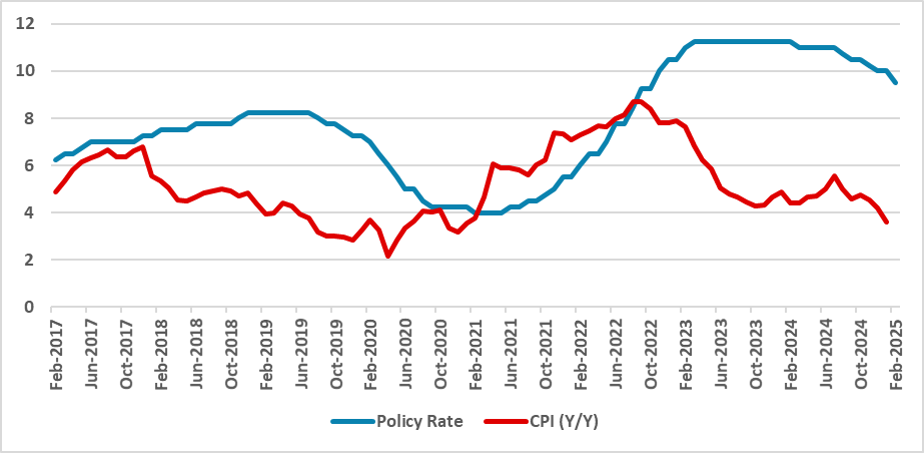

Banxico has cut by 50bps to 8.00%, while also signalling in its statement that further easing will now be data dependent. Our forecast is for easing to move to a 25bps pace and to come once a quarter – most likely in September and December. Some improvement in the monthly inflation trajectory woul

June 25, 2025

Outlook Overview: Trump’s Fluid Policies

June 25, 2025 7:20 AM UTC

· President Donald Trump still wants to use the tariff tool, and we see the eventual average tariff rate being in the 13-15% area, lowered by deals but increased by more product tariffs. Any lasting legal block on reciprocal tariffs will likely see the administration pivoting towards ot

June 24, 2025

Equities Outlook: Choppy Then 2026 Gains

June 24, 2025 8:15 AM UTC

Though the U.S. equity market has rebounded, we still scope for a fresh dip H2 2025 to 5500 on the S&P500 as hard data softens further to feed into weaker corporate earnings forecasts and CPI picks up and delays Fed easing. However, the AI story is still a positive, while share buybacks

