Brazil: Last Hike And Then Long Hold

Though the BCB surprised and hiked by 25bps to 15%, the statement signalled that policy will now go on hold for a very long period. Some economists feel that by year-end, that the BCB will be confident enough to move from very restrictive to restrictive and lower the SELIC rate. We would suspect it will likely by Q2 2026 that sees the first rate cuts delivered, given the hawkishness of the BCB. We see the SELIC at 12.25% end 2026.

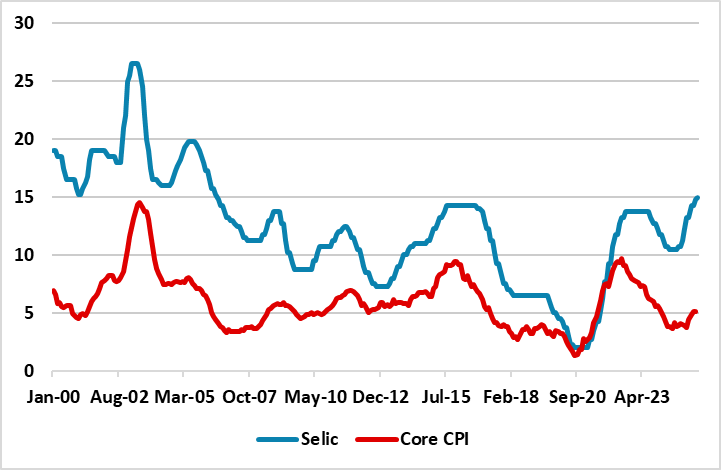

Figure 1: Brazil Core CPI and SELIC Policy Rate (%)

Source: Datastream/Continuum Economics

The June BCB statement provides a number of clues on prospective policy. Key points include

• 15% and long hold. The decision to raise rates by 0.25% to 15% ran against market expectations of no change and was unanimous. Nevertheless, this looks like the final hike in the cycle, with the BCB statement placing emphasis on the need to watch for the lagged impact of recent monetary tightening. The BCB statement said it will “evaluate whether the current interest rate level, assuming it’s stable for a very prolonged period, will be enough to ensure the convergence of inflation to the target.” A further hike is a possible but unlikely, if inflation picks up again on a headline and core basis. However, some data is starting to show a slowdown in the economy, while inflation dipped to 5.3% Yr/Yr last month and we see stable policy through the remainder of the year.

• 2026 easing. The key question for the market is what is a very long period. Some economists feel that by year-end, that the BCB will be confident enough to move from very restrictive to restrictive and lower the SELIC rate. We would suspect it will likely by Q2 2026 that sees the first rate cuts delivered, given the hawkishness of the BCB. They will want to see progress on inflation, softening of the labor market and forecasters reducing inflation projections to be closer to the BCB target. BCB forecasts are little changed, but they are below the market consensus for 2026 inflation at 3.6%. The BCB will likely start with 50bps at each meeting in Q2. We have pencilled in a gradual easing cycle to continue in Q3 and Q4 2026 getting to 12.25% end 2026 and then easing continuing at a gradual pace in 2027. The pace of 2026 easing is not set however and will depend on the main macro variables, but also the scale of the expected pick-up in government spending before the October 2026 election.