Brazil: Some Deceleration in Services

The Brazilian economy grew over 3% in 2024 despite tight monetary policy. While services (-0.9% m/m), industry, and retail sales weakened in November, agricultural exports and fiscal stimulus boosted overall activity. The Central Bank Activity Index showed marginal growth (0.1%) in October and November, reflecting resilience. Formal job creation remained strong, with 1.5 million jobs added, and unemployment dropped to 6.4%. However, deceleration is expected in 2025 as fiscal impacts wane and monetary tightening constrains growth.

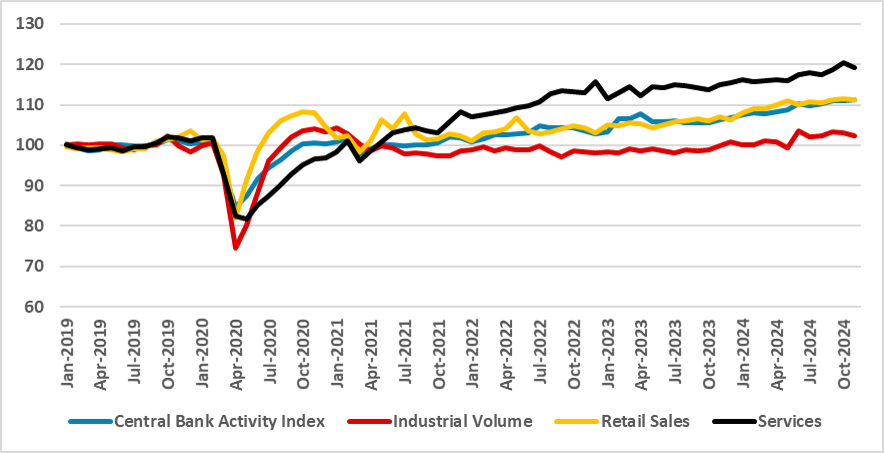

Figure 1: Brazil’s Activity Index (Seasonally Adjusted, 2019=100)

Source: BCB and IBGE

The Brazilian National Statistics Institute has released activity data up to November, providing a good picture of how the Brazilian economy performed during Q4. It is important to note that throughout 2024, the Brazilian economy has consistently surpassed expectations, with annual growth exceeding 3% again, despite the high degree of monetary tightening.

Services dropped by 0.9% (m/m) in November, but this contraction followed an acceleration of 1.4% in October. Some growth in December could lead to positive net growth for this sector. Most of the deceleration came from the Transport subgroup and Professional Services, with both dropping by 2% in November. The industrial sector declined marginally in November, marking two consecutive months of contraction. Retail sales also fell in November (-0.3% m/m) after expanding by 0.4% (m/m) in October.

In contrast to these indicators, the Central Bank Activity Index showed marginal expansion in both October and November, recording 0.1% growth in each month. This likely reflects significant growth in the agricultural sector, fueled by exports, which have shown notable expansion in the final months of the year.

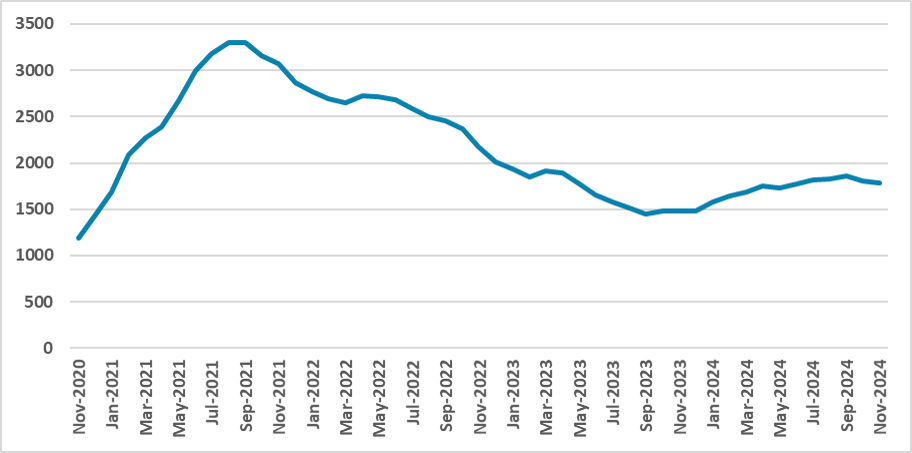

Figure 2: Net Formal Job Creation (Millions, 12-months sum)

Source: CAGED

Moreover, formal employment numbers remain strong, with approximately 1.5 million formal jobs created during the year. This highlights the continued acceleration of the labor market in Brazil. The unemployment rate, now at 6.4%, was also influenced by a lower participation rate. However, the net result suggests that the reduction was primarily driven by an increase in employment.

Overall, the data reveals mixed signs of deceleration. Our main takeaway is that the fiscal stimulus observed in the final months of last year, coupled with idle capacity from prior periods, supported economic activity. However, some deceleration is expected this year as these effects fade and monetary tightening begins to significantly constrain the economy. This slowdown is most likely to materialize in the second half of the year, although the Brazilian economy may once again exceed growth expectations.