Brazil CPI Review: 1.3% Monthly Growth, with Seasonal Impacts

Brazil's February CPI increased by 1.3%, the highest in 22 years, largely driven by the removal of subsidized electricity bills, which boosted Housing by 4.4%. The year-over-year inflation rose to 5.1%, above the BCB's target. Key contributors included Education (up 4.4%) and Food and Beverages (up 0.7%). Despite signs of economic slowdown, inflationary pressures suggest a 100bps rate hike in March. The BCB may pause or raise rates further in May depending on future data, with a terminal rate potentially at 14.25% or 15.0%.

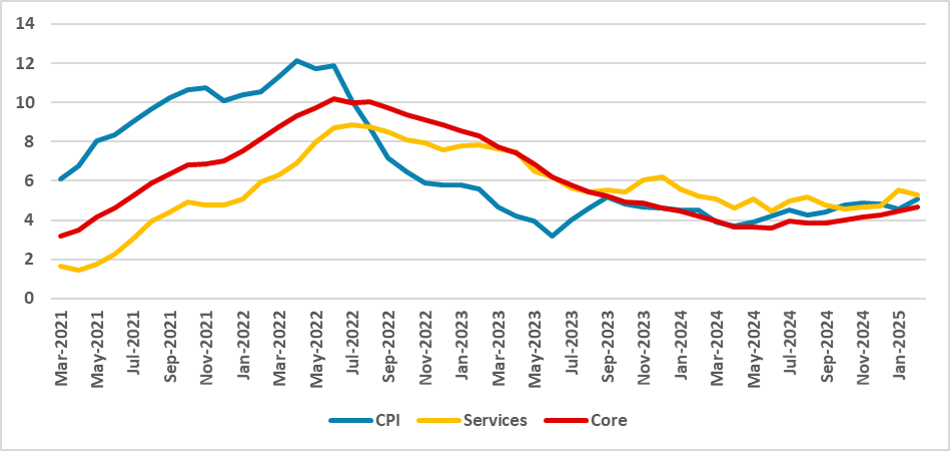

Figure 1: Brazil’s CPI (%, Y/Y)

Source: IBGE and BCB

The Brazilian National Statistics Institute (IBGE) has released the CPI figures for February. The data shows that the index grew by 1.3% in February, the highest figure for the month in 22 years. The figures were in line with market expectations, according to the Bloomberg survey. The index was heavily influenced by the re-adjustment of electricity bills, as the subsidized bills, financed by Itaipu Hydroelectric's profit, were removed during the month. This caused the Housing group to grow by 4.4% in the month, contributing to half of the 1.3% increase. With this rise, the year-over-year (Y/Y) index jumped to 5.1% from 4.6% in January, above the BCB's upper-bound target of 4.5%.

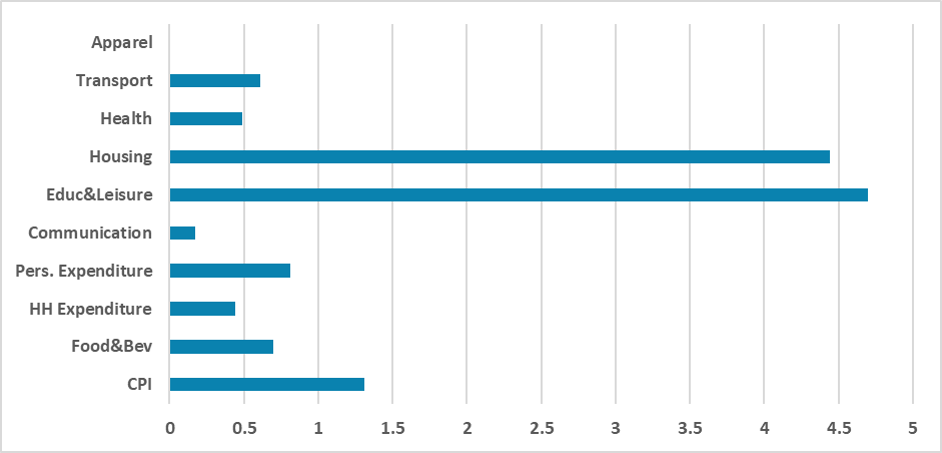

Figure 2: Brazil’s CPI (m/m, %)

Source: IBGE

Looking at specific groups, Education also rose significantly, increasing by 4.4%. This increase was expected, as educational institutions usually incorporate last year's inflation during February by raising the tuition fees of new students. Food and Beverages grew by 0.7%, influenced by increases in the price of coffee (+10% m/m) and eggs (+15.9% m/m). Food and Beverages have accumulated a 7.0% increase over the past 12 months, with some acceleration recently, impacting government popularity. Transport rose by 0.6%, influenced by adjustments in fuel prices. Apparel and Communication stabilized during February, with no change in the month.

In some core areas, Services grew by 0.8%, but its Y/Y index decelerated to 5.2% from 5.5% in January. The average of the cores monitored by the BCB indicates a 0.8% (m/m) growth, and its Y/Y index grew by 4.7%, marking six months of acceleration, signaling a deterioration in the inflationary outlook.

Most of the CPI growth occurred in groups over which the BCB has little control – housing, food and beverages, and transport. There are still some indications that the Brazilian economy is decelerating, and that much of the rise seen in the short term could be transitory. However, this deterioration will put pressure on the BCB. A 100bps increase for the March meeting has already been signaled. We still believe that this will be the last hike, resulting in a terminal rate of 14.25%, although market participants point to a 15.0% terminal rate. We believe the BCB communiqué will leave the door open for a pause or a final hike, indicating that future BCB actions will depend on data.