Argentina: Moving to Phase 3, Bands Flotation

Argentina launched Phase 3 of its macro plan, ending currency restrictions for individuals and securing a USD 20B IMF deal to stabilize falling reserves. The Central Bank shifted from a crawling peg to a target band exchange rate regime, allowing for a 1% monthly devaluation within ARS 1,000–1,400/USD. The move aims to boost exports and slow imports amid rising inflation. While offering short-term relief, the policy is seen as a stopgap, with deeper structural reforms still needed for long-term stability.

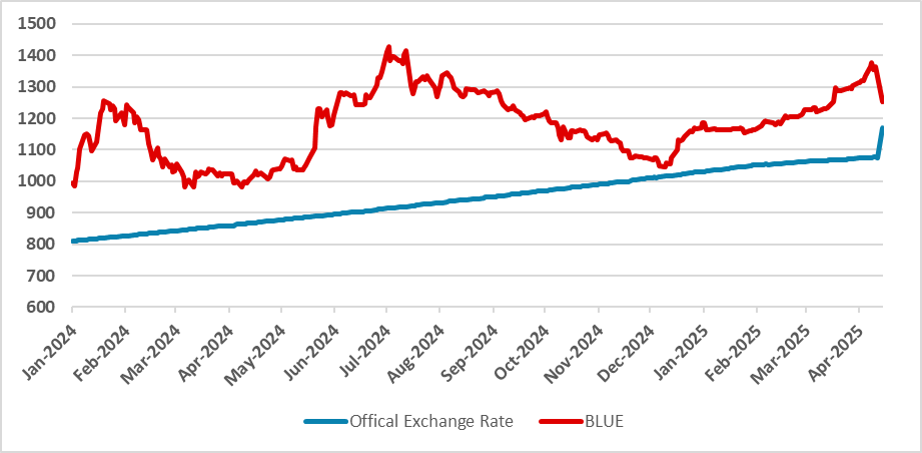

Figure 1: USD/ARS

Source: BCAR

Argentina’s government has announced Phase 3 of its macroeconomic plan. The government stated that the limits for Argentine citizens to buy U.S. dollars have been withdrawn, effectively ending the cepo (currency restrictions). However, some limitations remain in place for enterprises. The announcement was part of a new agreement with the IMF, which will provide an additional USD 20 billion, with USD 12 billion to be disbursed immediately.

In recent weeks, Argentine reserves dropped below USD 27 billion, and the fresh funds will allow the Central Bank of Argentina (BCAR) more flexibility to manage reserves in the coming months, helping it fulfill its obligations.

However, the most significant change was the shift in the exchange rate regime. The BCAR had been operating a crawling peg system but has now switched to a target band regime, with a planned monthly devaluation rate of 1%. The exchange rate range for the next month was set at ARS 1,000–1,400 per USD, meaning the official rate can fluctuate within that band. The BCAR may intervene if the exchange rate moves outside of this range. With the current official rate at ARS 1,075, this implies a potential depreciation of up to 30% within the month.

This change in regime follows a spike in inflation, which rose to 3.7% in March, up from 2.7% in the previous month. The adjustment in the exchange rate was necessary to make Argentine exports more competitive while discouraging imports. With inflation rising faster than the pace of devaluation, the real exchange rate had been appreciating, complicating the BCAR’s critical task of rebuilding reserves.

Additionally, the new monetary program will maintain a nominal anchor by ensuring net peso issuance remains at zero, except for operations required to keep the policy rate within the target range.

On the first day of implementation, both the parallel (blue) exchange rate and the official rate showed signs of convergence. Government officials expect both rates to align soon. The official rate depreciated by approximately 12% on the first day, which is likely to add further pressure to inflation.We believe this operation serves more as a palliative measure than a long-term solution. Argentina is making progress on fiscal adjustment, avoiding monetary financing of government spending, but additional structural changes will be necessary to balance its external accounts. For now, the IMF deal will likely buy Argentina some time, while deferring the financial burden to future years, when amortization payments will come due.