Brazil CPI Review: Mixed Signs from January Inflation

Brazil’s CPI rose 0.16% in January, lowering Y/Y inflation to 4.5% from 4.8%. A temporary electricity discount drove the decline, while Food (+1%) and Transport (+1.3%) showed worrying increases. Core inflation rose 0.7%, with Services CPI jumping to 5.4%, partly due to seasonal healthcare costs. The exchange rate appreciated, offering some relief, but electricity prices will rebound. We expect inflation to cool as fiscal stimulus fades and monetary policy bites, maintaining our 5% forecast for 2025.

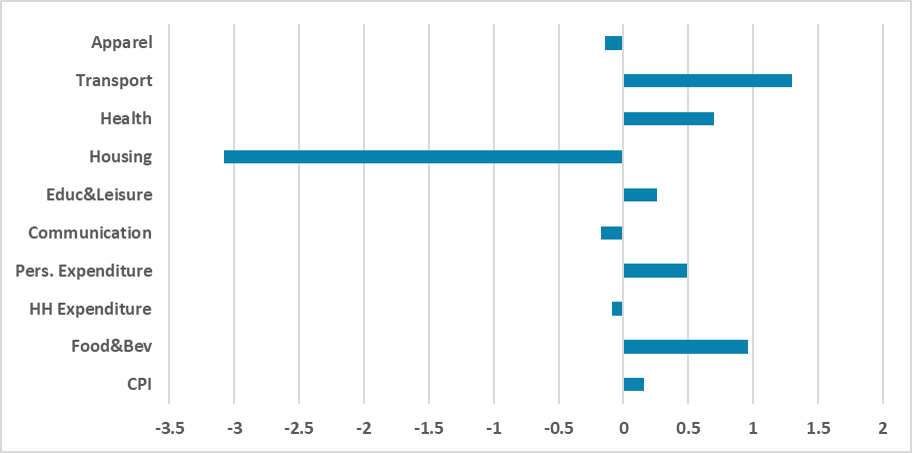

Figure 1: Brazil’s CPI by Group (%, m/m)

Source: IBGE

Brazil's National Statistics Institute (IBGE) has released the CPI data for January. The data show that Brazil's CPI increased by 0.16% during the month; therefore, the Y/Y index decreased to 4.5% from 4.8% in December. However, not all the news is positive.

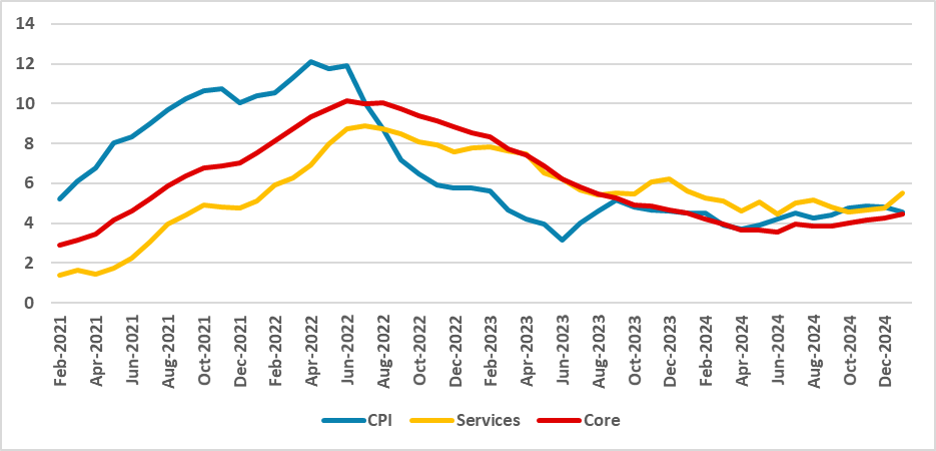

Figure 2: Brazil’s CPI (%, Y/Y)

Source: IBGE

Most of the low figure recorded was due to a one-month discount on energy bills, resulting from profits from the Itaipu hydroelectric plant, which were then redistributed to consumers. This caused the electricity CPI to drop by 14% in January, impacting the Housing group, which fell by 3.1%. Worrying signs came from the Food and Transport groups. The Food and Beverages group increased by 1% during January, marking a five-month streak of rises. On an annual basis, the Food and Beverages CPI has risen by 7.2%. In January, the biggest increases came from carrots (+36.1%), tomatoes (+20.3%), and coffee (+8.6%). The Transport group rose by 1.3% in the month, driven by airfare tickets (+10.4%), public transport (+3.9%), and fuel (+0.8%), the latter influenced by a new adjustment in Petrobras’ distribution prices.

The worst comes when we look at the core indices monitored by the Brazilian Central Bank (BCB). The average of the core indices rose by 0.7% in January and has accumulated a 5.4% increase, well above the headline figures. The Services CPI rose by 0.8% in the month, with its Y/Y index increasing to 5.4% from 4.6% in December. However, we believe the Services CPI was heavily influenced by the rise in health costs, stemming from the authorized adjustment of healthcare plans in January, suggesting that this index was impacted by seasonal effects.

All in all, we see mixed signals. Core CPI raises concerns, and it is still unclear whether the Brazilian economy will cool down or continue running hot and pushing inflation up. We believe that Services CPI, which the BCB views as highly sensitive to economic activity, was hit by a seasonal adjustment in healthcare plans, a pattern unlikely to repeat in the coming months. On the other hand, the drop in electricity prices is set to reverse. The good news comes from the exchange rate, which appreciated as expected and is likely to have a limited impact in the coming months. We believe inflation expectations in Brazil, reaching 5.5% for this year, are overly pessimistic. We expect the Brazilian economy to weaken, particularly in the second quarter, as the fiscal push from 2024 fades and monetary policy finally takes effect. We are sticking with our 5% inflation forecast for 2025.