Brazil CPI Review: March Acceleration, Hike Confirmation

March CPI in Brazil rose 0.6%, above expectations, pushing the annual rate to 5.5%. Broad-based price increases, especially in food, signal persistent inflation pressures. Core inflation, notably in services, is well above the BCB’s target, and external volatility adds risk. With activity and credit data pointing to resilience, the expected disinflation has yet to arrive. We anticipate a 75bps rate hike to 15.0%, with markets likely revising terminal rate forecasts upward amid ongoing inflationary and macroeconomic challenges.

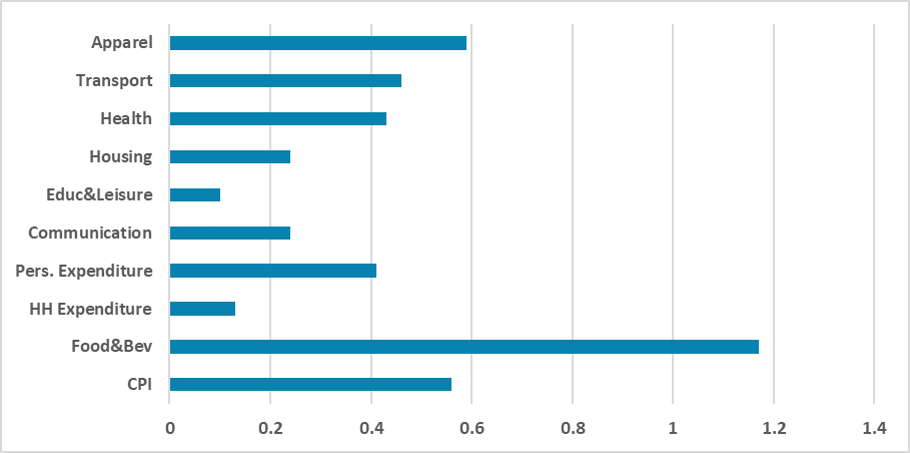

Figure 1: Brazil CPI (m/m, %)

Source: IBGE

The Brazilian National Statistics Institute has released the CPI data for March. The data shows that the CPI grew by 0.6% during the month, above market expectations of 0.5%, according to the Bloomberg Survey. As a result, the year-over-year CPI increased to 5.5% from 5.0% in February. Overall, there are signs of deterioration in the scenario, with most CPI groups showing growth—indicating that the so-called deceleration, which could provide some relief to inflation, is yet to materialize.

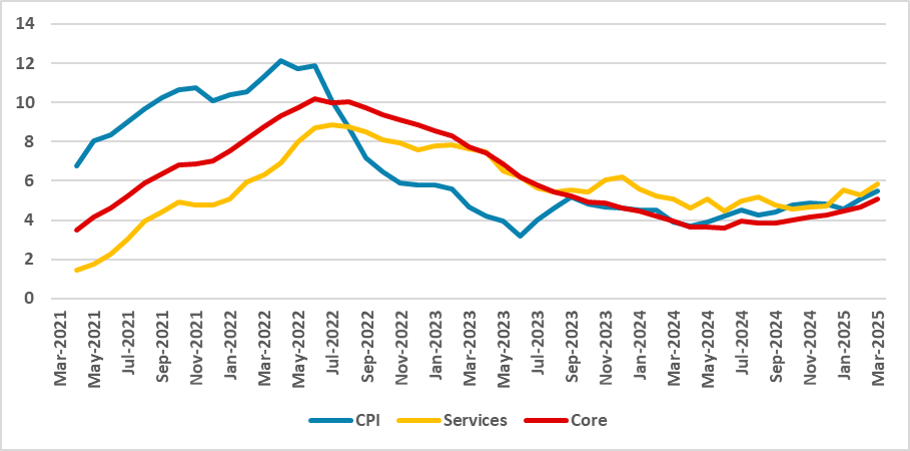

Figure 2: Brazil’s CPI (%, Y/Y)

Source: IBGE

The biggest contributor to the rise in March was the Food and Beverages group. This group grew by 1.2% month-over-month, accounting for more than half of March's overall increase. This rise was influenced by higher prices for tomatoes (+22.0%), eggs (+13.1%), and coffee (+8.2%). With the exception of vegetables, which tend to respond to climate conditions, other food categories are influenced by international prices in USD, with ongoing external volatility contributing to this rise. The Food CPI shows a 7.6% year-over-year increase, which is negatively affecting the popularity of the government.

All CPI groups posted increases, with personal expenditures rising by 0.4% and transportation rising by 0.5%, impacted by higher fuel prices. Looking at the core indices monitored by the Brazilian Central Bank (BCB), services are clearly an area of concern. This group rose by 0.6%, and its year-over-year rate accelerated to 5.8%, clearly above the BCB’s target of 3.0% and its target band of 1.5%–4.5%. The average of core indices grew by 0.5% in the month and shows an annual variation of 5.0%, up from 4.6% in February.

We believe this acceleration, coupled with a more volatile external environment and potential negative effects on the exchange rate, will lead the Brazilian Central Bank to hike rates by 75 basis points at its next meeting, bringing the policy rate to 15.0%. To make matters worse, activity data points to possible expansion in the first quarter of the year. Additionally, credit is not decelerating but rather accelerating, which suggests that the anticipated slowdown is still yet to come. The output gap is likely to remain in positive territory, increasing the cost of disinflation. The question of whether the BCB will stop at 15.0% is likely to arise in the markets, and we believe that in the coming month, market participants will raise their forecasts for the terminal rate, currently at 15.0%.