EMEA

View:

September 18, 2025

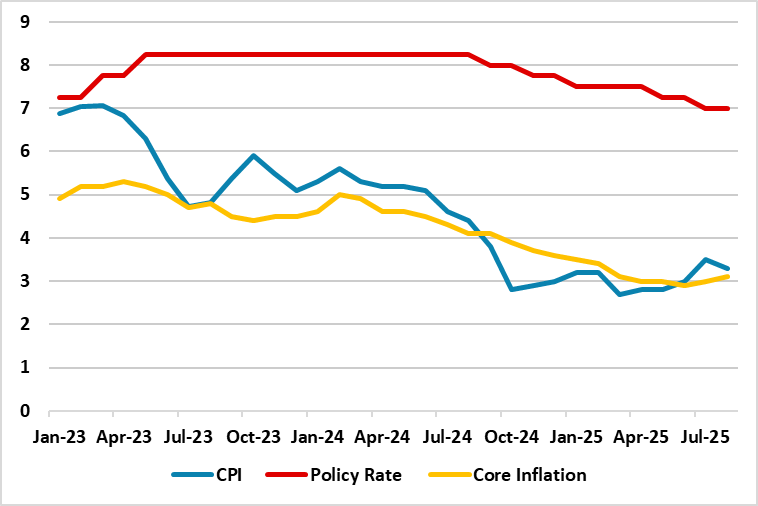

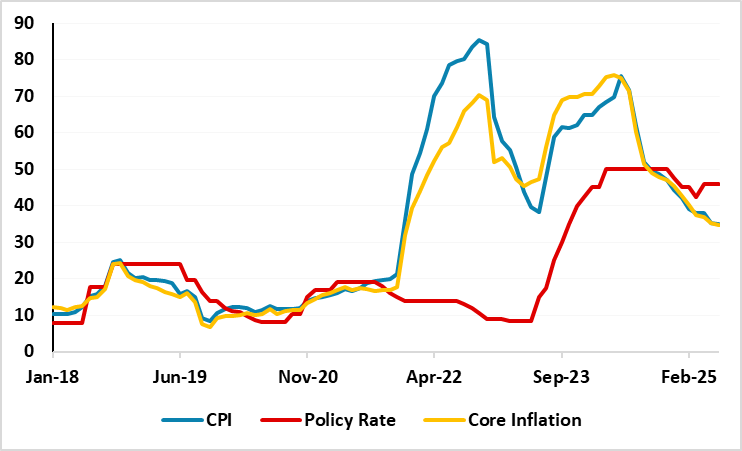

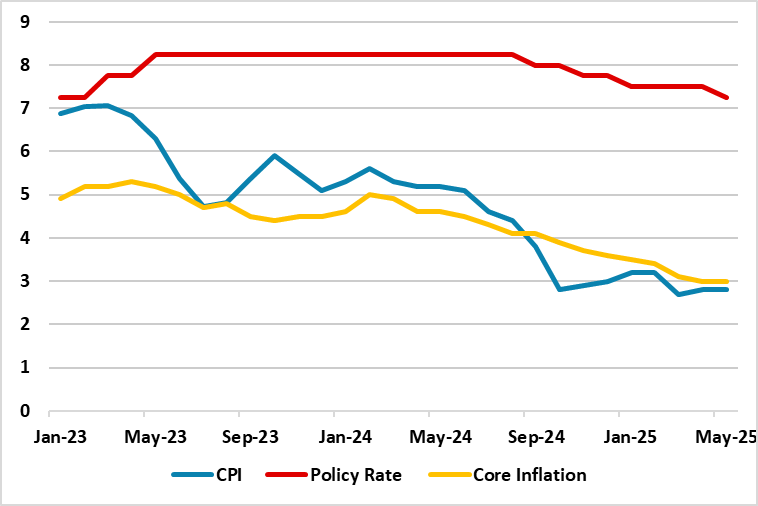

SARB Holds Rate Stable at 7.0% to Bring the Inflation Down to New 3% Anchor and Assess Impacts of Earlier Cuts

September 18, 2025 6:36 PM UTC

Bottom Line: South African Reserve Bank (SARB) held the policy rate at 7.0% during the MPC on September 18 as annual inflation hit 3.3% YoY in August which is above new inflation anchor coupled with surged core inflation. SARB governor Kganyago said on September 18 that MPC expects headline inflatio

Norges Bank Review: More Caution But Another Cut Flagged for This Year

September 18, 2025 8:58 AM UTC

Despite the stronger than expected data seen of late (real and price-wise), as we expected, the Norges Bank cut is policy rate by a further 25 bp to 4.0%, an outcome markets had dithered over. But with a small cumulative upgrade to the real economy outlook and an ensuing reduction in the anticipat

September 17, 2025

South Africa Inflation Slightly Softened to 3.3% YoY in August

September 17, 2025 1:17 PM UTC

Bottom Line: Statistics South Africa (Stats SA) announced on September 17 that annual inflation softened to 3.3% YoY in August from 3.5% in July thanks to slower food price growth and falling fuel costs. Despite inflation is still within the South African Reserve Bank’s (SARB) 3%-6% target rang

SNB Preview (Sep 25). Staying at Zero Amid Credit Cross Currents?