June 19, 2025

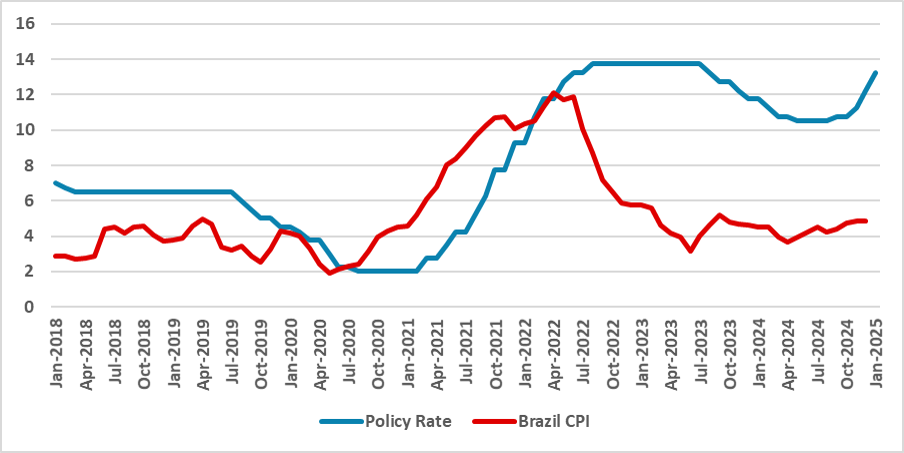

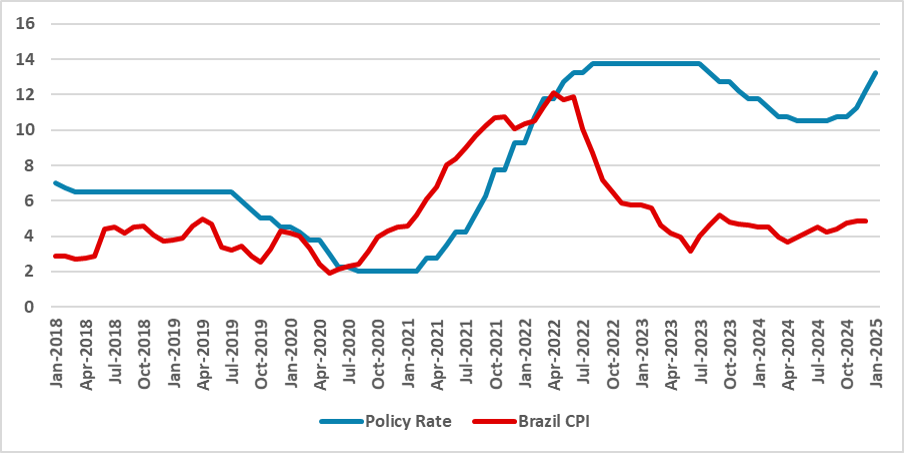

Brazil: Last Hike And Then Long Hold

June 19, 2025 6:33 AM UTC

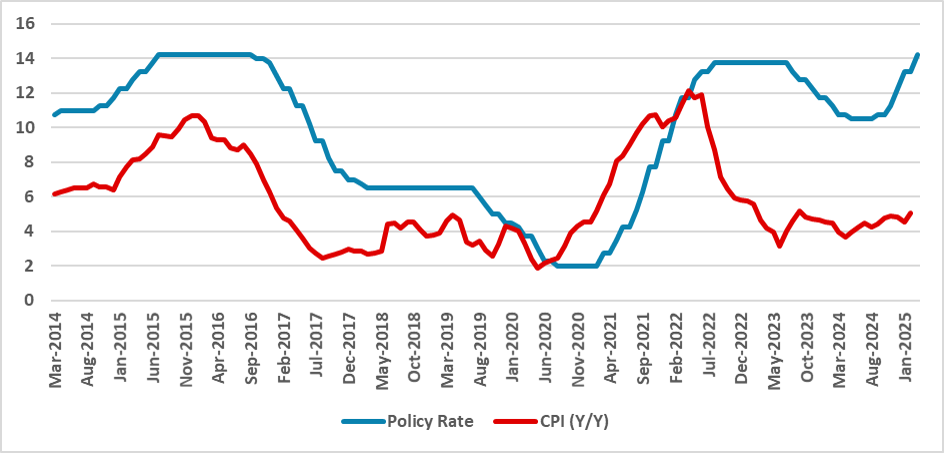

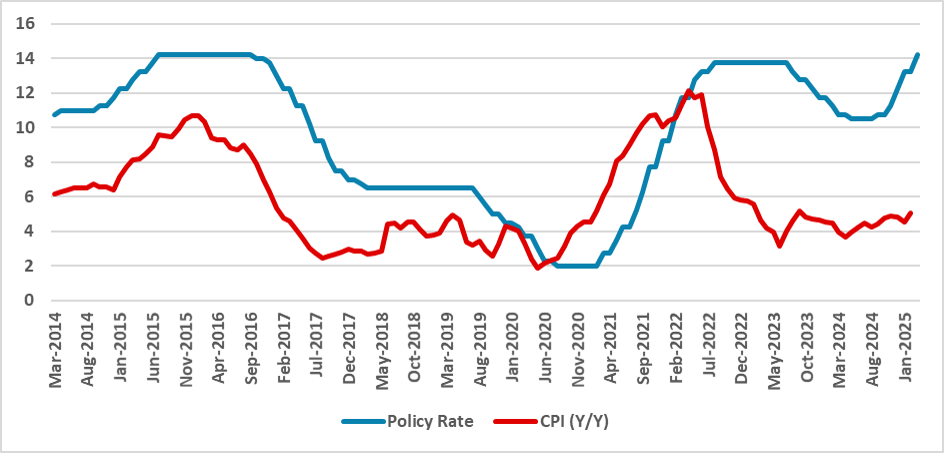

Though the BCB surprised and hiked by 25bps to 15%, the statement signalled that policy will now go on hold for a very long period. Some economists feel that by year-end, that the BCB will be confident enough to move from very restrictive to restrictive and lower the SELIC rate. We would suspect

June 03, 2025

May 08, 2025

Brazil: Reaching the Rate Peak

May 8, 2025 6:43 AM UTC

Forward guidance from the BCB after the 50bps hike to 14.75% suggests that we are close to a rate peak, with inflation concerns now cited on both sides. The disinflationary impact of Trump tariffs on global trade and commodity prices is now being watched, as BCB members have signaled over the last

April 30, 2025

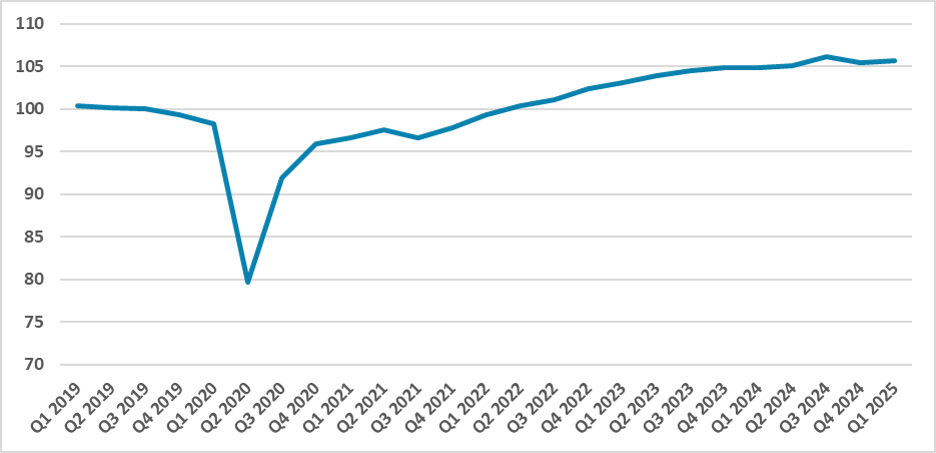

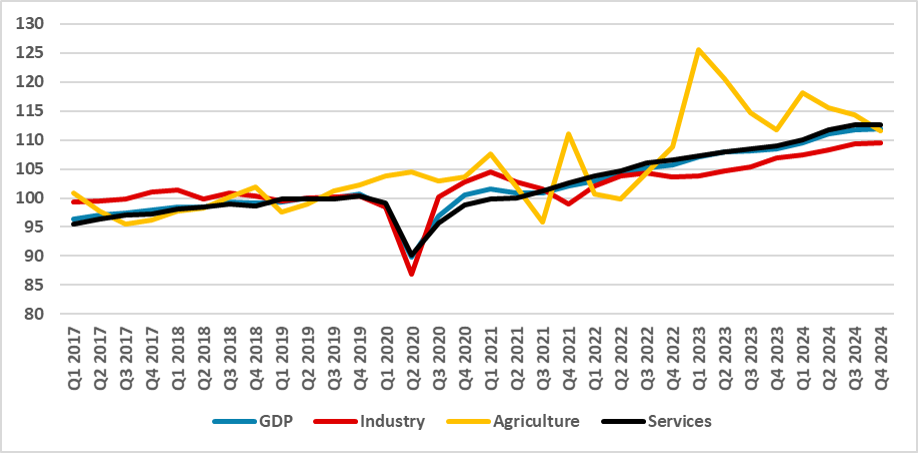

Mexico’s GDP Review: Saved from the Technical Recession, but Growth Slows

April 30, 2025 2:52 PM UTC

Mexico narrowly avoided a technical recession in Q1 2025 with 0.2% GDP growth, driven by a volatile rebound in agriculture. However, industrial output contracted and services stagnated, highlighting a broader economic slowdown. Uncertainty over potential U.S. tariffs and tight monetary and fiscal po

