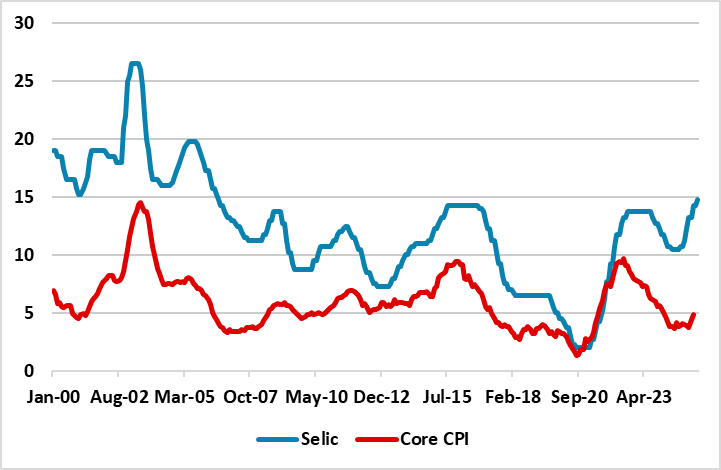

Brazil: Reaching the Rate Peak

Forward guidance from the BCB after the 50bps hike to 14.75% suggests that we are close to a rate peak, with inflation concerns now cited on both sides. The disinflationary impact of Trump tariffs on global trade and commodity prices is now being watched, as BCB members have signaled over the last month. However, underlying domestic inflation concerns suggest that the BCB could still do one final 25bps hike in June to 15% and on balance we stick with this forecast.

Figure 1: Brazil Core CPI and SELIC Policy Rate (%)

Source: Datastream/Continuum Economics

Source: Datastream/Continuum Economics

The BCB 50bps hike was widely expected after previous BCB guidance in March and is understandable as the economy is not yet slowing down quickly enough to curb inflation. The forecast for 2026 inflation was reduced marginally from 3.7% to 3.6% and more noticeable to 4.8% for 2025.

However, the BCB statement forward guidance is become less certain. The BCB note the higher uncertainty caused by the Trump tariffs effects on global trade and commodity prices and this is now cited as a downside risk to inflation. The inflation view is becoming more symmetric, rather than skewed to the upside. Additionally, the statement notes the advanced stage of the monetary policy cycle and the lagged effects that are still to feedthrough. All of this now has the BCB urging caution on interest rates and flexibility to reflect the incoming data. This signals the view that policy rates are close to the peak, but it is less clear whether one final rate hike could still be seen.

We see the BCB leaving the door open for a final hike, which could be 25bps or 50bps. The BCB needs to see progress on inflation, before going on what looks like at least a 6 month hold period for policy rates – the statement calls for a significantly contractionary monetary policy for a prolonged period. The BCB will also be wary about a modest easing of fiscal policy, as Lula seeks to stop his fall in popularity. Given the lags of previous tightening, 25bps or no hike is more likely than 50bps at this mature stage of the tightening cycle and with the BCB reducing the 2025 inflation projection from 5.1% to 4.8% at this meeting. It is a close call whether this will be June or a later meeting such as September. June would round off the tightening cycle and then allow the pause in high rates that the end of the statement signaled. A September hike would allow the BCB the option to then keep rates high until early 2026 before an easing cycle starts. However, if the BCB wait then data could also mean no further hike. On balance, the domestic concerns on inflation argue for one final 25bps hike in June to 15%. We then see stable rates through year end, before a modest 2026 easing cycle.