September 17, 2025 9:01 AM UTC

Having the SNB cut the policy rate by 25 bp back to zero in June, as widely expected, we see no further change for the time being, and with little likelihood of any move at the quarterly assessment due later this month (Sep 25). Indeed, despite barely positive inflation, markets have priced out wh

September 16, 2025

Succession and Strongmen Leaders

September 16, 2025 10:53 AM UTC

In the unexpected scenario of an early death, Putin and Xi have no clear successors, and any new Russia or China leader would have to spend time building domestic strength and compromising on external goals. Erdogan also has no clear successors, which could create political uncertainty. For Trump su

September 15, 2025

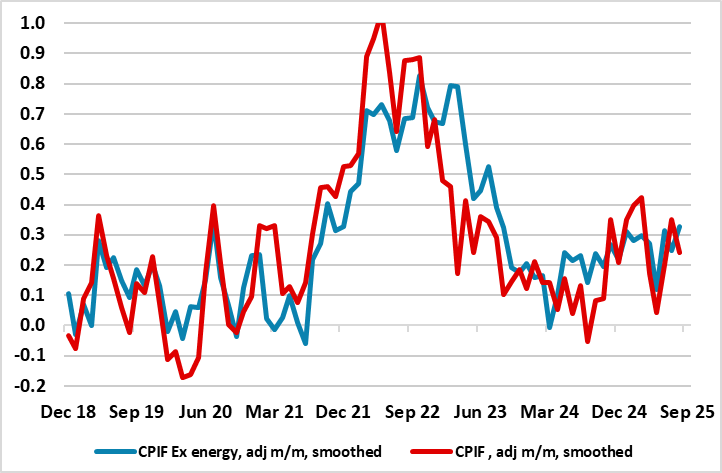

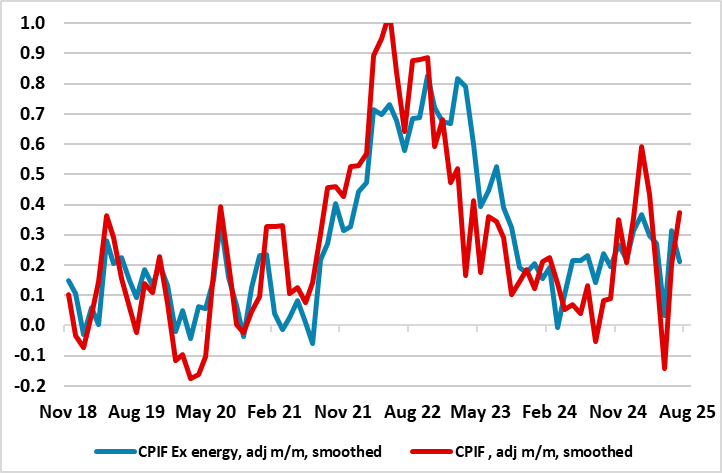

Sweden Riksbank Preview (Sep 23): Riksbank To Deliver Final Rate Cut?

September 15, 2025 1:09 PM UTC

Although noting the possible impact of recent both real activity and adjusted CPI data having delivered upside news and surprises, we adhere to our view that a further but final rate cut is looming and probably at the Sep 23 verdict. Indeed, we were disappointed that the Riksbank did not deliver a

