Inflation in Russia Continued to Moderately Decelerate in May: 9.9% YoY

Bottom Line: According to Russian Federal Statistics Service (Rosstat) data, inflation stood at 9.9% YoY in May after hitting 10.2% in April, the softest in four months. Despite CPI remained above the Central Bank of Russia’s (CBR) midterm target of 4%, the deceleration was remarkable as prices increased for a slower pace for food (12.5% YoY in May versus 12.7% in April) and services (12.6% YoY in May and 12.8% in April). We think that risks to the inflation outlook continue to remain upside until the war in Ukraine comes to an end, which is very unlikely in 2025 under current circumstances.

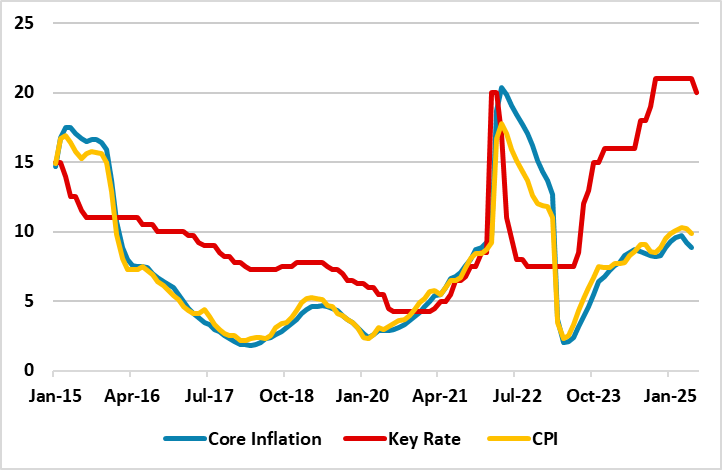

Figure 1: CPI, Core Inflation (YoY, % Change) and Policy Rate (%), January 2015 – June 2025

Source: Continuum Economics

According to Rosstat figures, on annual terms, inflation slowed to 9.9% in May from 10.2% in April, the softest in four months. Prices increased at a slower pace for food (12.5% YoY in May vs 12.7% in April), mainly fruits and vegetables (19.8% YoY vs 21.2% in April); services (12.6% YoY vs 12.8% in April) and non-food products (4.8% YoY vs 5.4% in April). Service sector inflation has cooled slightly, which can be associated with strengthening ruble and a modest slump in consumer demand.

The core CPI rose 8.9% on a yearly basis from 9.2% the previous month, which is a five-month low. MoM price growth fastened to 0.43% in May over the previous month.

According to the CBR’s MPC statement on June 6 there are signs of economic cooling and easing price pressures emerged. CBR added that the monetary policy would remain tight for a long period in order to return inflation to its 4% target. Speaking about the course of inflation, CBR governor Nabiullina recently stated that the importance of maintaining low inflation for the overall economy and indicated that “What we are saying is that it will be necessary to maintain tight monetary conditions for an extended period of time."

Despite optimistic opinions by the CBR, we think balance of inflation risks is still tilted to the upside over the medium-term as the fiscal policy is making a big contribution to domestic demand. High military spending, likely deterioration in the terms of external trade during ongoing trade wars and rising wages do not signal a significant permanent inflation slowdown in the horizon yet. Inflation is projected to moderately slow down after Q3 as tight monetary policy will likely affect bank lending and private consumption, but slowly. We think rates will stay high for a longer period, as signaled by the CBR.

Under current circumstances, we foresee a peace deal in Ukraine could ease some pressure on inflation and alleviate demand-supply imbalances in Russia despite sealing a peace deal will likely take longer-than-expected, while a deal in 2025 is very unlikely. We continue to feel reaching 4% target will be very tough even in 2026, since cooling off inflation will take longer than CBR anticipates taking into account that demand stays elevated, military spending dominate, and inflation expectations of households and businesses remain high.