Outlook Overview: Navigating the Turbulence

· The economic effects on other countries of tariffs are adverse to GDP and likely disinflationary. Other countries will likely not match the scale or breadth of U.S. tariffs and this will mean a hit to their exports and trade impacting production/income and domestic demand. It is also difficult to see a major quick shift in global trading patterns occurring, especially as China is seeing restrained growth. This has left us revising down 2025 GDP forecasts in a number of countries and increases our conviction about further interest rate cuts in most DM countries – except Japan where further slow normalization will be evident.

· Geopolitically the U.S. is also drawing back from Ukraine and Europe, which has sparked a European commitment to increased defense spending (here). However, most European[DS(1] countries are more deficit constrained than Germany and Germany’s pace of defense and infrastructure spending is unlikely to be matched. Meanwhile, our baseline still expects a Russia-friendly ceasefire followed by a peace deal, both as the Trump administration drives a hard bargain to get Ukraine to agree and also as Russia remains opposed to European peacekeepers in Ukraine – the alternative scenario is that the war continues, but without new U.S. support will be tough even if Europe steps up to support Ukraine. Meanwhile, we still feel that the risk on an invasion of Taiwan in the next 2 years is very low, both as China military is not strong enough and President Xi would invade only if China was assured of success – with the U.S. strategic ambiguity support of Taiwan, invasion is currently a very high risk option.

· For financial markets, short end government bond yields can see small to modest falls, as actual easing and an easing bias in most countries helps sentiment. The outlook at the long-end of the curve is more volatile, with the prospect of a 6.5-7% U.S. budget deficit in 2026, though on balance the U.S. economic slowdown should cap yields and also produce a small yield decline. This is all a tricky environment for U.S. equities and we look for an extended correction into mid-2025, due to the various trade wars and adverse economic hit. The overvaluation of U.S. equities leaves it vulnerable, especially if any hard landing fears appear. Other global equity markets will likely follow the U.S. on any selloff, but should outperform the U.S. for the remainder of 2025 – we prefer India equities.

· A weaker USD should also be evident against DM currencies, as the Trump administration is biased to a lower value for the USD and given the current overvaluation of the USD. The USD trends against EM currencies will be more mixed, due to tariff hikes; starting point in currency valuation terms and inflation differentials versus the U.S. However, we could see some recovery in the oversold Brazilian real that benefit from a high carry versus the U.S.

· Risks to our views: A hard landing in the U.S. economy would spillover globally in GDP terms. While this would likely trigger more aggressive Fed easing, it could still prompt a bear market in U.S. equities and a noticeable decline in the USD.