September 12, 2025

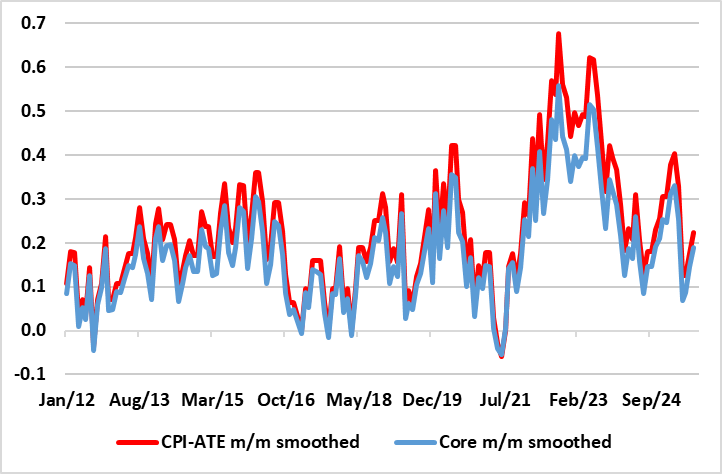

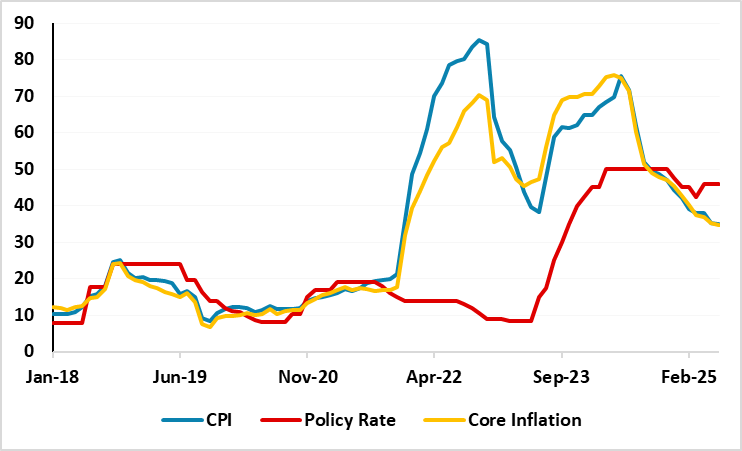

CBR Reduced its Key Rate to 17% as Inflation Softened, but Warned Inflation is Still High

September 12, 2025 3:48 PM UTC

Bottom Line: As we expected, Central Bank of Russia (CBR) reduced policy rate by 100 bps to 17% on September 12 taking into account that inflation continued to slow down in Q3 but still warned inflation remains high. CBR stated in its written statement it will maintain monetary conditions as tight

September 11, 2025

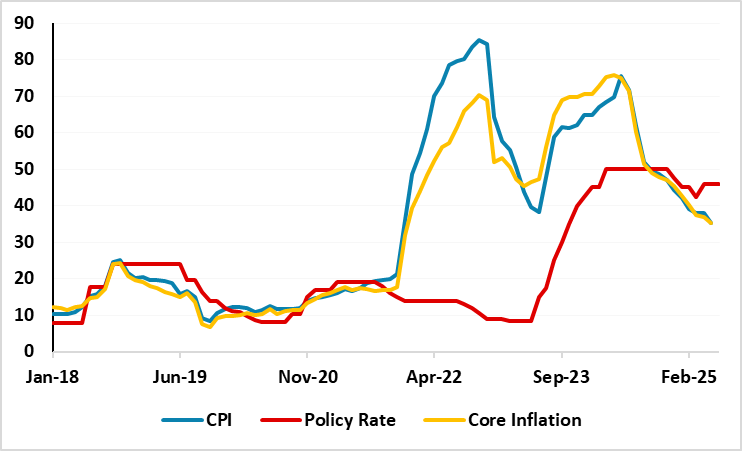

Easing Cycle Continues: CBRT Reduced the Key Rate to 40.5% on September 11

September 11, 2025 5:17 PM UTC

Bottom Line: As we expected, Central Bank of Republic of Turkiye (CBRT) reduced the policy rate by 250 bps to 40.5% during the MPC meeting on September 11 taking moderate fall in inflation and relative TRY stability into account. CBRT highlighted in its written statement that recent data indicate de

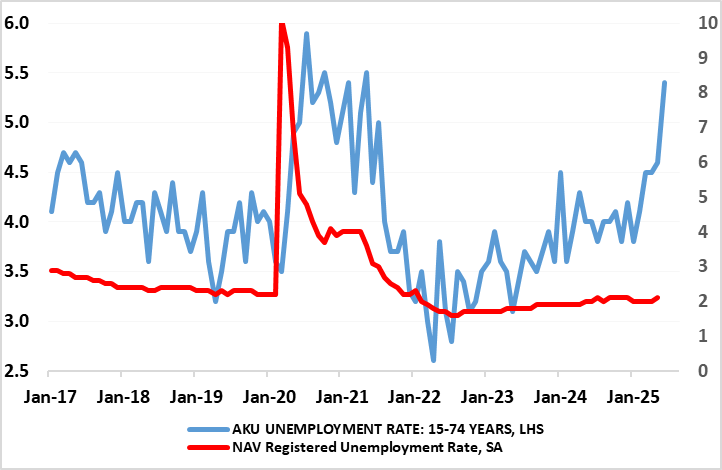

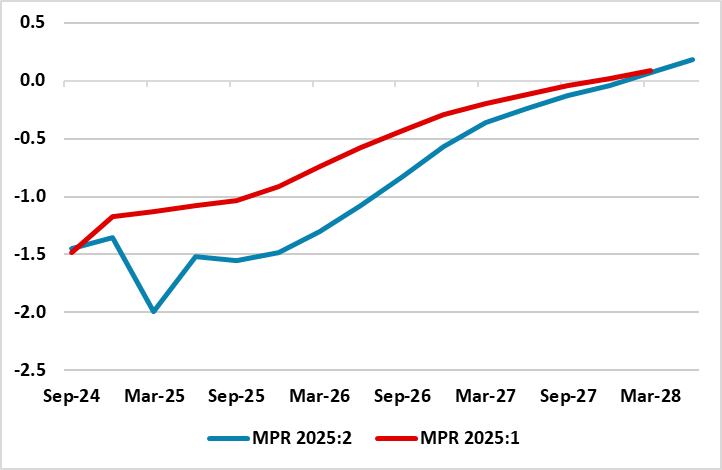

Norges Bank Preview (Sep 18): Taking Foot Further of the Brake?

