Brazil: Fiscal Target will be Fulfilled but Doubts Remains over the Fiscal Sustainability

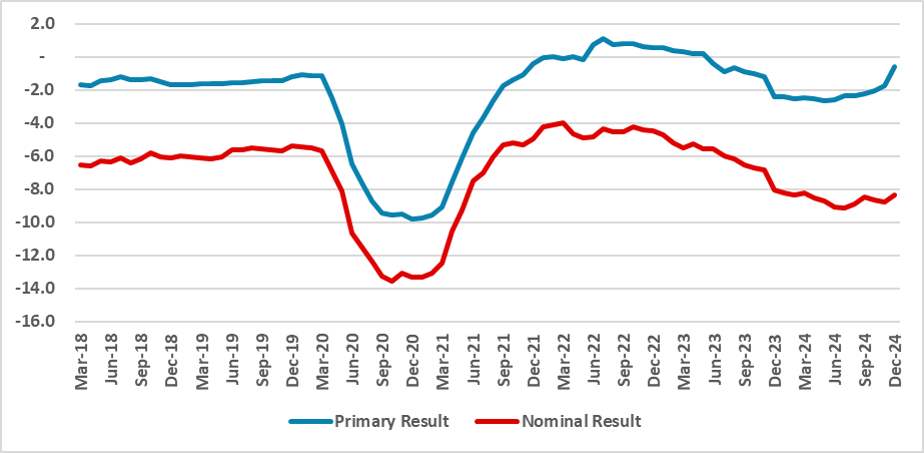

Brazil achieved significant fiscal consolidation in 2024, with a primary deficit of 0.6% of GDP, or 0.2% excluding flood-related costs, driven by revenue growth and reduced judicial expenditures. However, rising debt servicing costs, now at 8% of GDP, worsen the nominal result. Fiscal discipline will be vital in 2026 to regain market confidence and reduce debt costs.

Figure 1: Nominal and Primary Result of the Central Government (12-months sum, % of the GDP)

Source: STN and Continuum Economics

The Brazilian National Treasury has released fiscal data up to November, and we have forecasted December figures to provide a complete picture of 2024. Our forecasts indicate that the primary deficit reached around 0.6% of GDP. However, excluding expenditures related to the floods in the southern region, the primary result was approximately 0.2% of GDP, within the fiscal target range of -0.25% to +0.25%. Compared to the 2023 deficit of 2.4% of GDP, significant fiscal consolidation occurred in 2024. This improvement was primarily driven by revenue growth, influenced by robust economic activity. Additionally, expenditures related to judicial decisions, which totaled 1.0% of GDP in December 2023, did not recur this year. Revenues from concessions and state company dividends also contributed about 0.5% of GDP, helping the government meet its fiscal targets.

However, the government’s nominal result has deteriorated. Debt-related expenditures have increased, now reaching around 8.0% of GDP. This rise in debt servicing costs is directly influenced by the higher interest rates of 2024, driven by BCB hikes and heightened risk perceptions among economic agents in Brazil. These factors are likely to offset the improvements in the primary result, worsening the overall fiscal situation.

Brazil’s risk perception is rising, but we consider these fears unjustified. We expect the BCB to implement two additional 100bps hikes, and with fiscal stimulus fading and the economy weakening in 2025, inflation is likely to subside in the second half of the year. With economic growth projected at around 2.0% in 2025, the preliminary budget for that year will likely be met, and a 0% primary result is expected. However, higher interest rates will persist, keeping the nominal result above 8% of GDP.

Efforts are being made by the Finance Minister to align most expenditures with the New Fiscal Framework, but uncertainties remain, especially as some government members push for higher spending to foster growth. We project that 2026 will be a critical year for regaining market confidence and reducing interest rates. However, achieving this will require the government to resist the temptation to increase expenditures during an election year.