Argentina: Lower Rates, Conditions to Lift the Controls

The Argentine Central Bank cut rates to 29%, citing improved inflation expectations. Rather than using a contractionary policy, it aims to curb monetary base growth through fiscal consolidation. Inflation is below 3%, with a 2% target feasible by mid-year. However, the 1% crawling peg risks eroding export competitiveness. Further rate cuts are expected, possibly reaching 20%. Capital controls may be lifted in 2026, but only if inflation stabilizes at 1% monthly and BCAR reserves increase, likely requiring an IMF deal.

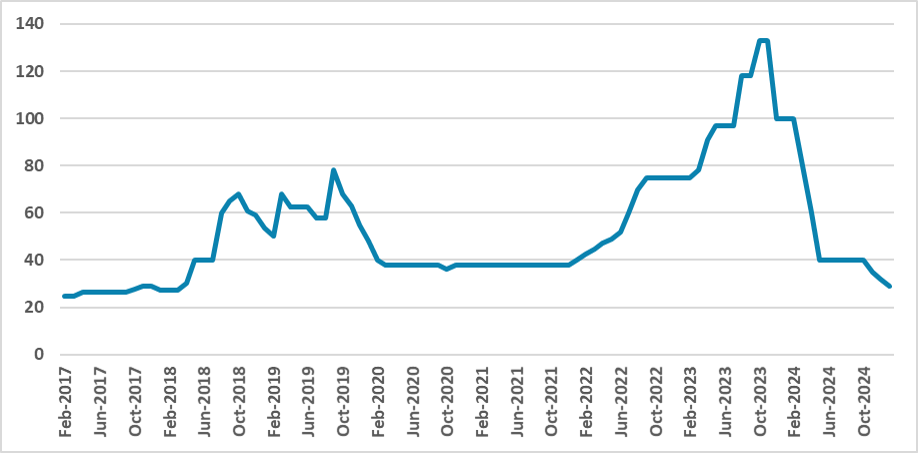

Figure 1: Policy Rate (%)

Source: BCARThe Argentine Central Bank (BCAR) has opted to cut the policy rate again, lowering it to 29% from 32%. In their communiqué, there was a vague mention of inflation expectations improving, which thus allows the BCAR to lower the interest rate. Rather than having a contractionary policy rate to lower inflation, the BCAR is focusing on avoiding the endogenous emissions of the ARS, which, therefore, limits the growth of the monetary base, diminishing the need for sterilization and aiding in reducing inflation. The main anchor to diminish inflation has been the enormous fiscal consolidation, allowing the BCAR to stop financing the deficit.

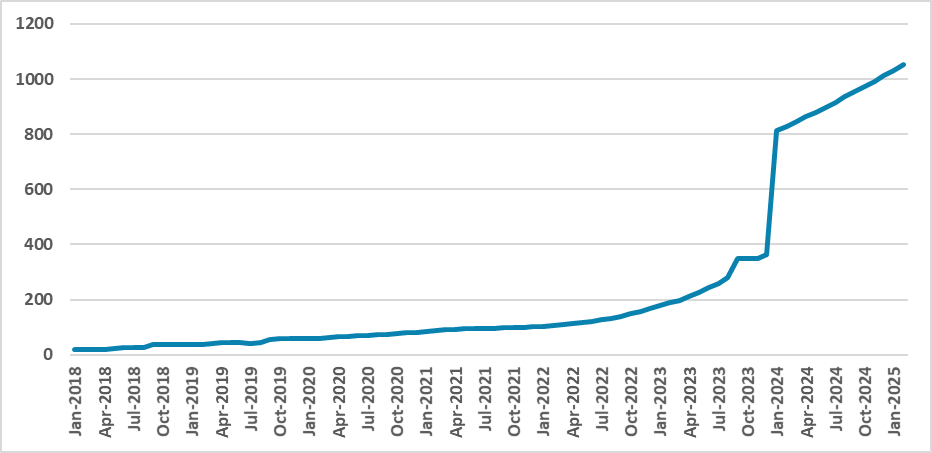

Figure 2: Official Exchange Rate (ARS/USD)

Source: BCAR

Inflation has been registering numbers below 3.0%, and we believe that registering around 2.0% will be feasible until the end of the first half, despite the huge inertia from it. However, with the crawling peg of the official exchange rate at 1%, this means that, in real terms, the exchange rate will continue to appreciate, which could weaken the competitiveness of Argentine exports—so much needed to allow the BCAR to accumulate USD.At 29%, and with inflation numbers falling, we believe new cuts will be seen throughout the year, with the likely terminal rate being 20%, though it could go even lower. The fiscal anchor will likely prevent any strong rebound in economic activity while allowing inflation to converge, although it will likely be a lengthier process.

A lot has been said about when the Argentine authorities will lift capital controls (cepo), allowing the public to freely acquire USD in local markets. Javier Milei has put forth a tentative date of January 1, 2026. However, his Minister of Economy, Luis Caputo, also outlined the conditions under which the lift would occur. First, the inflation rate needs to match the pace of the devaluation of the official exchange rate plus the international level of inflation, meaning inflation will need to reach the 1% monthly level. Second, the BCAR will need to be capitalized. We understand that to be capitalized means increasing the level of reserves at the BCAR, which we believe would only be possible with a new IMF deal, which is still being negotiated.