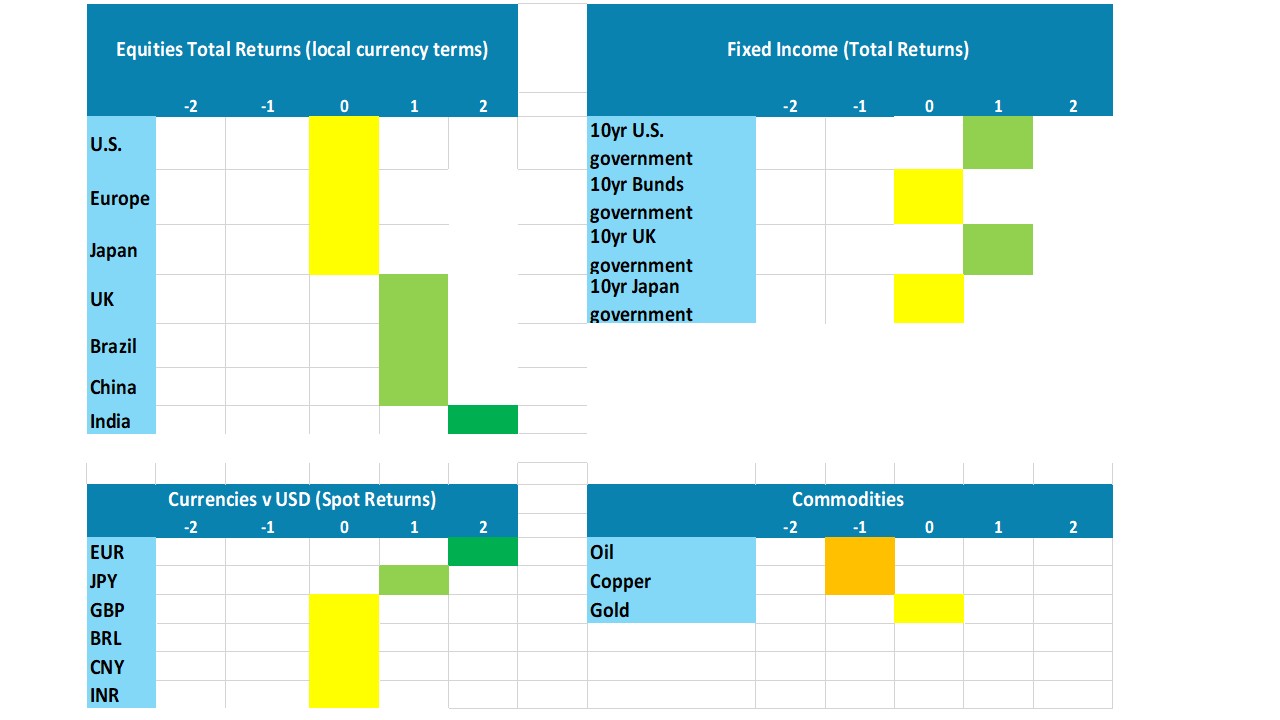

Figure 1: Economic Scenarios

Source: Continuum Economics

Market Implications

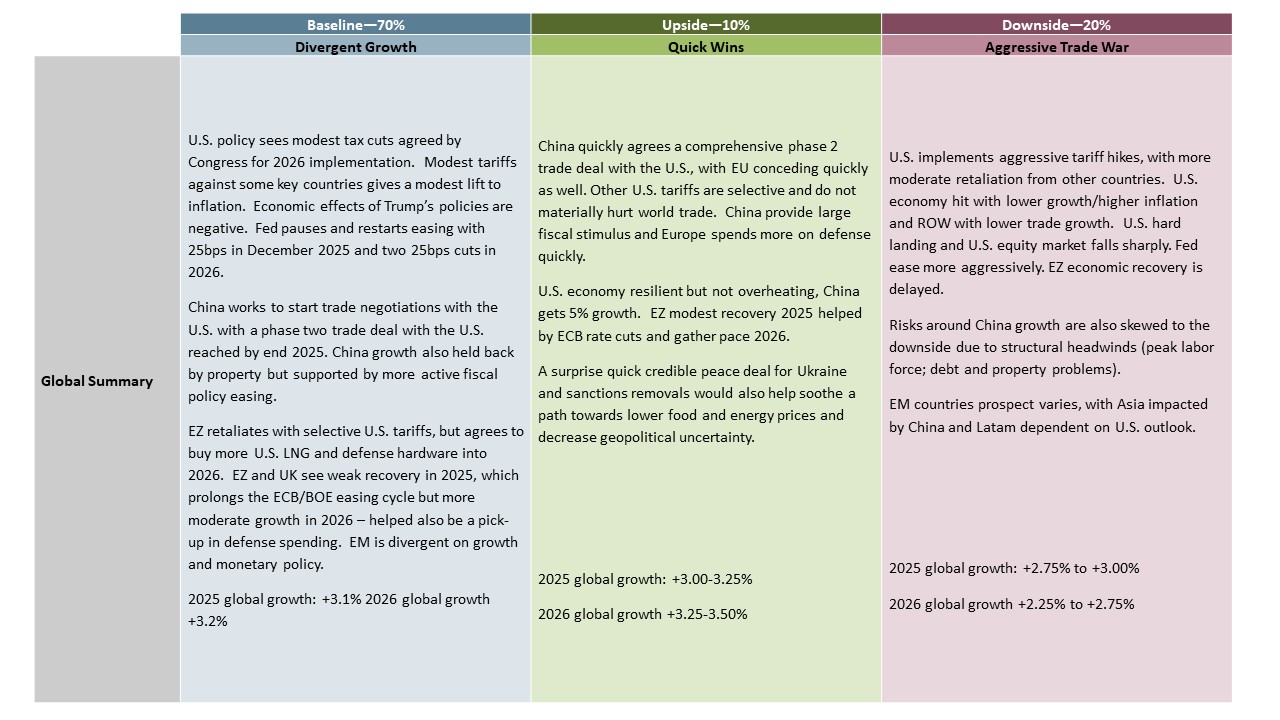

Figure 2: Asset Allocation for the Next 9 Months

Source: Continuum Economics Note: Asset views in absolute total returns from levels on March 25 2025 (e.g., 0 = -5 to +5%, +1 = 5-10%, +2 = 10% plus).