April 28, 2025

Argentina: Activity Continues Growing

April 28, 2025 1:15 PM UTC

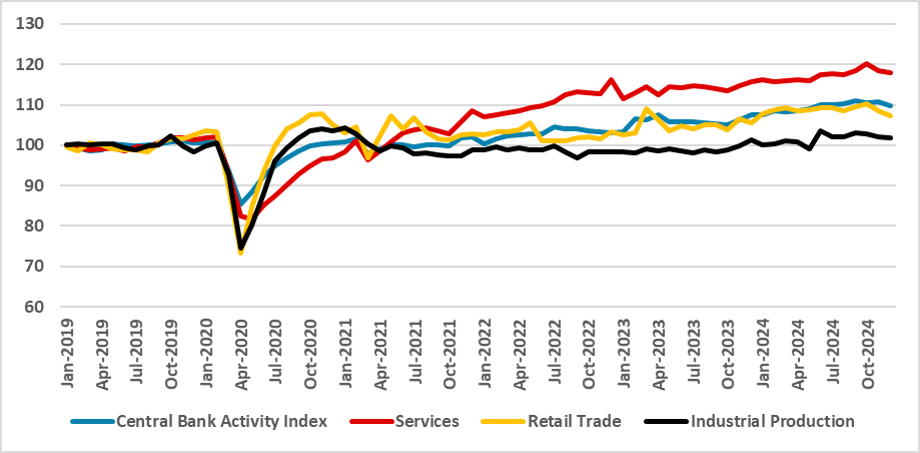

Argentina’s economy grew 2.3% in February and 6% year-on-year, showing continued short-term recovery driven by financial and mining sectors. However, rising imports and an overvalued exchange rate are straining reserves, despite IMF support. While agricultural exports may ease pressure mid-year, s

April 23, 2025

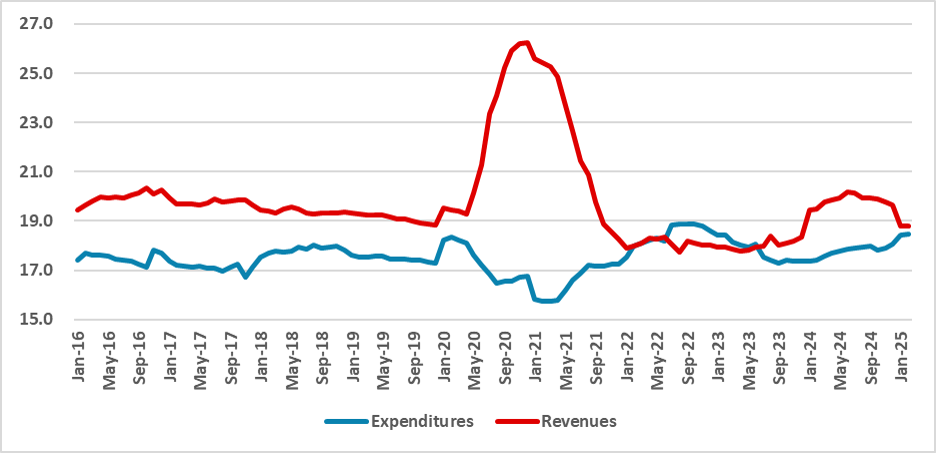

Brazil: Fiscal Result Improves but Structural Changes Remains in Doubt

April 23, 2025 5:57 PM UTC

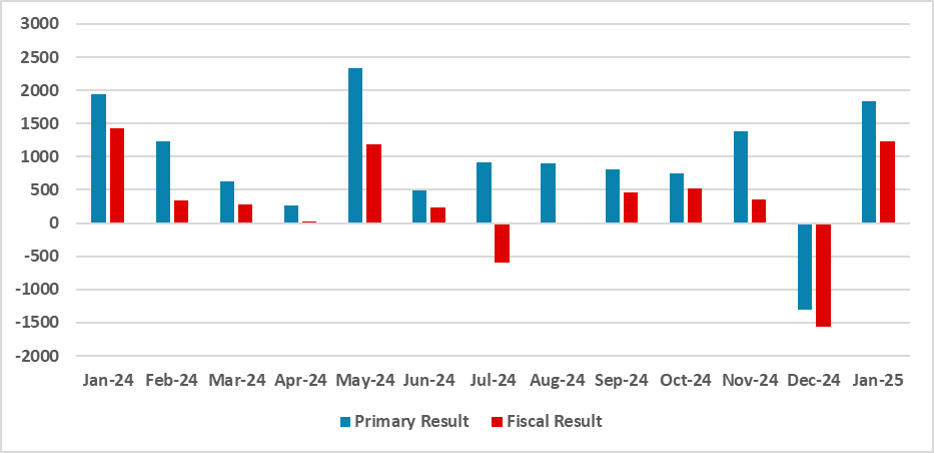

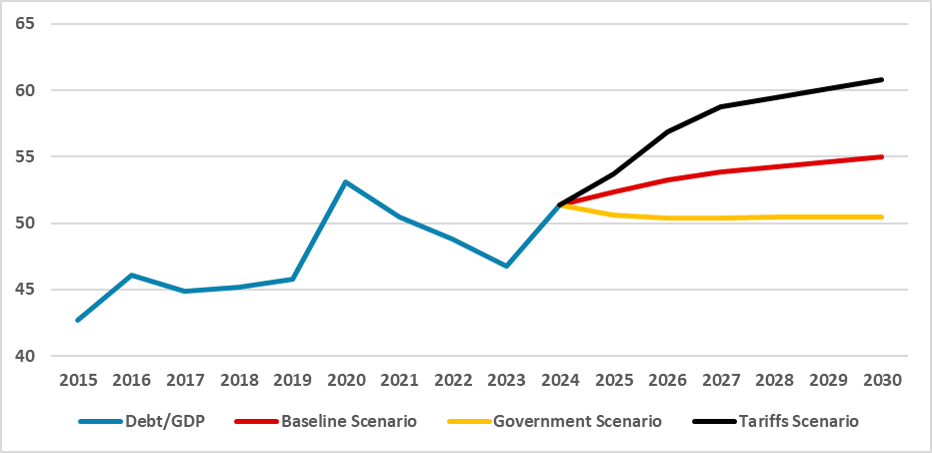

Brazil’s fiscal data shows slight improvement, with a 0.1% primary deficit by February and a 2024 deficit in line with targets, excluding flood aid. The 2025 goal is a 0% deficit, but structural issues remain. Recent gains stem from reduced court-ordered payments and delayed hiring. However, risin

April 17, 2025

Banxico Minutes: Comfortable about the Cuts Amid the Volatility

April 17, 2025 2:26 PM UTC

Banxico’s latest minutes confirm a cautious but steady path toward policy normalization, with the policy rate expected to reach neutral levels (7.00–8.00%) in 2025. While the economy shows signs of deceleration and a negative output gap, inflation continues to ease, nearing historical averages.

