Argentina CPI Review: January Relief but Inflation Fight Continues

Argentina’s CPI rose 2.2% in January, slightly below forecasts, with Y/Y inflation dropping to 84% from 116%. Core CPI increased by 2.4%, accumulating 75% annual inflation. Inflation is expected to decline as devaluation effects fade, though inertia may keep it above 2% in the first half. Services inflation remains high at 152%, while goods CPI rose 64%. The Central Bank’s dollar accumulation and an appreciated exchange rate raise concerns. CPI is projected to close 2025 at 23%, marking significant improvement.

Figure 1: Argentina CPI (%, Y/Y)

Source: INDEC

The Argentine National Statistics Institute (INDEC) has released the inflation figures for January. The data shows that Argentina’s CPI has risen by 2.2%, slightly below the 2.3% forecasted by markets, according to the Bloomberg Survey. As a result, the year-over-year (Y/Y) index has dropped to 84% from 116% in December. Core CPI rose 2.4% and has accumulated an annual inflation rate of 75%.

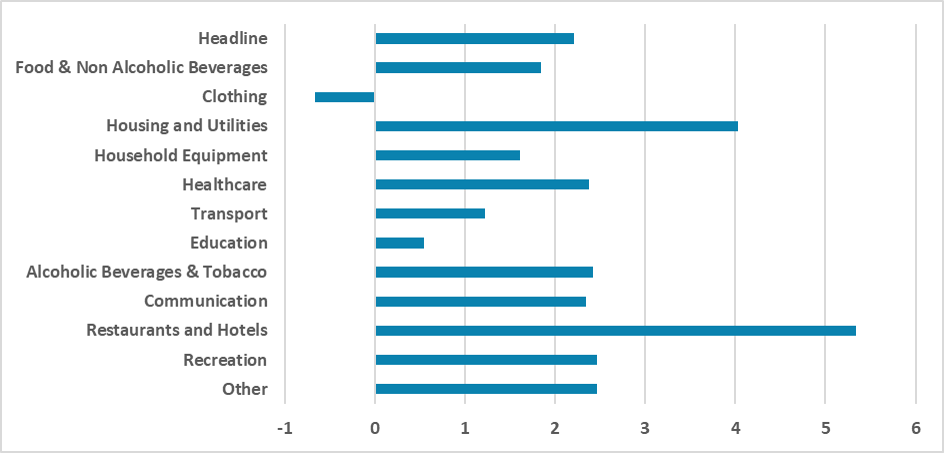

Figure 2: Argentina CPI by Groups (%, m/m)

Source: INDEC

We believe that in February, annual inflation will continue to decline as the effects of the devaluation in the first month of Milei’s government are phased out of the index.

January marks the first month of a new monetary framework, in which the pace of devaluation was reduced to 1%. With inflation running at 2%, this implies a real appreciation. However, with this pace of devaluation, government officials expect to anchor monthly inflation closer to 1%. We anticipate that inflationary inertia will continue to exert pressure in the first half of the year, keeping inflation above 2%, while in the second half, it is likely to decline to around 1%.

The biggest question remains the accumulation of U.S. dollars by the Central Bank. With an appreciated exchange rate, exports become less competitive. However, much of Argentina’s exports, such as energy and soybeans, are priced in U.S. dollars. We believe that the supply of these exports is relatively inelastic to exchange rate fluctuations.

Looking at specific sectors, the largest increase occurred in the Housing category, which rose 4.0% in January due to higher electricity tariffs and rent prices. Education increased by only 0.5% in the month, the lowest rise since February 2021. Interestingly, clothing prices fell by 0.5% due to lower demand for these products. Food and Beverages rose 1.8% in January and have accumulated a 64% increase over the past 12 months.

One notable trend is the gap between goods and services inflation. While goods CPI rose 64% in the past year, services CPI more than doubled, rising 152%. We believe that services inflation will take some time to converge to the 2.0% monthly target, likely not before the second quarter. However, caution is warranted as Argentina’s economy is showing signs of recovery.

In any case, we expect Argentina’s economic activity to return to pre-Milei levels only in the second quarter of the year. We forecast CPI to close the year at 23%, which is still high but represents a significant improvement from the 117% recorded in 2024.