Argentina: Primary Surpluses Continues

Argentina’s fiscal anchor under Milei remains the key stabilizer, with inflation gradually declining and the crawling peg rate cut to 1% monthly. A primary surplus of USD 8 billion was achieved in 2024 through spending cuts, while capital controls and IMF support help manage low reserves. For 2025, a 1% of GDP primary surplus is targeted, though the budget remains unapproved. Lifting CEPO depends on reserve accumulation, IMF funds, and inflation falling below 1%, likely by 2026.

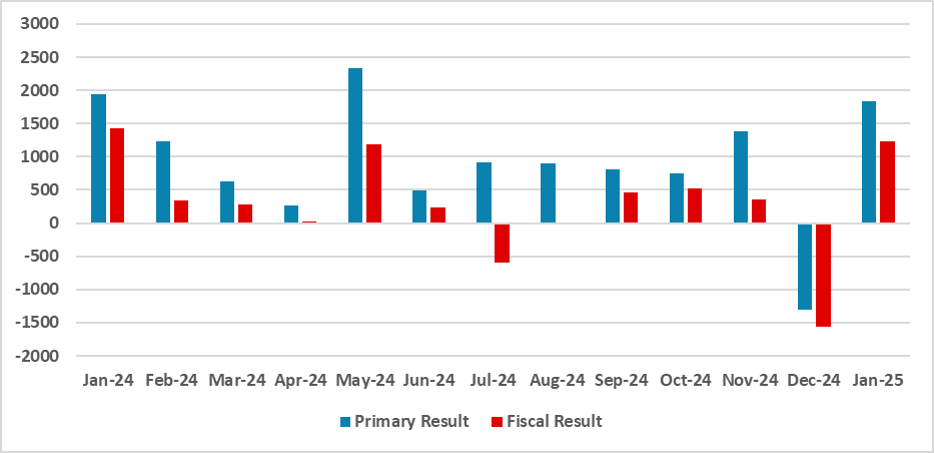

Figure 1: Public Sector Primary and Fiscal Result (ARS Billions)

Source: Secretaria de Hacienda de Argentina

Milei’s fiscal anchor continues to be the main stabilizer of Argentina's macroeconomy. Inflation, which is still running above 2% monthly, is falling marginally, while the crawling peg rate has been dropped to 1% monthly in the hope of anchoring inflation below the current 2% level. However, the main tool for lowering inflation has been shutting down the printing machine of the Argentine Central Bank. In the past, the huge fiscal deficit was usually financed through Central Bank transfers to the Treasury, a practice that was abandoned after Milei’s administration took office.

In 2024, Argentina managed to achieve a primary surplus of around USD 8 billion. The fiscal result (including net interest payments) stood at USD 2 billion, meaning Argentine revenues were able to cover all expenditures. This was mainly accomplished by reducing costs associated with public employees, with over 34,000 being dismissed, and by freezing almost all scheduled investments for the year.

Following its latest default in 2020, Argentina has virtually lost access to international financing, relying instead on the IMF and capital controls to manage its low levels of reserves. At present, gross international reserves stand at USD 29 billion, a figure that appears even lower considering that Argentina needs to cover approximately USD 15 billion in obligations. With the Argentine economy rebounding, fostering imports, and an appreciating exchange rate, some risks to reserve accumulation persist.

For 2025, the targeted primary surplus, as indicated in the budget bill, is 1% of GDP. It is important to note that the budget for 2025 has not been approved by Congress, and the 2023 budget was extended through a government decree. The government continues to propose a zero-deficit budget, signaling that the current fiscal anchor will remain in place to address Argentina’s macroeconomic imbalances.

Another important question that remains is when the capital controls (CEPO) will be lifted. We believe that reserve stocks need to increase to allow a safe exit from the CEPO. Of course, devaluation risks and another spike in inflation could arise once it is removed, which is why we believe this will only happen once fresh funds arrive from the IMF and monthly inflation falls below 1%—something that is only likely to occur in 2026.