April 15, 2025

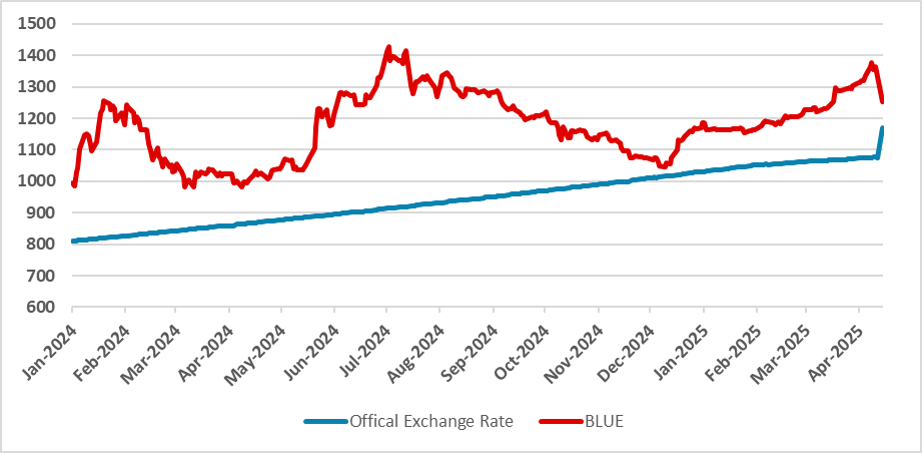

Argentina: Moving to Phase 3, Bands Flotation

April 15, 2025 8:33 PM UTC

Argentina launched Phase 3 of its macro plan, ending currency restrictions for individuals and securing a USD 20B IMF deal to stabilize falling reserves. The Central Bank shifted from a crawling peg to a target band exchange rate regime, allowing for a 1% monthly devaluation within ARS 1,000–1,400

April 11, 2025

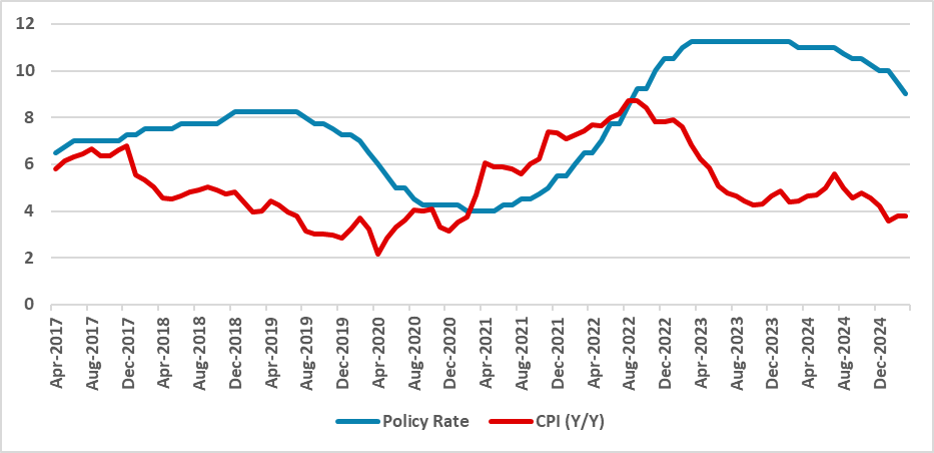

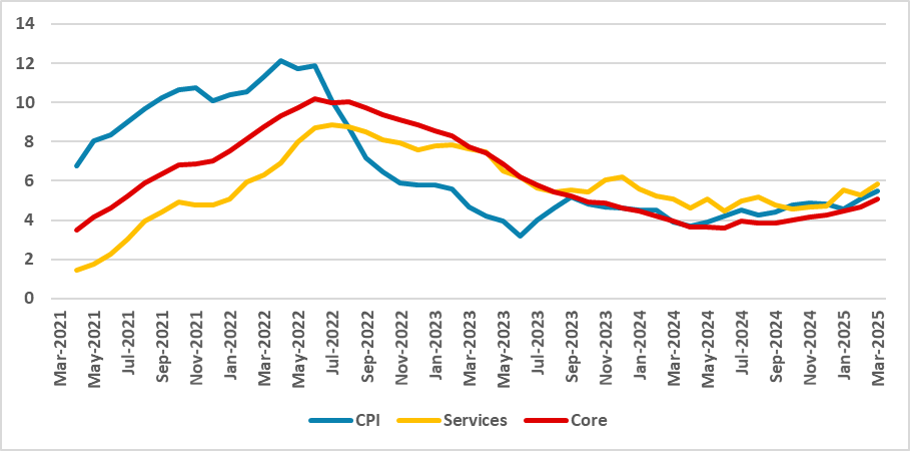

Brazil CPI Review: March Acceleration, Hike Confirmation

April 11, 2025 2:21 PM UTC

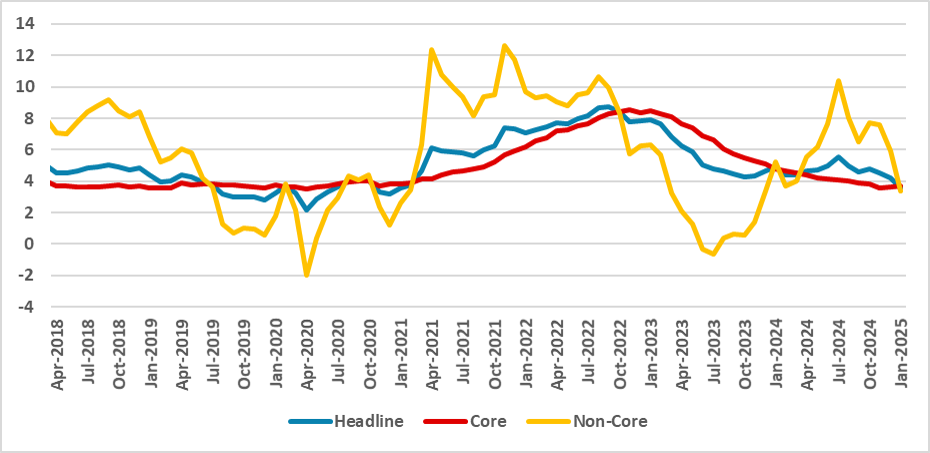

March CPI in Brazil rose 0.6%, above expectations, pushing the annual rate to 5.5%. Broad-based price increases, especially in food, signal persistent inflation pressures. Core inflation, notably in services, is well above the BCB’s target, and external volatility adds risk. With activity and cred