· Government Bonds. We see 10yr U.S. Treasuries at 4.05% by end 2025, as economic slowdown is more powerful than the supply pressures from the still large budget deficit. EZ government bond yields should also decline from recent highs, as Trump is likely to implement tariffs against the EU and partially offset the boost to EZ growth from higher defense spending. We see 10yr Bund yields at 2.6% by end 2025. Finally, 10yr JGB yields will likely peak 1.75-2.00%, as we see one 25bps hike in Q2 before soft consumer spending prompts see the BOJ pause until 2026.

· Equities. We see scope for an extended correction in U.S. equities into mid-2025, as tariffs hit U.S. growth and given the overvaluation of U.S. equities. Other markets will follow any selloff initially, but can outperform in the remainder of 2025. India can perform now that overvaluation is less stretched, and the UK helped by more BOE rate cuts than expected.

· FX. DM currencies can gain further against the USD. Though tariffs helped the USD psychologically, the USD overvaluation is more important and the hit to U.S. growth can sour sentiment towards the USD. EM currencies will be more divergent, with China likely to favour a modestly weak Yuan, but the oversold Brazilian Real likely to gain ground versus the USD.

· Commodities. Oil demand growth remains sluggish with the slowdown in the world economy. Combined with OPEC+ keenness to scale down voluntary production cuts, this can keep oil prices soft in the remainder of 2025. We see WTI at USD65 by end 2025 and USD60 by end 2026.

Figure 3: Key Events

| April 28, 2025 | Canada Federal Election | What had at the start of the year looked set for a certain Conservative victory, led by Pierre Poilievre, now looks set to be a close race, with ruling Liberals now enjoying a marginal lead in the polls. Liberal support has been revived by Mark Carney replacing Justin Trudeau as Prime Minister and a wave of patriotic sentiment generated by the US-induced trade war. While Canada faces a recession due to the trade war both the Liberals and Conservatives look set to be cautious over providing fiscal stimulus. | ||

| From July 2025 | French Parliamentary Election | The surprise snap parliamentary election last July, much to President Macron’s consternation actually made his minority government even weaker, instead creating three clear factions with the legislature. A fresh government has been formed but faces key battles over immigration, pension reform and the budget any of which could see it toppled. Opinion polls suggest that if/when a fresh election occurs (which cannot occur before July due to the constitution) this will not change materially with adverse fiscal and economic implications. President Macron may come under pressure to resign, but is likely to try and complete his term which runs to 2027. but the political impasse, via any possible fiscal and economic crunch could yet trigger further political upheaval. | ||

| July 27, 2025 | Japan House of Councillors election |

| ||

| By September 27, 2025 | Australia House of Parliament election | The Australian election will see 150 seats from House of Representative and more than half of the Senate’s seats to be contested. Early polls are seeing a pretty close call with the ruling labor party slightly in disadvantage. | ||

| October 26, 2025 | Argentina Legislative Election | Argentina will hold legislative election in October 2025. Half of the Chamber of Deputies (127 seats from 257) will be renovated for a four-years mandate. Additionally, one third of the Senate (24 seats for 74) will also be renovated for a 6-years mandate. Most of the polls are pointing that President Javier Milei party will increase the participation of his far-right party, La Libertad Avanza, in both houses while other centre-right parties, such as PRO, will likely lose seats. The left and centre-left are expected to diminish in seats and they will likely be more fragmented than before. | ||

| September 13, 2026 | Sweden General Election | The current right-wing coalition still has very slim effective majority in parliament even with the far-right Sweden Democrats offering support. This is all the result of the 2022 election which brought a fragmented result but locking out the Social Democrats even though they are the largest party. This fragmentation was a result of a more polarized parliament and polls suggest more of the same, but with a general drip more to the left. But even if left-leaning parties return to power, it unlikely to change much given the current focus on defence but where an election issue may be a speedier defence build-up. | ||

| October 4 and 26, 2026 | Brazil General Election | In 2026, Brazil will hold general elections to elect the next President, renew all the Chamber of Deputies seats, and two-thirds of the Senate, while also electing the governors of all Brazilian states. Lula will likely seek re-election, while the candidate representing the right/center-right remains undefined, as Jair Bolsonaro is expected to be ineligible due to decisions by electoral authorities. The likely scenario is that the governor of São Paulo will succeed Bolsonaro in an attempt to challenge President Lula. However, an irrational decision by Bolsonaro, such as nominating his son for the presidency resulting in a fragmented opposition, cannot be ruled out. | ||

| November 3, 2026 | U.S. Mid Term Elections | All seats in the House and a third of the seats in the Senate will be up for election. With the current Republican majority in the House of five seats being marginal even a modest level of disappointment in the Trump administration could see the Democrats gain control of the House, but it will be a lot harder for the Democrats to make the necessary gain of 4 seats in the Senate. |

Source: Continuum Economics