September 11, 2025 8:41 AM UTC

Recognizing the stronger than expected data seen of late (real and price-wise), we still see the Norges Bank cutting a further 25 bp at next week’s policy meeting. While still high, targeted (CPI-ATE) inflation is being boosted by stubborn services inflation, this partly offsetting ever softer g

September 03, 2025

Turkiye’s Inflation Slightly Eased to 32.9% YoY in August... But, Monthly Inflation is Still Over 2.0%

September 3, 2025 4:11 PM UTC

Bottom line: Turkish Statistical Institute (TUIK) announced on September 3 that the inflation slightly softened to 32.9% y/y in August from 33.5% y/y in July driven by lagged impacts of previous monetary tightening, tighter fiscal measures and suppressed wages. August figure came in slightly above

September 01, 2025

Hitting Beyond Expectations thanks to Construction Activities: Turkiye’s GDP Growth Rebounded Strong in Q2

September 1, 2025 10:55 AM UTC

Bottom Line: According to Turkish Statistical Institute’s (TUIK) announcement on September 1, Turkish economy increased by a strong 4.8% YoY despite political turbulence after arrest of Istanbul mayor and opposition’s presidential candidate Ekrem Imamoglu in Q2, prolonged monetary tightening eff

Aging: Slow Growth for Some in 2020’s

September 1, 2025 8:35 AM UTC

Population aging always seems to be beyond the market horizon, but the 2020’s are already seeing population aging in some countries. What is the economic impact? Aging is already causing a peak in labor force in China and the EU. Meanwhile, the population pyramid also means less consumptio

August 27, 2025

South Africa GDP Growth Preview: Moderate Growth Will Resume in Q2

August 27, 2025 3:22 PM UTC

Bottom line: Department of Statistics of South Africa (Stats SA) will announce Q2 GDP growth on September 3, and we expect that South African economy will likely grow by around 1.0%-1.2% YoY in Q2 2025. We think that the growth momentum will continue to be supported by low inflation and interest rat

August 26, 2025

Turkiye GDP Growth Preview: Slowdown Will Continue in Q2

August 26, 2025 5:14 PM UTC

Bottom Line: Turkish Statistical Institute (TUIK) will announce Q2 GDP growth on September 1 and we expect that Turkish economy will expand around 1.7% -2.0% YoY backed by private consumption despite early indicators demonstrate a lower acceleration rate in domestic demand amid tightening financial

France and Italy: Deficit, ECB QT and Foreign Debt Holders Stories

August 26, 2025 7:35 AM UTC

A large budget deficit in France, looking persistent given the current political impasse, combined with ECB QT means that the market has to absorb a very large 8.5% of GDP of extra bonds. Our central scenario is that persistent French supply causes a further rise in 5yr plus French government yields

August 20, 2025

South Africa Inflation Surges: 3.5% YoY in June

August 20, 2025 11:12 AM UTC

Bottom Line: Statistics South Africa (Stats SA) announced on August 20 that annual inflation rose to 3.5% YoY in July from 3.0% in June due to elevated prices of food and non-alcoholic beverages; housing and utilities; and restaurants and accommodation services. MoM prices surged by 0.9% in July, m

Sweden Review: Riksbank Still Flagging Final Rate Cut?

August 20, 2025 8:37 AM UTC

Although matching nearly all expectations, we are disappointed that the Riksbank did not deliver a further and probably final 25 bp rate cut this time around, especially given its repeated suggestion of prob a cut later this year. Now, there are three more policy verdicts before year-end and we thin

August 18, 2025

Trump-Putin Summit: No Ceasefire Agreement, Possible Concessions Discussed

August 18, 2025 12:29 PM UTC

Bottom Line: U.S. President Trump and Russian President Putin met in Alaska on August 15 to discuss the fate of war in Ukraine. The meeting lasted three hours, but did not yield an immediate ceasefire agreement as we expected. After the meeting, Trump and Putin both signaled what could happen next i

August 14, 2025

CBRT Kept Its End-Year Inflation Forecast at 24%, and Announced Its New Interim Targets

August 14, 2025 4:01 PM UTC

Bottom Line: Central Bank of Turkiye (CBRT) released its third quarterly inflation report of the year on August 14, and kept its inflation forecast constant at 24% for 2025, 16% by the end of 2026 and 9% by end-2027. CBRT governor Karahan said the regulator decided to separate the targets from its i

Russian Economy is Slowing: GDP Growth Continued to Lose Steam in Q2 2025

August 14, 2025 9:23 AM UTC

Bottom Line: According to Russian Federal Statistics Service (Rosstat) figures, Russia's GDP expanded by 1.1% YoY in Q2, the slowest pace of growth since the economy resumed expansion in Q2 2023, driven by military spending, investments, higher wages and fiscal stimulus. We think Central Bank of R

Norges Bank Review (Aug 14): Job Concerns Growing?