April 10, 2025

Mexico CPI Review: Moving as Expected

April 10, 2025 2:20 PM UTC

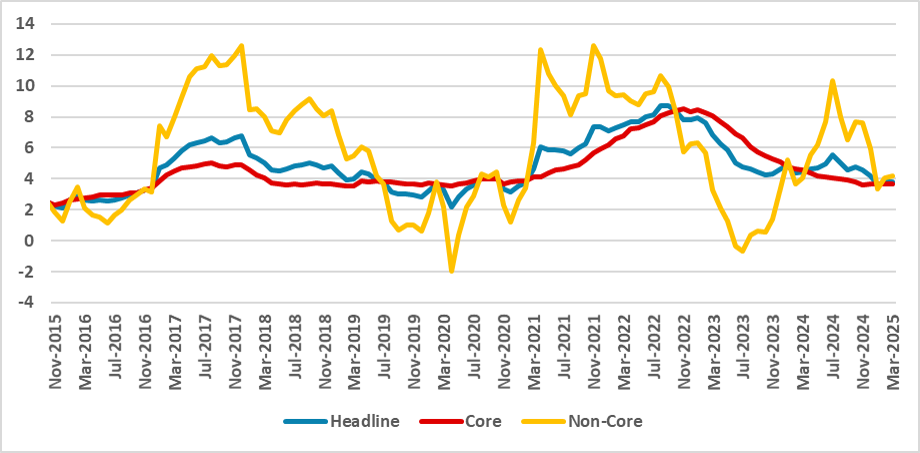

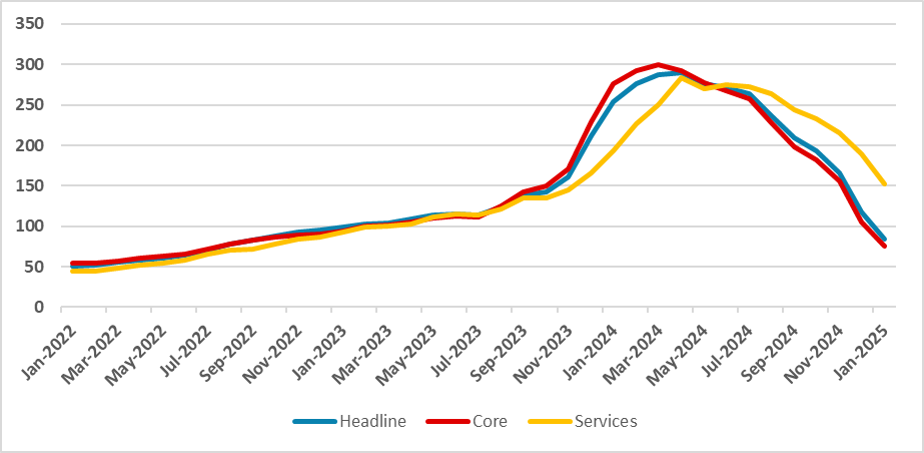

Mexico’s March CPI rose 0.31%, matching expectations but below the historical average. Annual inflation edged up to 3.80%, driven by core components like food and services. Non-core inflation fell due to lower energy prices. Food saw strong gains, while transport costs declined. The narrowing gap

April 08, 2025

Brazil: Credit Accelerating Despite Higher Rates

April 8, 2025 6:44 PM UTC

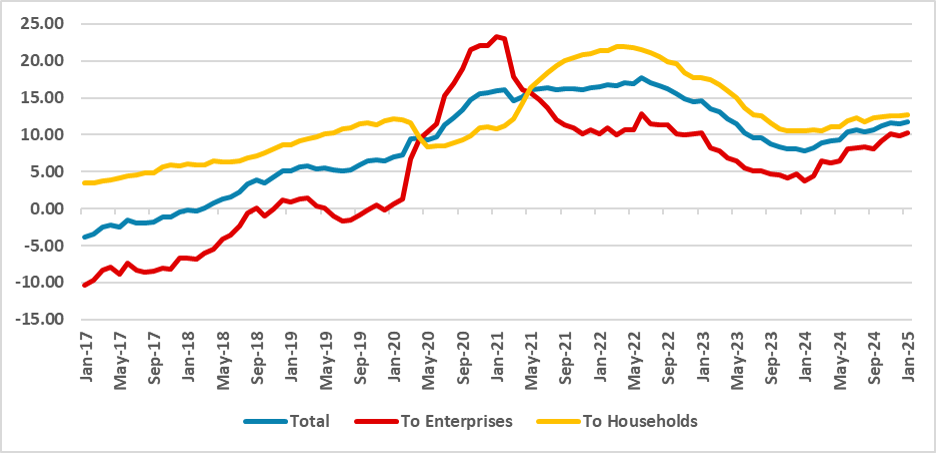

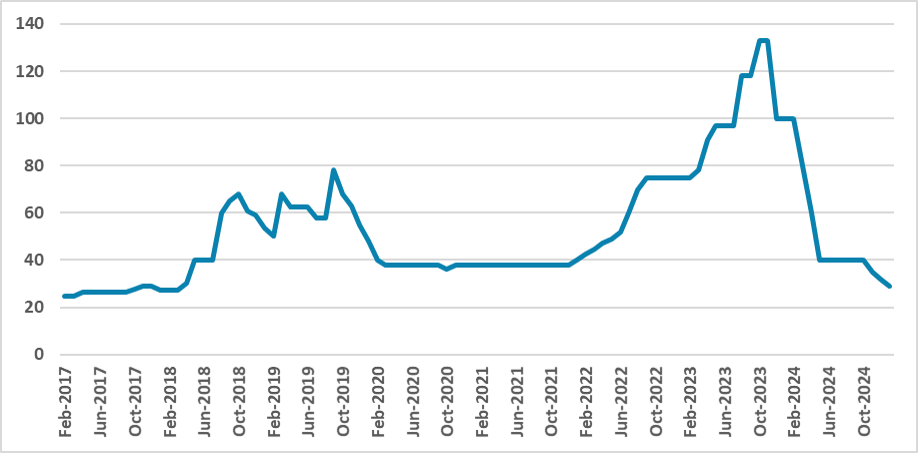

The Brazilian Central Bank (BCB) has resumed raising the policy rate due to persistent inflation concerns, despite expectations of credit deceleration. In contrast, credit has accelerated in recent months, indicating that the credit channel through monetary policy may be compromised, increasing disi

April 04, 2025

Argentina: Reserves Depleting, New Devaluation?

