Argentina: Recovery Complete?

Argentina’s economy showed signs of recovery in December, growing 0.5% m/m and 1.2% q/q in Q4, with a 4.7% annual increase. The banking and trade sectors saw strong growth, but construction and industry stagnated. Despite progress, challenges remain, including inflation above 2%, a current account deficit, and limited foreign reserves. Argentina faces external restrictions and must stick to tight fiscal policies while avoiding monetary emissions. The Milei administration has a chance of reducing inflation to 1% by term end, but dollarization remains unlikely.

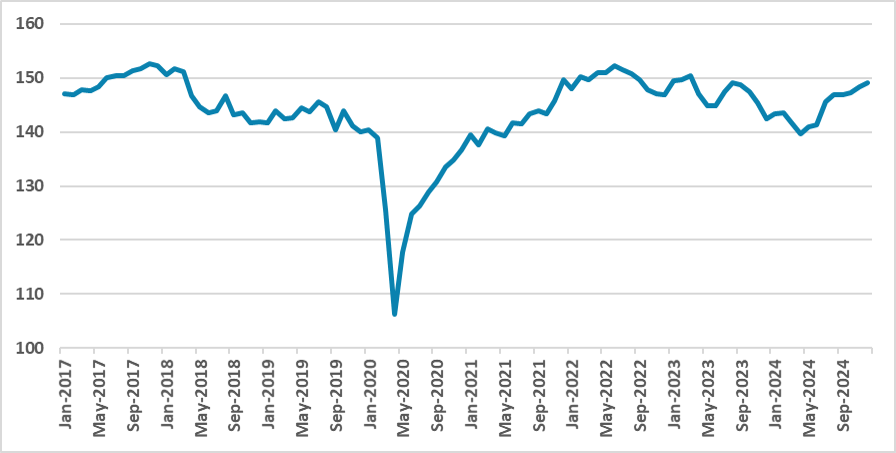

Figure 1: Argentina Monthly Economic Activity Index (Seasonally Adjusted)

Source: INDEC

Argentina’s Statistics Institute (INDEC) has released the economic activity data for December. The data shows that Argentina’s economy continued to recover during December, growing 0.5% (m/m). In the fourth quarter, the index grew 1.2% (q/q). Compared to December 2023, the index is 4.7% higher, indicating that the recovery from the Milei shock plan is likely complete. With this activity data, we estimate the Argentine economy likely contracted 2.0% in 2024, quite below our initial estimates of -4.5%.

Looking at specific sectors and comparing with December 2023, the biggest expansion occurred in the banking sector (+18%) and in the trade sector (+7.5%), indicating some rebound in the services sector. However, the industrial sector seems stagnated. Construction has contracted 7.2%, likely affected by the pause in public construction projects and the recession seen in the first half of the year. Manufacturing grew 6.7%, and mining grew 7.2% on an annual basis.

Although the expansion is good news and shows that Argentina’s recovery from the shock plan has occurred quicker than we expected, the index is still 2.2% below its highest point in November of 2017. With the economy growing, Argentina will have to deal with external restrictions. With demand rebounding and the relatively appreciated exchange rate, imports tend to rise, and the current account deficit expands. This could make things more difficult for the Central Bank to accumulate foreign reserves, as the stock is at a low level for the Argentine economy – currently valued around USD 29 billion. Inflation, which is also a big problem, is currently running above 2% monthly, which is still not at healthy levels. Capital controls remain in place, and the government expects to remove them in 2026. However, for this to materialize, the BCAR will need to increase its reserves, control inflation, and likely need a new IMF deal.

What comes next is interesting. It will be vital for Argentina not to enter again into a rollercoaster of unstable growth. To do so, Argentina will need to stick with tight fiscal policy while avoiding monetary emissions and strengthening the peso. We still believe the idea of dollarization will not prosper in the medium term, but Milei’s administration has a good chance of reducing monthly inflation to 1% before the end of his term.