August 14, 2025 8:52 AM UTC

After the surprise 25 bp rate cut in June, it was back to humdrum predictability with the widely expected stable policy decision at 4.25%. Regardless, the Board could be attacked for plagiarism given the manner in which the updated press release mimics that seen in June, save for the fact that bot

August 13, 2025

Deceleration in Inflation Resumes in Russia: 8.8% YoY in July

August 13, 2025 7:28 PM UTC

Bottom Line: According to Russian Federal Statistics Service (Rosstat) data on August 13, inflation stood at 8.8% YoY in July after hitting 9.4% YoY in June, ignited by higher non-food and services prices. Despite inflation eased for a fourth straight month, we foresee inflation will continue to st

August 11, 2025

Sweden Preview (Aug 20): Riksbank to Cut for Final Time?

August 11, 2025 12:42 PM UTC

We see the Riksbank delivering a further 25 bp rate cut on Aug 20, taking the policy rate to new cycle low of 1.75%. This would chime with the hints after the last meeting and cut in July of a further move is possible. And with both real activity and CPI data having delivered downside news and s

August 05, 2025

Norges Bank Preview (Aug 14): Amid Very Restrictive Stance, A Policy Pause – Already?

August 5, 2025 1:48 PM UTC

Although surprised, we thought the Norges Bank’s unexpected easing in June was very much warranted, as are the further cuts being flagged in the Monetary Policy Report (MPR) that came alongside – ie two more such moves by end year. We actually envisage up to three more moves this year and arou

July 31, 2025

SARB Cuts Key Rate to 7.0% Given Subdued Inflation; Lower CPI Goal Announced

July 31, 2025 3:32 PM UTC

Bottom Line: Despite the uncertainty around United States tariffs and rising domestic food inflation, South African Reserve Bank (SARB) reduced the policy rate by 25 bps to 7.0% during the MPC on July 31 as annual inflation hit 3.0% YoY in June coupled with eased core inflation, and a relatively sta

July 30, 2025

Turkiye Inflation will Slightly Soften in July: Tax Adjustments and Gas Price Hike in July Will Limit the Fall

July 30, 2025 8:35 AM UTC

Bottom line: After easing to 35.1% annually in June, we expect Turkiye’s consumer price index (CPI) will continue to soften moderately in July to 34.1%-34.3% as tax adjustments and energy price hikes in July will limit the downward trend. Despite tight monetary policy and moderately falling dema

July 25, 2025

CBR Reduced its Key Rate to 18% as Inflation Softens

July 25, 2025 11:41 AM UTC

Bottom Line: As we expected, Central Bank of Russia (CBR) reduced policy rate by 200 bps to 18% on July 25 taking into account that inflation slowed to 9.4% in June from 9.9% in May; MoM price growth marked the lowest hike after August 2024; and the inflation expectations declined to 13% in June fro

July 24, 2025

Easing Cycle Restarts: CBRT Reduced the Key Rate to 43% on July 24

July 24, 2025 2:15 PM UTC

Bottom Line: As we expected, Central Bank of Republic of Turkiye (CBRT) reduced the policy rate by 300 bps to 43% during the MPC meeting on July 24 taking the deceleration trend in inflation and relative TRY stability in June into account. CBRT highlighted in its written statement that the underly

July 23, 2025

Food Prices Lifted South Africa Inflation to 3.0% YoY in June

July 23, 2025 12:36 PM UTC

Bottom Line: Statistics South Africa (Stats SA) announced on July 23 that annual inflation rose to 3.0% YoY in June from 2.8% in May as food prices reached a 15-month high coupled with elevated restaurant and health services prices. The inflation is still within South African Reserve Bank’s (SARB)

July 16, 2025

CBR will Likely Cut its Key Rate to 19% on July 25

July 16, 2025 4:32 PM UTC

Bottom Line: After Central Bank of Russia (CBR) reduced its key interest rate by 100 basis points to 20% on June 6, citing continued easing in inflationary pressures, including core inflation, we foresee that the rate will be further reduced to 19% on July 25 taking into account that inflation slowe

July 15, 2025

Turkiye MPC Preview: CBRT will Likely Restart its Easing Cycle on July 24

July 15, 2025 12:09 PM UTC

Bottom Line: After Central Bank of Turkiye (CBRT) held its key policy rate stable at 46% on June 19, we believe CBRT will likely reduce the policy rate by 150-250 bps during the MPC meeting scheduled for July 24 considering the deceleration trend in inflation in June beat forecasts and reinforced ex