April 4, 2025 6:28 PM UTC

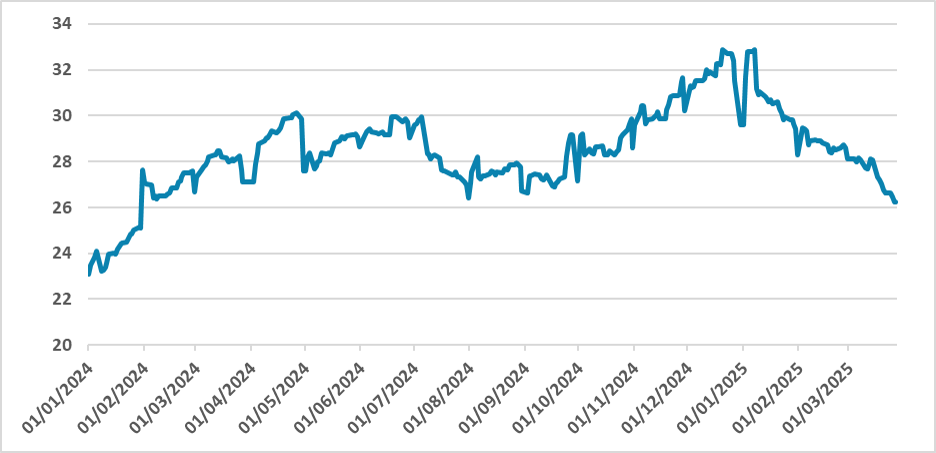

Argentina's foreign reserves have recently fallen to USD 26 billion, the lowest since February 2024, largely due to Central Bank bond payments and difficulties acquiring USD. While internal demand recovers, imports are outpacing exports, complicating reserve accumulation. Additionally, maturing Cent

April 03, 2025

Mexico: Saved from Tariffs?

April 3, 2025 7:56 PM UTC

Mexico has avoided reciprocal tariffs but still faces steel, aluminum, and auto tariffs. Authorities are negotiating to exempt goods, though retaliatory tariffs on U.S. imports seem unlikely. Mexico's economy is slowing, with growing recession fears and diminishing nearshoring prospects. The industr

March 29, 2025

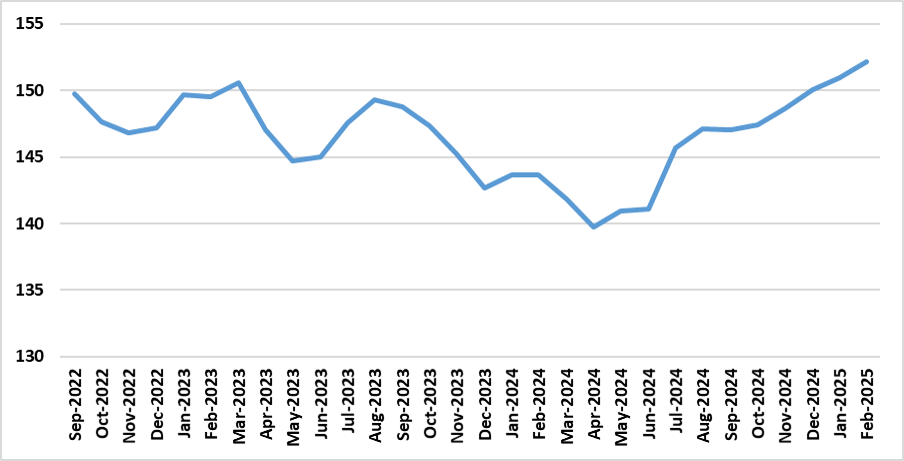

Banxico Review: Lowering Rates Amid Tariffs

March 29, 2025 9:29 PM UTC

Mexico’s Central Bank (Banxico) has cut the policy rate by 50 bps to 9%, in line with market expectations. The tone of the communiqué suggests a more dovish stance, with the board moving towards a neutral rate. Inflation has reached its lowest level since 2021, while economic growth has slowed. B

March 27, 2025

March 26, 2025

LatAm Outlook: Navigating the Uncertainty

March 26, 2025 9:56 PM UTC

· Brazil and Mexico economy are likely to decelerate in terms of growth in 2025, although we see this being stronger in Mexico. Mexico institutional reforms and its close ties with U.S. increases uncertainty for 2025, especially after Trump victory, and the menaces of Trump imposing tar

Outlook Overview: Navigating the Turbulence

March 26, 2025 9:30 AM UTC

· More tariffs will arrive from the U.S. from April with product (car, pharma, semiconductors and lumber) and reciprocal tariffs. President Trump has a 3-part approach to tariffs to raise (tax) revenue; bring production back to the U.S. and get fairer trade deals. This means some of t

Equities Outlook: Turbulence Ahead

March 26, 2025 9:05 AM UTC

· U.S. trade wars will likely hurt U.S. growth and raise inflation, with only small to modest Fed easing and a 10yr budget bill that will likely be neutral to negative for the economy. With valuations still very high (Figure 1), we see scope for a correction to extend into mid-year th

March 25, 2025

BCB Minutes: Caution Rather than Optimism

March 25, 2025 10:51 PM UTC

The Brazilian Central Bank (BCB) raised the policy rate by 100bps to 14.25% amid signs of economic deceleration, including slower growth, job creation, and consumption. The BCB highlighted external uncertainties, such as U.S. trade policy, and domestic challenges with rising inflation. It emphasized

March 19, 2025

BCB Review: Confirming More Hikes

March 19, 2025 10:38 PM UTC

The Brazilian Central Bank (BCB) raised the policy rate by 100 bps to 14.25% and signaled further hikes, likely reaching 15.0% by May, potentially ending the current tightening cycle. The BCB emphasized inflation concerns and strong economic activity, suggesting a hawkish stance. Fiscal policy was n

March 12, 2025

Brazil CPI Review: 1.3% Monthly Growth, with Seasonal Impacts

March 12, 2025 10:43 PM UTC

Brazil's February CPI increased by 1.3%, the highest in 22 years, largely driven by the removal of subsidized electricity bills, which boosted Housing by 4.4%. The year-over-year inflation rose to 5.1%, above the BCB's target. Key contributors included Education (up 4.4%) and Food and Beverages (up

Argentina: Fresh IMF Deal on the Pipeline

March 12, 2025 12:00 AM UTC

The Argentine government has issued an emergency decree to authorize a new IMF deal, potentially worth USD 20 billion, to pay off Treasury debt to the Central Bank. This deal includes a 4-year grace period and 10-year repayment terms. The government aims to stabilize reserves, delay debt amortizatio

