Brazil: Credit Accelerating Despite Higher Rates

The Brazilian Central Bank (BCB) has resumed raising the policy rate due to persistent inflation concerns, despite expectations of credit deceleration. In contrast, credit has accelerated in recent months, indicating that the credit channel through monetary policy may be compromised, increasing disinflation costs. The government has boosted earmarked operations, leading to a 12% annual growth. Meanwhile, non-earmarked operations have also increased, but have yet to respond to rate hikes. The BCB is likely to implement further rate hikes, potentially reaching 15.0%.

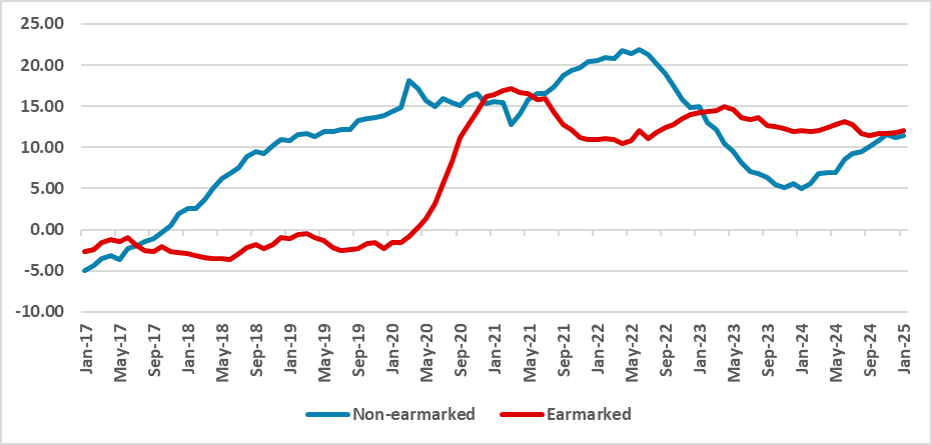

Figure 1: Total Credit Nominal Growth (%, Y/Y)

Source: BCB

The Brazilian Central Bank (BCB) has resumed hiking the policy rate after clear signs that inflation will not converge with the previous level of rates. Despite this situation, credit, which was expected to decelerate, actually accelerated in the last few months. This could be an indication that the credit channel through monetary policy actions is compromised at the moment, which increases the costs of disinflation, supporting further hikes by the BCB.

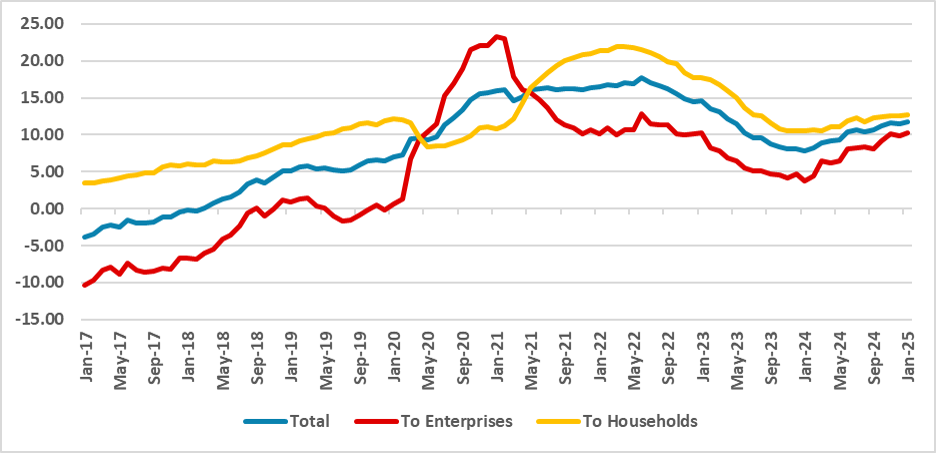

Figure 2: Total Credit Nominal Growth (%, Y/Y)

Source: BCB

The current government has increased earmarked operations, usually with lower interest rates backed by public banks. This type of operation kept accelerating in the last few months, and it now registers a 12% annual growth in these operations. However, these operations have just caught up in terms of growth with non-earmarked ones. The latter is usually done with market interest rates and with little support from the government. Non-earmarked operations currently represent around 43% of total credit operations, and they have been increasing in recent months. However, non-earmarked operations also accelerated in the last few months, not yet reacting to the tightening of the policy rate.

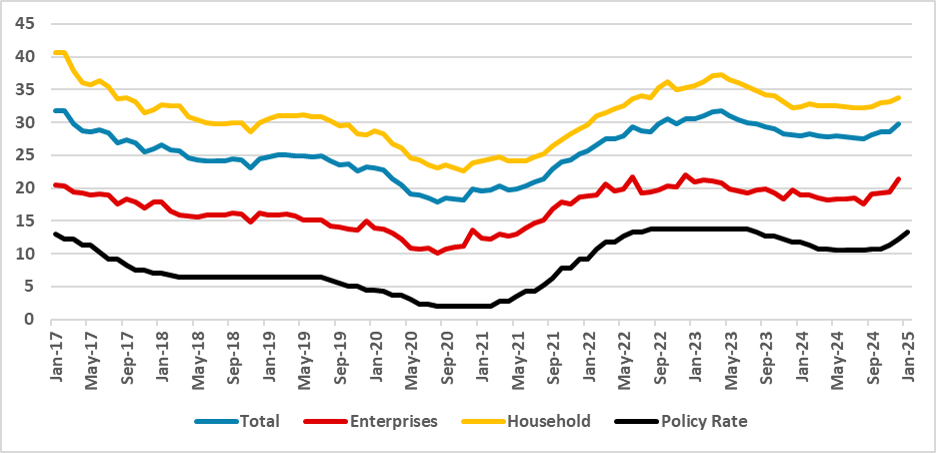

Figure 3: Interest Rate of New Credit Operations (%)

Source: BCB

Regarding the destination of the credit operations, credit to households accelerated to 12.6% (Y/Y), but the gap with credit for enterprises has been narrowing. Credit to enterprises accelerated 10.22% (Y/Y), and we believe this happened due to the acceleration of earmarked credit, a measure actively taken by the government.

However, it is important to note that the interest rate for new credit operations has increased. Although credit is now available at a more expensive rate, the value of operations continued to increase in the last few months.

Monetary policy acts with a lag, and it is possible that this recent acceleration was just the result of the previous easing cycle, although we see evidence of public banks increasing the supply of credit at lower rates than the market rate. The increase in credit indicates that we are still seeing some growth in the short term, and the expected deceleration will likely occur only in the second half of the year. The BCB is now focusing on the terminal rate, and due to the acceleration of credit in recent months, they will likely adopt a higher rate. We believe the BCB will apply a final hike of 75bps to 15.0%, but it could be higher if the channels of monetary policy do not respond.