July 11, 2025

Deceleration in Inflation, Albeit Gradual, Continued in June: 9.4% YoY

July 11, 2025 4:48 PM UTC

Bottom Line: According to Russian Federal Statistics Service (Rosstat) data, inflation stood at 9.4% YoY in June after hitting 9.9% YoY in May, partly due to favorable base impacts, recent RUB strengthening and falling oil prices. We think the recent tariffs hike for electricity, gas, heating and w

July 09, 2025

South Africa Opposes Trump’s 30% Tariffs

July 9, 2025 3:47 PM UTC

Bottom Line: After a 90-day reprieve, U.S. president Trump announced on July 7 that the U.S. would implement 30% additional tariffs against South Africa-origin products from August 1. Despite President Ramaphosa opposed what he calls the unilateral trade tariffs by the U.S., and emphasized that Sout

July 07, 2025

New Probes into Turkiye’s Opposition Party

July 7, 2025 10:34 AM UTC

Bottom Line: After mayor of Istanbul Ekrem Imamoglu got arrested on March 23, political tension remains high in Turkiye, particularly after the Republican People’s Party (CHP) Adana mayor Zeydan Karalar, Antalya mayor Muhittin Bocek and Adiyaman mayor Abdurrahman Tutdere were detained on July 5 fo

July 03, 2025

Turkiye’s Inflation Slightly Eased to 35.1% YoY in June

July 3, 2025 1:00 PM UTC

Bottom line: Turkish Statistical Institute (TUIK) announced on July 3 that the inflation softened to 35.1% y/y in June from 35.4% y/y in May driven by lagged impacts of previous monetary tightening, tighter fiscal measures and suppressed wages. Despite moderate fall, inflationary risks remain tilte

U.S. Assets and Valuation

July 3, 2025 9:30 AM UTC

The U.S. equity market has returned to be clearly overvalued on equity and equity-bond valuations measures and is vulnerable to a new correction in H2 on any moderate bad news (e.g. further economic slowing and corporate earnings downgrades). In contrast, U.S. Treasuries are at broadly fai

July 02, 2025

Russia GDP Growth Continues to Lose Steam

July 2, 2025 6:43 PM UTC

Bottom Line: According to Ministry of Economic Development figures, Russia's GDP expanded by 1.2% YoY in May following a 1.9% rise the previous month, which marked one of the lowest pace of growth since the economy resumed expansion in Q2 2023, driven by military spending, higher wages and fiscal

South Africa: Coalition Under Pressure After President Ramaphosa Fires DA Deputy

July 2, 2025 12:25 PM UTC

Bottom Line: The political tension between the African National Congress (ANC) and Democratic Alliance (DA) has peaked as of late June after President Ramaphosa sacked DA’s deputy minister Andrew Whitfield due to an unauthorized trip to the U.S. at the end of February. Following the dismissal, DA

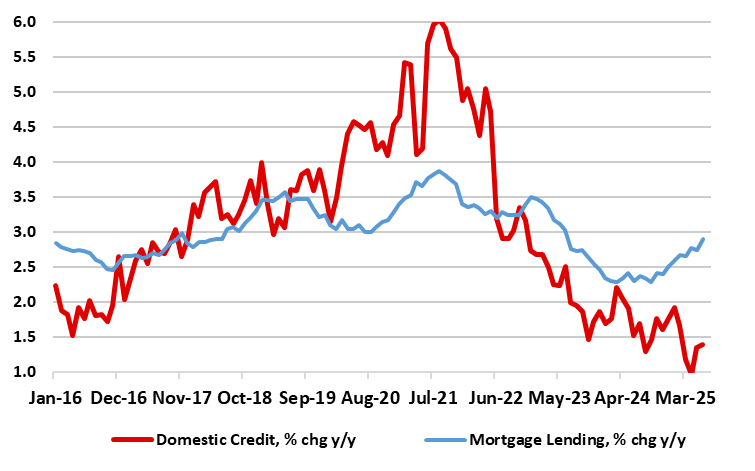

DM Central Banks: Overlooking Lagged 2021-23 Tightening and QT?