March 07, 2025

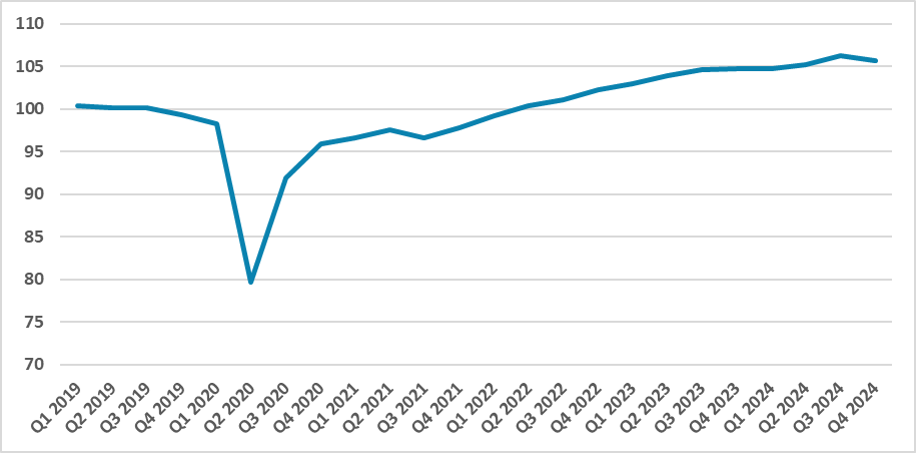

Brazil GDP: 3.4% Growth in 2024, but Deceleration in Q4

March 7, 2025 10:03 PM UTC

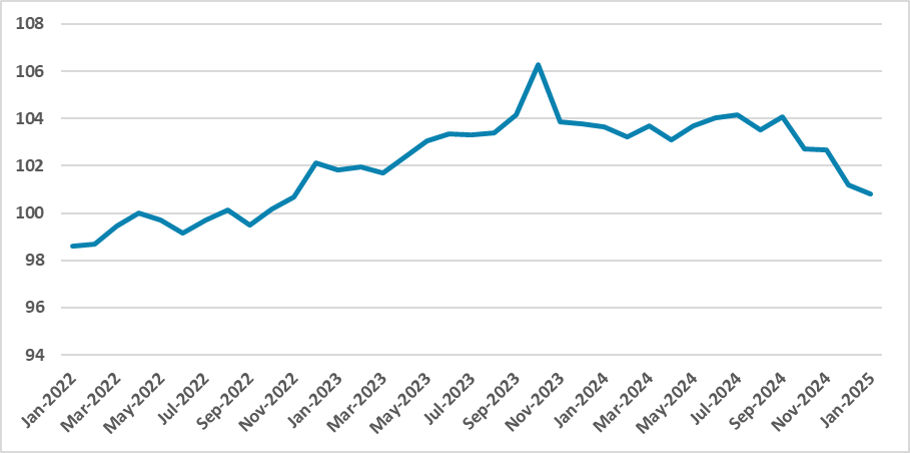

Brazil’s economy grew 3.4% in 2024, exceeding forecasts of 1.6%, with a 0.2% growth in Q4, reflecting a significant slowdown from Q3’s 0.9%. Key sectors like agriculture contracted, while industry and services showed modest growth. Investment and government consumption were the main drivers, tho

March 05, 2025

Mexico: Uncertainty Mounts as Tariffs Are Imposed

March 5, 2025 2:43 PM UTC

Trump's administration has moved forward with 25% tariffs on Mexican imports, citing drug trafficking and migration issues. Mexico’s President Sheinbaum has stated retaliatory measures will be announced on March 9. The tariffs could push Mexico into recession in 2025, although we forecast growth a

February 28, 2025

Mexico: Labour Market Decelerating as Expected

February 28, 2025 5:53 PM UTC

Mexico's labor market remains strong with an unemployment rate of 2.7%, but signs of deceleration are emerging. Worker affiliation to the pension system and wage growth are slowing, and some job creation stagnation is expected, potentially pushing the unemployment rate above 3%. A technical recessio

February 27, 2025

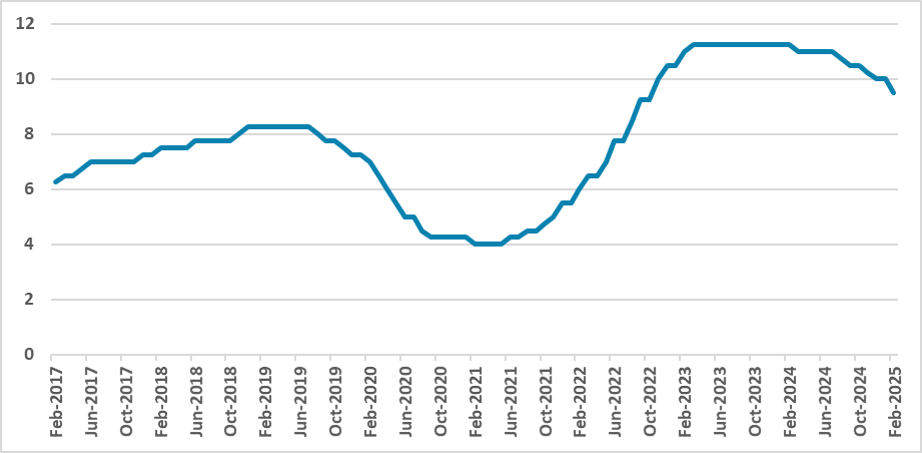

Brazil: Some Deceleration on Labour Markets, But Still Strong

February 27, 2025 7:53 PM UTC

Brazil's labor data through January indicates a slight deceleration in job creation, with annual net formal job growth at 1.6 million, above the 1.4 million registered in July 2023. While the unemployment rate rose slightly to 6.5%, it remains lower than January 2024. Admission salaries are growing

Argentina: Recovery Complete?

