Brazil: Fiscal Result Improves but Structural Changes Remains in Doubt

Brazil’s fiscal data shows slight improvement, with a 0.1% primary deficit by February and a 2024 deficit in line with targets, excluding flood aid. The 2025 goal is a 0% deficit, but structural issues remain. Recent gains stem from reduced court-ordered payments and delayed hiring. However, rising wages and social spending may pressure the fiscal framework. Despite concerns, debt is expected to stabilize at 84% of GDP by 2029, supported by inflation control and primary surpluses.

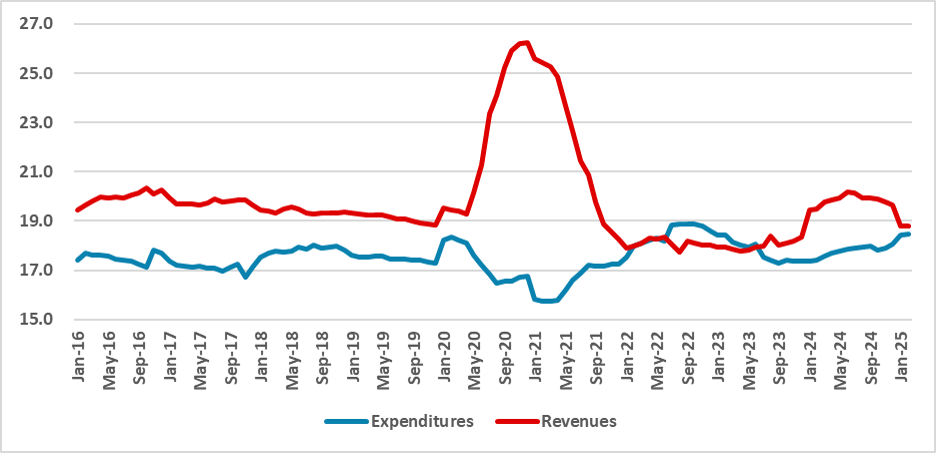

Figure 1: Primary Expenditures and Revenues (%)

Sources: STN

The Brazil National Treasury has released fiscal data up to February. The data indicates some improvement on the fiscal front, with the federal government registering a primary deficit of only 0.1%. The year 2024 closed with a primary deficit of 0.4% of GDP. Excluding the 0.2% of GDP directed to flood aid in the South region, the government effectively met the 0.25% of GDP primary deficit target set by the fiscal rule.

In 2025, the government's target is a 0% deficit. Although this shows a commitment to the fiscal rule, some structural factors need to be addressed to ensure long-term debt sustainability.

The recent reduction is mostly due to two factors: the decrease in payments of judicial decisions—which reached around 0.7% of GDP last year and have now nearly halted—and the reduction in government wages as a proportion of GDP. Several government ministries postponed hiring new employees, as the 2025 budgetary law had not yet been approved. Now that the law has been passed, ministries are expected to resume hiring, which will likely increase in the coming months and negatively affect the fiscal result.

There is growing concern that the current structure of social benefits—pegged to the minimum wage—and the ongoing real wage growth will strain the new fiscal framework. This framework ties expenditure growth to 70% of the previous year’s revenue growth. We maintain the view that as long as the economy grows above 2.0%, these expenditures will remain contained in the short term.

There is still resistance within the government to cutting expenditures, and this reluctance has raised doubts among market participants regarding the sustainability of both the fiscal framework and the national debt, justifying higher premiums on government bonds. So far, the central bank is still fighting inflation, maintaining a high policy rate, which in turn increases debt servicing costs and affects sustainability.

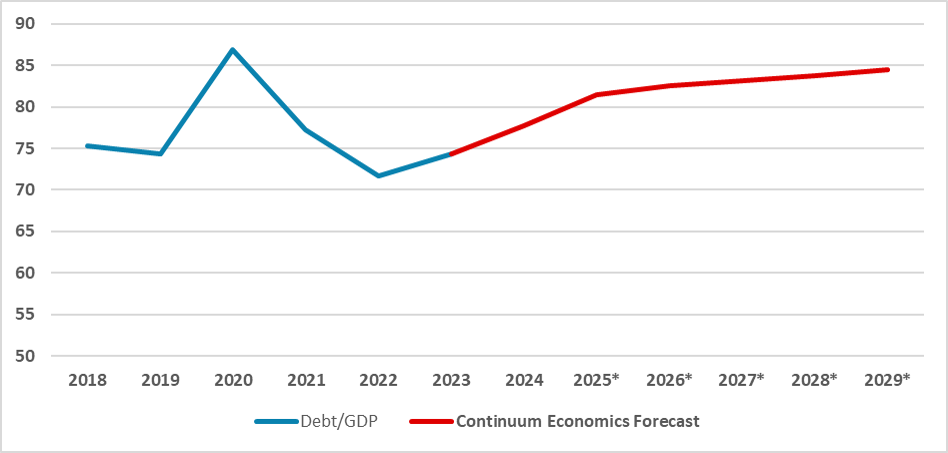

We continue to believe that the debt-to-GDP ratio will rise over the next year due to high interest rates but will eventually stabilize around 84% of GDP—well below market expectations of around 94%. We believe that inflation stabilization, likely to occur in 2026, will reduce debt servicing costs, and primary surpluses will help offset the impact of current interest rate levels.

Figure 2: Debt/GDP (%)

Source: Continuum Economics and BCB