Brazil: Some Deceleration on Labour Markets, But Still Strong

Brazil's labor data through January indicates a slight deceleration in job creation, with annual net formal job growth at 1.6 million, above the 1.4 million registered in July 2023. While the unemployment rate rose slightly to 6.5%, it remains lower than January 2024. Admission salaries are growing below inflation. Despite fiscal push fading and restrictive monetary policies, the economy is yet to shows signs of cooling. The BCB is likely to raise rates to 15.0%, but whether further hikes will occur depends on first-quarter economic data.

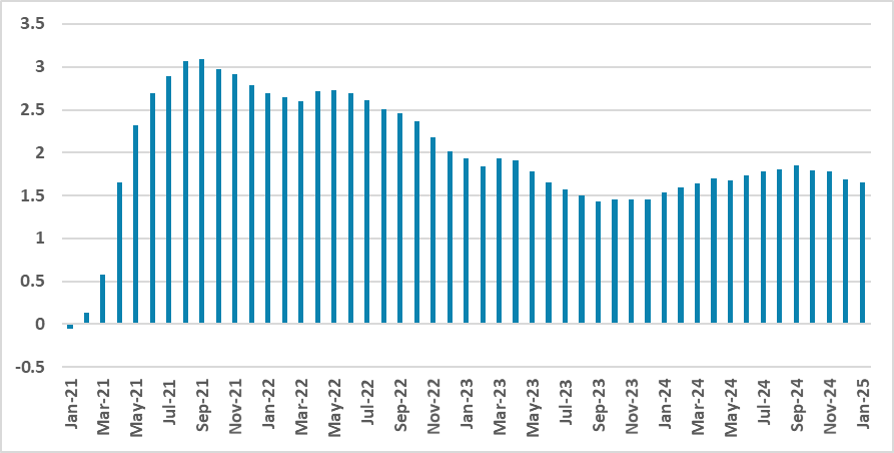

Figure 1: Net Formal Jobs Creation (Millions)

Source: CAGED

The Brazil National Statistics Institute (IBGE) and Ministry of Labour have released labour data up until January. With a very restrictive monetary policy and fiscal push fading, one would expect the Brazilian economy to start cooling down. Some data supports this view for December, although activity points to a 1% growth in Q4, driven by strong October and November (here). Administrative data for formal employees indicates that job creation has decelerated slightly in recent months, although we continue to see this level of job creation as significant for an economy that needs to cool down. Annual net formal job creation now stands at 1.6 million, which is well above the 1.4 million registered in July 2023. Although it has decelerated from the previous months, we believe this number needs to get closer to 1 million for the economy to show signs of cooling.

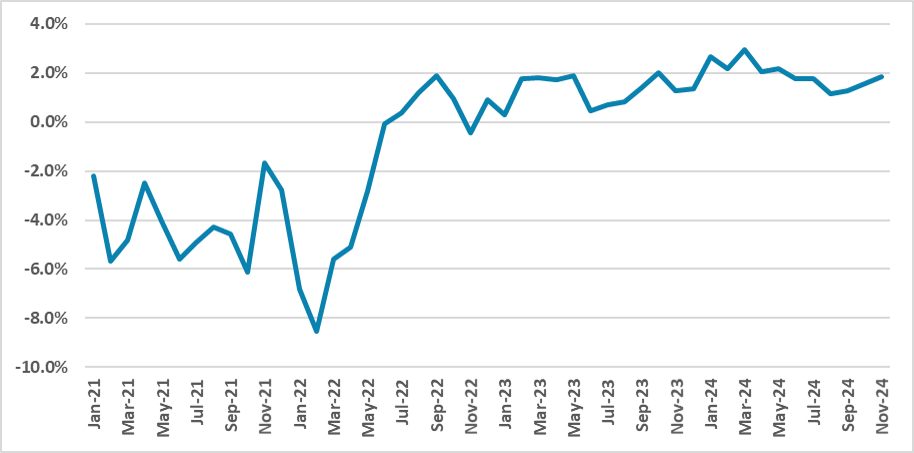

Figure 2: Admission Salaries Annual Growth (%)

Source: CAGED

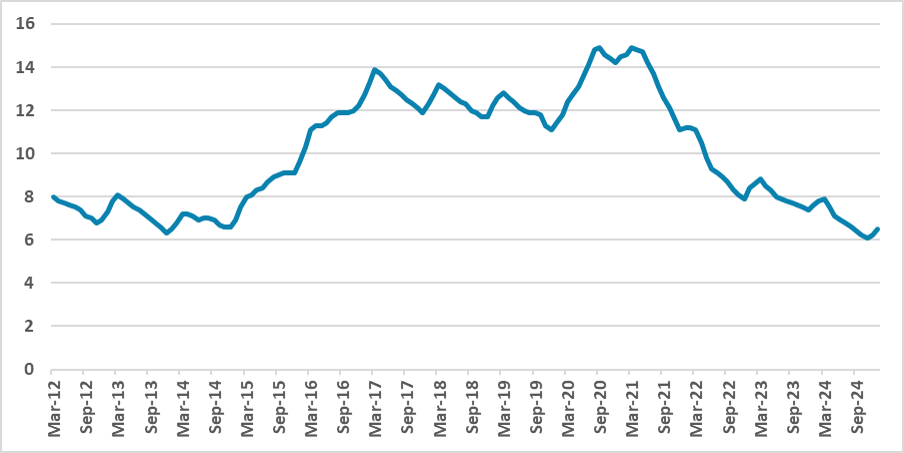

Interestingly, admission salaries are growing below inflation. Compared to one year earlier, admission salaries grew by only 1.8%, but this accelerated when compared to the previous month. Another indicator, monthly estimates of the unemployment rate, registered 6.5% in January, up from 6.3% in December, but this estimate is affected by seasonal components. Compared to January 2024, the unemployment rate has dropped from 7.5%, which could be a sign that the economy remains strong. However, it is important to note that the participation rate is currently at 62.3%, below its peak of 63.8% in 2019, and this is likely also affecting the final unemployment figures.

Figure 3: Unemployment Rate (%)

Source: IBGE

We still believe that with the fiscal surge fading this year and the high level of monetary tightening, the economy will continue to decelerate. The BCB, which has already contracted an additional 100 bps in March, will likely keep the door open for future hikes, with markets expecting the policy rate to rise to 15.0%, implying a further 75 bps hike in May. We remain skeptical about whether this will be the chosen path, as a lot of data will come in before May. If the economy decelerates in the first quarter, the BCB could stop the hiking cycle at 14.25%. However, with the latest data, we are now at a crossroads between these two scenarios.