February 27, 2025 2:32 PM UTC

Argentina’s economy showed signs of recovery in December, growing 0.5% m/m and 1.2% q/q in Q4, with a 4.7% annual increase. The banking and trade sectors saw strong growth, but construction and industry stagnated. Despite progress, challenges remain, including inflation above 2%, a current account

February 21, 2025

Banxico Minutes: More Cuts on the Way

February 21, 2025 9:57 PM UTC

Banxico cut the policy rate by 50 bps to 9.5%, signaling a more dovish stance as inflation trends downward. The board cited weak domestic demand and improved inflation prospects but highlighted risks from U.S. policy uncertainty, tariffs, and immigration effects. While most members supported a 50 bp

February 20, 2025

Argentina: Primary Surpluses Continues

February 20, 2025 6:18 PM UTC

Argentina’s fiscal anchor under Milei remains the key stabilizer, with inflation gradually declining and the crawling peg rate cut to 1% monthly. A primary surplus of USD 8 billion was achieved in 2024 through spending cuts, while capital controls and IMF support help manage low reserves. For 2025

February 19, 2025

Mexico: Tariffs and Growth Issues Could Impose Fiscal Difficulties

February 19, 2025 10:20 PM UTC

Mexico aims for fiscal consolidation in 2025, relying on revenue growth while freezing most expenditures. However, weak growth could undermine this strategy. Authorities expect 2–3% GDP growth, but our forecast is 1.6%, with a recession risk. A less integrated U.S.-Mexico trade relationship, parti

February 18, 2025

Brazil: Activity Strong in Q4 but Some Marginal Deceleration

February 18, 2025 10:04 PM UTC

We see Brazilian economy growing 1.0% in Q4 and is expected to expand 3.6% in 2024, surpassing initial forecasts. However, monthly data shows signs of weakness, with contractions in services, industry, and retail trade in in December. Despite tight monetary policy (13.25%), the expected slowdown has

February 14, 2025

Argentina CPI Review: January Relief but Inflation Fight Continues

February 14, 2025 7:05 PM UTC

Argentina’s CPI rose 2.2% in January, slightly below forecasts, with Y/Y inflation dropping to 84% from 116%. Core CPI increased by 2.4%, accumulating 75% annual inflation. Inflation is expected to decline as devaluation effects fade, though inertia may keep it above 2% in the first half. Services

February 12, 2025

Brazil CPI Review: Mixed Signs from January Inflation

February 12, 2025 12:33 AM UTC

Brazil’s CPI rose 0.16% in January, lowering Y/Y inflation to 4.5% from 4.8%. A temporary electricity discount drove the decline, while Food (+1%) and Transport (+1.3%) showed worrying increases. Core inflation rose 0.7%, with Services CPI jumping to 5.4%, partly due to seasonal healthcare costs.

February 10, 2025

Mexico CPI Review: Inflation Falls as Demand Eases

February 10, 2025 7:14 PM UTC

Mexico’s CPI rose 0.3% in January, below its 0.6% historical average but in line with expectations. Y/Y inflation fell to 3.6%, the lowest since Jan/2021. Core CPI rose 0.4%, with core goods up 0.7% and services up 0.2%. Non-core CPI fell 0.13%, led by a 1.5% drop in agricultural goods. The econom

February 08, 2025

Banxico Review: 50 bps Cut as Expected

February 8, 2025 9:39 PM UTC

Banxico cut the policy rate by 50bps to 10.5%, with a cautious stance and a split vote. Inflation has fallen but remains above target, expected to converge to 3.0% by Q3 2026. Global risks, including Trump’s tariff threats, add uncertainty. Despite economic weakness, some monetary tightening may s

February 06, 2025

Argentina: Lower Rates, Conditions to Lift the Controls

February 6, 2025 6:16 PM UTC

The Argentine Central Bank cut rates to 29%, citing improved inflation expectations. Rather than using a contractionary policy, it aims to curb monetary base growth through fiscal consolidation. Inflation is below 3%, with a 2% target feasible by mid-year. However, the 1% crawling peg risks eroding

February 04, 2025

BCB Minutes: Detailing the Deterioration

February 4, 2025 6:29 PM UTC

The BCB raised rates by 100bps to 13.25%, signaling another hike in March. External uncertainty remains, but domestic risks worsened, with inflation expectations rising. The BCB stressed fiscal-monetary coordination and warned about policy distortions. Despite markets pricing a 15% rate, we expect s

January 31, 2025

Mexico GDP Review: 0.6% Contraction in Q4 and Recession Risks

January 31, 2025 6:34 PM UTC

Mexico’s GDP shrank by 0.6% in Q4 2024, bringing annual growth to 1.5%, well below previous years. The industrial sector led the decline, driven by uncertainty over Trump’s election and weaker investment, while agriculture also contracted sharply. Monetary tightening, lower U.S. demand, and poli

January 30, 2025

BCB Review: Maintaining the Course

January 30, 2025 6:09 PM UTC

The Brazilian Central Bank (BCB) raised the policy rate by 100bps to 13.25%, signaling another hike in March while monitoring economic data. The statement had a neutral-to-dovish tone, with inflation risks stemming from services CPI, unanchored expectations, and fiscal policy. Market projections see

January 27, 2025

BCB Preview: 100bps Hike Will Buy Some Time

January 27, 2025 7:09 PM UTC

The Brazilian Central Bank is expected to maintain its course with two 100bps hikes, reaching 14.25% by March. Inflation forecasts for 2025 exceed the target, necessitating a firm policy stance. Despite market concerns, new President Gabriel Galípoli is likely to act decisively. The Real’s recent

January 24, 2025

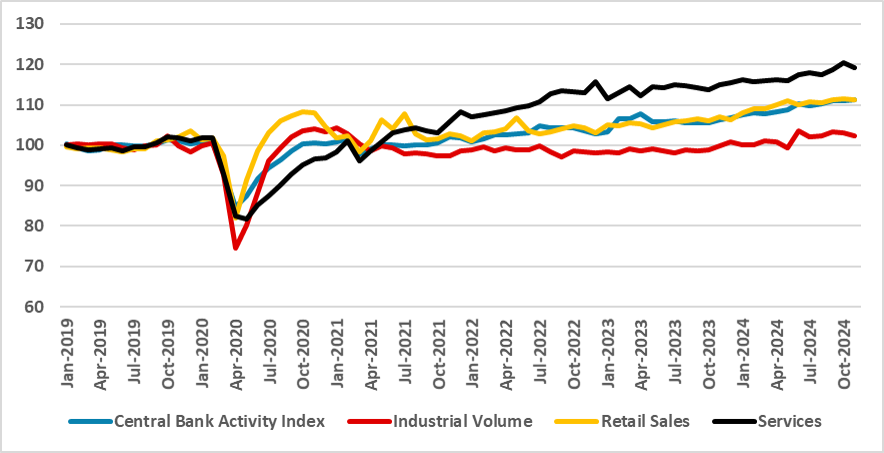

Brazil: Some Deceleration in Services

January 24, 2025 4:48 PM UTC

The Brazilian economy grew over 3% in 2024 despite tight monetary policy. While services (-0.9% m/m), industry, and retail sales weakened in November, agricultural exports and fiscal stimulus boosted overall activity. The Central Bank Activity Index showed marginal growth (0.1%) in October and Novem