Argentina: Adjusting the Anchor

Argentina is refining its monetary framework as inflation stabilizes below 3.0% (m/m), marking progress after double-digit levels. Key measures include halting Peso issuance, fiscal adjustments, sterilization to stabilize the monetary base, and diminishing the pace of depreciation of the official exchange rate. Despite a USD 18 billion trade surplus in 2024, concerns remain about export competitiveness amid an appreciating exchange rate. Reserves rose to USD 29 billion but remain critically low, making dollarization unfeasible. The government plans FX market liberalization, likely requiring IMF support to sustain economic recovery.

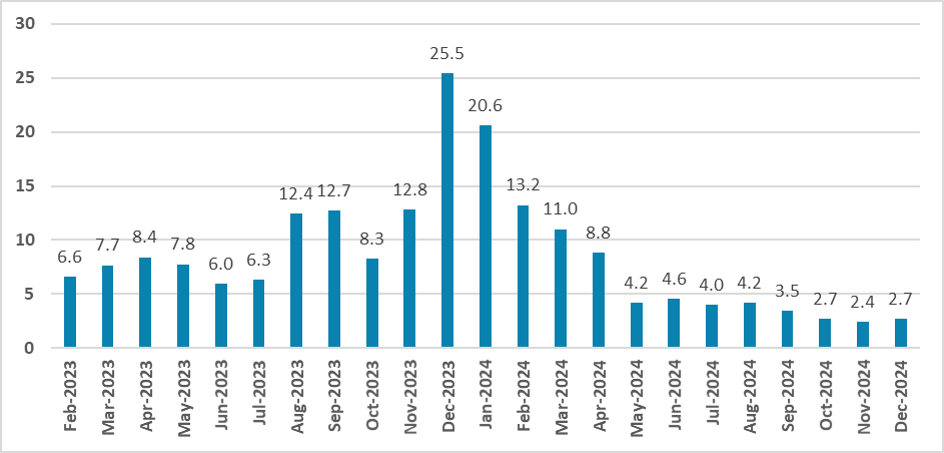

Argentina will adjust its monetary framework once again. Inflation is maintaining a trend of being below 3.0% (m/m). While this is still a high level, there is some sense that progress has been made on that front, especially after months of double-digit monthly inflation. One of the tools the government used to drive inflation down was stopping the monetary issuance of Pesos. To achieve this, the government has made a significant fiscal adjustment, allowing the Central Bank to stop the monetary financing of the deficit.

Figure 1: Argentina CPI (m/m)

Source: INDEC

Later in June, BCAR announced a Pesos sterilization scheme, reducing the issuance of Pesos to nearly zero. Additionally, lowering the interest rate reduced Peso emissions from BCAR assets held by private institutions, cleaning up BCAR's balance sheet.

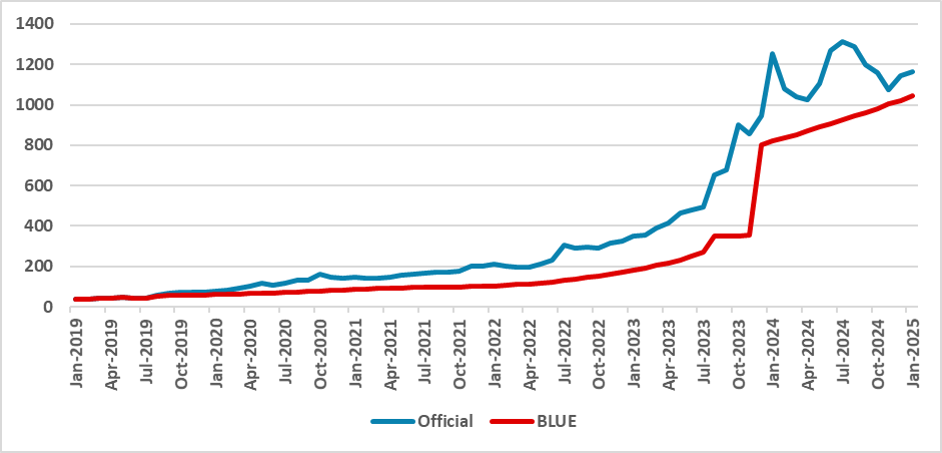

Figure 2: Argentina Exchange Rate (ARS/USD)

Source: BCAR and Refinitiv

At the moment, inflation expectations for 2025 stand at 45%, according to the latest expectations report, which corresponds to around 3.2% monthly inflation. The government has announced that they will reduce the current crawling peg rate to 1% from the current 2%, meaning that, in real terms, the official exchange rate will continue to appreciate. The good news is that with the monetary base stabilized, the demand for USD has been diminishing, allowing the parallel quotation of the USD (BLUE) to narrow.

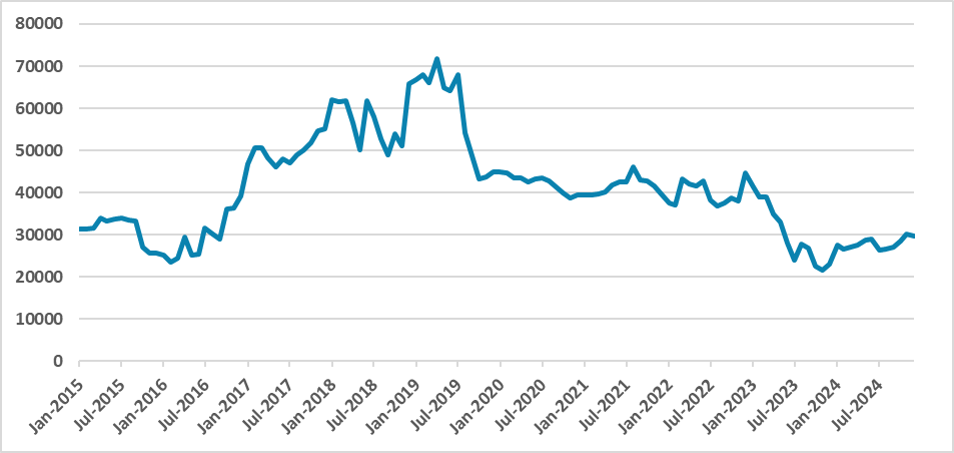

Figure 3: Argentina Real Exchange Index

Source: BCAR

One area of concern is whether this appreciation will decrease the competitiveness of Argentinean exports. In 2024, Argentina registered a record trade surplus of USD 18 billion, but this was highly influenced by the drop in imports caused by the recession seen in 2024. Now that the economy is clearly on a recovery path, an appreciated exchange rate could increase imports while diminishing export competitiveness. The government is betting that increasing net energy exports will be enough to sustain the trade surplus, allowing a net influx of USD, which will ultimately enable BCAR to increase its foreign reserves.

Figure 4: Argentina Foreign Reserves (USD Million)

Source: BCAR

Still, the level of reserves continues to be extremely low at USD 29 billion, as registered in December, but this is still above the level recorded 12 months ago (USD 23 billion). So far, what the Argentine government has achieved is strengthening the Argentine Peso. With the current low level of reserves, dollarization looks impossible. The next step for the government is to liberalize the FX markets. We believe some help from the IMF will likely be needed to fulfill that task.