Argentina: Fresh IMF Deal on the Pipeline

The Argentine government has issued an emergency decree to authorize a new IMF deal, potentially worth USD 20 billion, to pay off Treasury debt to the Central Bank. This deal includes a 4-year grace period and 10-year repayment terms. The government aims to stabilize reserves, delay debt amortization, and create breathing room before the October elections. However, challenges persist, such as the risk of devaluing the peso and managing inflation, while export growth may struggle to meet import demands, impacting reserves.

The Argentine government has published an emergency decree authorizing a new deal with the IMF. The emergency decree allows the government to move forward with the deal, although Congress can cancel it if both houses vote against it, an unlikely situation. The decree was vague on the amount of the deal, but it states that it will be used to pay Treasury debt to the Central Bank, helping to clean the Central Bank's balance sheet. The total amount of the disbursement was not detailed, although sources say it could amount to USD 20 billion. The program will have a 4-year grace period and a 10-year repayment period. The deal is likely to be announced between April and May, aiming to avoid a further drop in the already low level of reserves.

Figure 1: Argentina Gross International Reserves (USD Millions)

Source: BCAR

We believe the deal will also delay some of the amortization Argentina has scheduled for the next few years, which will buy the country some breathing room before the October mid-term elections, in which Javier Milei expects to increase the presence of his party in Congress. We all know that the goal is to transition to a low level of inflation and safely remove capital controls. Although the Argentine currency seems to have stabilized, especially the parallel (black market) rate, the Argentine peso is currently appreciating, and this phenomenon is starting to appear in the current account. If this situation continues, the government will have little option but to devalue the official peso before unifying the multiple exchange rates.

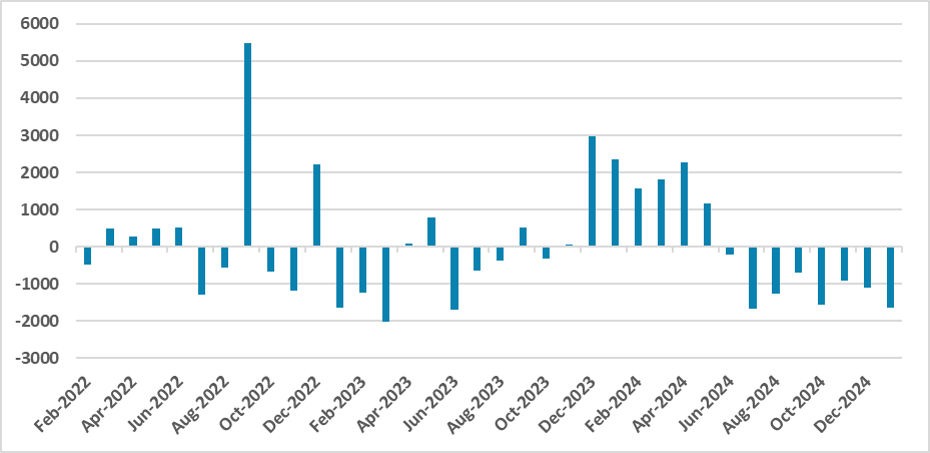

Figure 2: Current Account Balance (USD Millions)

Source: INDEC

With the economy recovering and demand being stronger in the coming months, Argentine exports will likely not keep up with the pace of imports, which could once again jeopardize the Central Bank's reserves absorption. So far, the government has maintained the statement that a new devaluation won't be needed, betting that controlling the growth of the money supply and maintaining a balanced budget will be enough to bring inflation back to healthy levels. Once the conditions of the deal are released, we will have a better idea of how Argentina will implement the third phase (here) of their stabilization program, which aims to safely phase out capital controls.