July 2, 2025 8:30 AM UTC

We are concerned that DM central banks are underestimating the lagged impact of 2021-23 tightening and ongoing QT, which impacts the transmission mechanism of monetary policy. Central banks need to consider cyclical and structural issues, but also need a more rounded view of the stance and implica

June 26, 2025

Ukraine War Update: War Continuing Probability is Now at 70%

June 26, 2025 11:06 AM UTC

Bottom Line: Our baseline scenario (70%) is based on the war continuing after talks fail since president Putin insists on his peace terms. President Trump is reluctant to threaten or implement of secondary tariffs on Russia oil buyers, that would really pressure president Putin. The U.S. financing o

June 25, 2025

Outlook Overview: Trump’s Fluid Policies

June 25, 2025 7:20 AM UTC

· President Donald Trump still wants to use the tariff tool, and we see the eventual average tariff rate being in the 13-15% area, lowered by deals but increased by more product tariffs. Any lasting legal block on reciprocal tariffs will likely see the administration pivoting towards ot

June 24, 2025

Equities Outlook: Choppy Then 2026 Gains

June 24, 2025 8:15 AM UTC

Though the U.S. equity market has rebounded, we still scope for a fresh dip H2 2025 to 5500 on the S&P500 as hard data softens further to feed into weaker corporate earnings forecasts and CPI picks up and delays Fed easing. However, the AI story is still a positive, while share buybacks

EMEA Outlook: Global Uncertainties and Domestic Dynamics Continue to Dominate

June 24, 2025 7:00 AM UTC

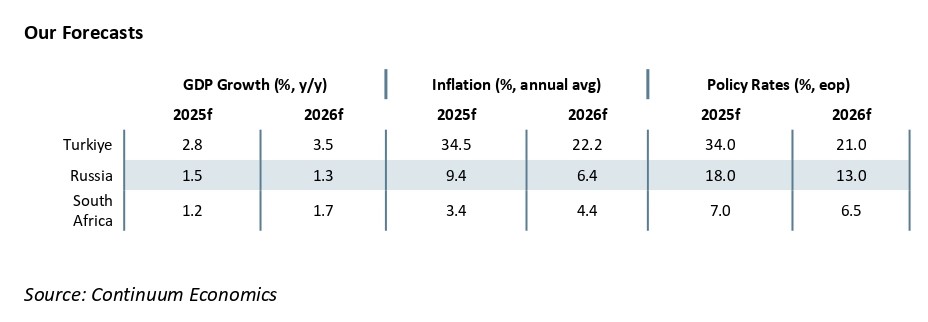

· In South Africa, we foresee average headline inflation will stand at 3.4% and 4.4% in 2025 and 2026, respectively, despite upside risks to inflation such as power cuts (loadshedding), tariff hikes by Eskom, spike in food prices, and global uncertainties. We see growth to be 1.2% and 1.7%

June 23, 2025

DM Rates Outlook: Yield Curve Steepening?

June 23, 2025 8:30 AM UTC

• We see the U.S. yield curve steepening in the next 6-18 months. 2yr U.S. Treasury yields can step down with cautious Fed easing on a modest/moderate growth slowdown and also if the Fed keeps an easing bias in H2 2026. 10yr U.S. Treasury yields face a tug of war between lower short-dated y

