Argentina: Activity Continues Growing

Argentina’s economy grew 2.3% in February and 6% year-on-year, showing continued short-term recovery driven by financial and mining sectors. However, rising imports and an overvalued exchange rate are straining reserves, despite IMF support. While agricultural exports may ease pressure mid-year, structural imbalances remain. Sustained recovery depends on increased FDI and market access, but skepticism persists. Without stronger exports or slower growth, a currency devaluation by 2026 seems likely as IMF repayments begin and external pressures mount.

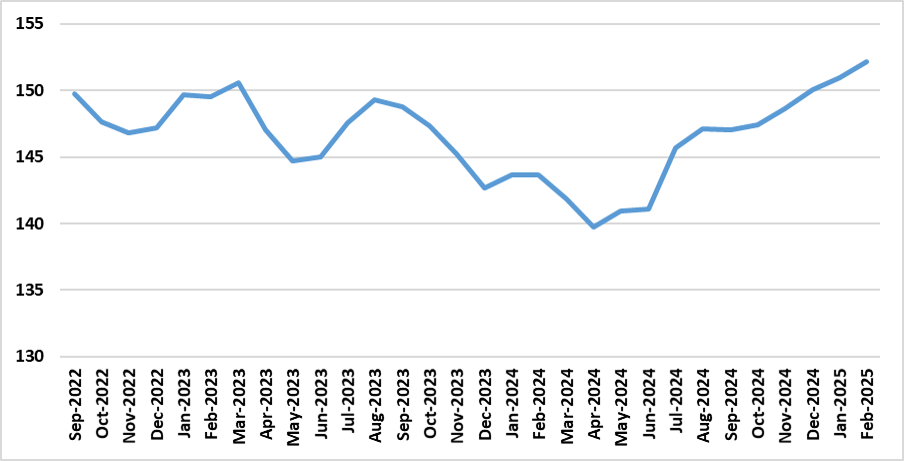

Figure 1: Argentina Monthly Economic Activity Index (Seasonally Adjusted)

Source: INDEC

The Argentine National Statistics Institute (INDEC) has released activity data for February. The data show that the Argentine economy continues to recover, growing by 2.3% in the month, according to seasonally adjusted figures. On an annual basis, the indicator is 6% higher than it was in February 2024.

It appears that Argentina’s economy is still catching up after the recession seen last year and coping with reduced government expenditure. The highest growth was recorded in Financial Activities (+28.2%), while the mining industry grew by 5% year-on-year. In contrast, the Food and Hotel sector contracted by 1.4%, and Public Administration shrank by 1.2%.

However, the strong level of economic activity also brings challenges. Currently, international reserves have been bolstered by a new deal with the IMF, but the higher level of activity has led to increased demand for imported goods and services. This is creating balance of payments pressures and jeopardizing the much-needed accumulation of Central Bank reserves. Additionally, the real exchange rate is currently overvalued. While this helps control inflation, it also incentivizes imports.

With rising incomes among Argentine families, we expect the economy to continue recovering in the short term. Moreover, with the current level of reserves and agricultural exports expected to support reserve accumulation from June onwards, Argentina will likely be able to manage the increased demand this year. However, this situation is unlikely to be sustainable in the medium term, once Argentina begins repaying the large IMF loan (USD 52 billion).

So far, the Argentine government has been able to maintain the exchange rate within its target bands (here). However, this has occurred at a time when the US dollar is weakening globally. We believe this imbalance in demand for dollars versus pesos will become more evident in the coming months, likely pushing the Argentine peso closer to the upper limit of the band.

The government is relying on strategies to increase foreign direct investment (FDI) and restore access to international financial markets. This could enable Argentine companies and consumers to continue spending abroad. However, we believe that markets will remain somewhat skeptical of Milei’s Argentina. We continue to believe that a new devaluation will be necessary in 2026, unless economic activity contracts or exports grow more than expected, particularly from the mining and agricultural sectors, which show strong potential for export expansion.