Brazil: Activity Strong in Q4 but Some Marginal Deceleration

We see Brazilian economy growing 1.0% in Q4 and is expected to expand 3.6% in 2024, surpassing initial forecasts. However, monthly data shows signs of weakness, with contractions in services, industry, and retail trade in in December. Despite tight monetary policy (13.25%), the expected slowdown has not yet materialized, though growth may weaken in early 2025. Inflation risks persist, but we maintain a 5% forecast, assuming exchange rate stability. Government spending pressures remain a concern, especially amid rising food inflation.

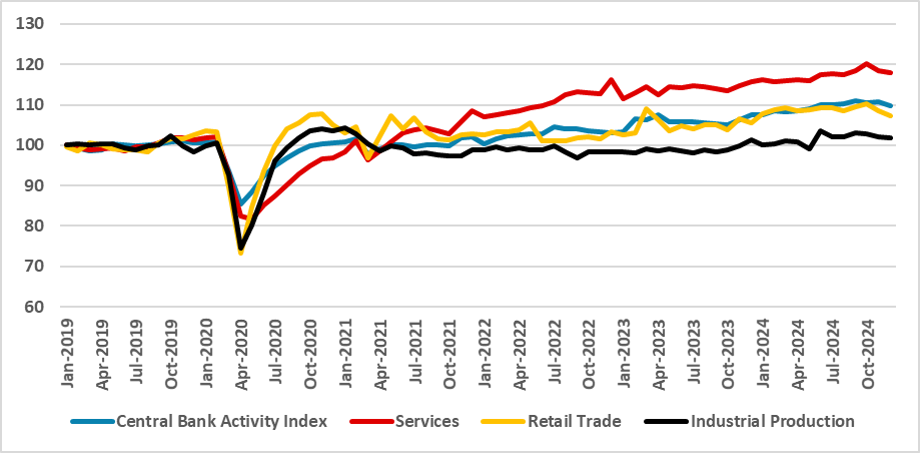

Figure 1: Activity Indexes (Seasonally Adjusted, 2019 = 100)

Source: IBGE and BCB

The National Statistics Institute (IBGE) has released most of the activity data for the fourth quarter, giving us a good picture of what happened in the fourth quarter. We are forecasting that the Brazilian economy grew by 1.0% in the fourth quarter of the year. This will likely mean that the Brazilian economy grew by 3.6% in 2024, surpassing most expectations, as the consensus at the beginning of the year was that the economy would grow by only 1.6%.However, looking at the monthly data, not everything is positive. The Central Bank Activity Index indicates that the Brazilian economy contracted in December (-0.7% m/m) and in October. Services, the main sector, grew by 0.8% in the fourth quarter, according to the services volume index, but this same index contracted in November (-1.4% m/m) and December (-0.5%). Industry has shown some signs of stagnation, contracting by 0.1% in the quarter. Retail trade contracted by 0.3% in the quarter, with declines in November (-1.4% m/m) and December (-1.1% m/m). This behavior suggests that consumption weakened in Q4, although the expansion seen in October will support growth in the last quarter of 2024.

For quite some time, Brazil has been expecting a deceleration caused by the very tight monetary policy, with policy rates currently at 13.25%. With 1% q/q growth in the last quarter, it is fair to say that the deceleration has not yet materialized, but the December activity data suggests that growth could be weaker at the beginning of the year. The strong growth seen so far is largely due to idle capacity being absorbed by the strong fiscal push at the end of 2022 and 2023. As the impact of these measures starts to fade, we expect the effects of the contractionary monetary policy to begin feeding through in 2025. However, there is still some risk that the government will seek additional ways to increase expenditures.

One particular risk that draws our attention is inflation. With the output gap likely negative, inflation is being influenced by some excess demand. We believe that in the next quarters, demand will weaken somewhat, and the BCB will raise rates only to 14.25%, not 15% as the market expects. Additionally, the market's 5.5% inflation forecast appears somewhat exaggerated. With the exchange rate stabilizing at 5.7, pass-through risks are minimal, and we do not expect another depreciation during the year. Therefore, we are maintaining our 5% inflation forecast for this year. However, food inflation, currently at 7%, is negatively affecting the government's popularity, and we cannot rule out the possibility of the government seeking additional expenditures to address this issue. Our baseline scenario is that the Finance Minister will be able to resist this pressure while food prices ease over the course of the year.