June 20, 2025

Commodities Outlook: Policy Realignment

June 20, 2025 9:30 AM UTC

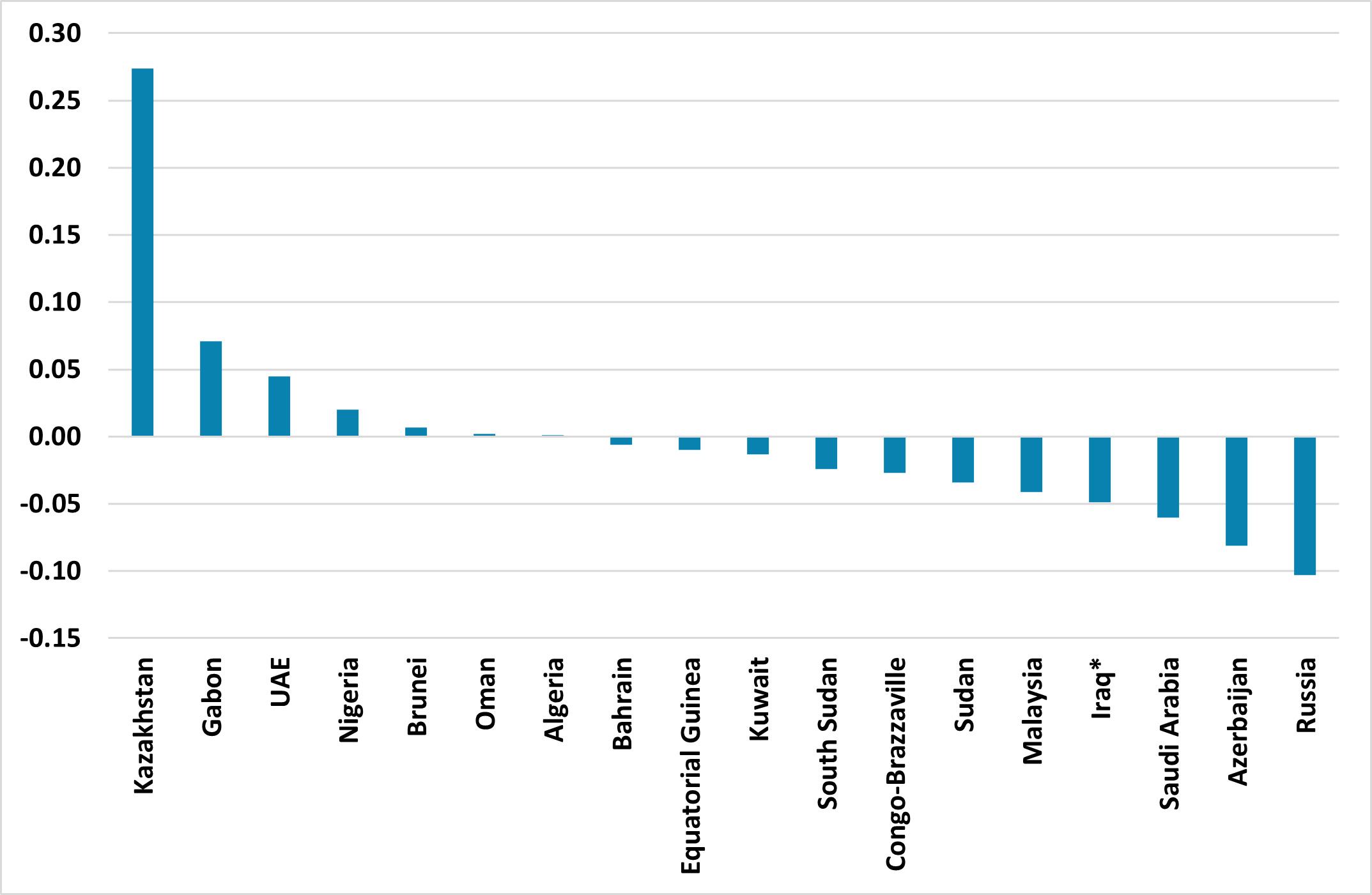

In Q2 2025, eight OPEC+ countries pledged a faster oil supply hike, motivated by market share losses, internal frictions, and geopolitical shifts. However, actual output has fallen short due to overproduction offsets, domestic consumption, and capacity limits. Further gradual increases are expected,

June 19, 2025

Hawkish Stance Maintained: CBRT Held the Key Rate Stable at 46% Despite Softening Inflation

June 19, 2025 7:49 PM UTC

Bottom Line: Central Bank of Turkiye (CBRT) held the policy rate unchanged at 46% during the MPC on June 19 despite inflation continues to ease. CBRT highlighted in its written statement that the tight monetary stance will be maintained until price stability is achieved via a sustained decline in in

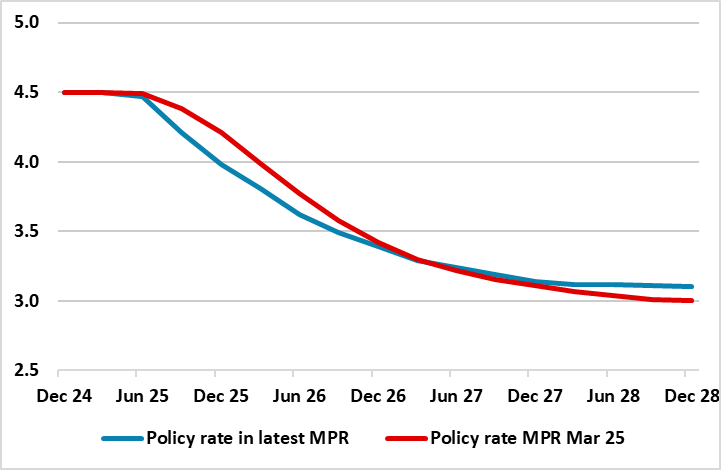

Norges Bank Review: Coming (Very) Late to the Party

June 19, 2025 8:57 AM UTC

Although we thought the Norges Bank would not start to ease until its next (Aug) meeting, we think the surprise 25 bp policy rate cut (to 4.25%) announced today is very much warranted, as are the further cuts (Figure 1) being flagged in the updated Monetary Policy Report (MPR) – ie two more such m

SNB: Cut to Zero, But Negative Rates an Option

June 19, 2025 8:00 AM UTC

The SNB would probably prefer to consolidate the effects of previous rate cuts, but the low inflation forecast and downside risk to inflation means that a cut to -0.25% is feasible at the September or December meetings. The SNB will also hope that the threat of negative rates restrains the CHF s

June 18, 2025

South Africa Inflation Stayed Unchanged in May 2.8% YoY

June 18, 2025 9:50 AM UTC

Bottom Line: Annual inflation stayed stable at 2.8% in May after April as food prices rose, remaining below the lower bound of South African Reserve Bank’s (SARB) target range of 3% to 6%. We think unpredictable outlook for the global economy, and return of power cuts (loadshedding) pressurized do