CBR will Likely Cut its Key Rate to 19% on July 25

Bottom Line: After Central Bank of Russia (CBR) reduced its key interest rate by 100 basis points to 20% on June 6, citing continued easing in inflationary pressures, including core inflation, we foresee that the rate will be further reduced to 19% on July 25 taking into account that inflation slowed to 9.4% in June from 9.9% in May; MoM price growth marked the lowest hike after August 2024; and the inflation expectations declined to 13% in June from 13.4% the prior month.

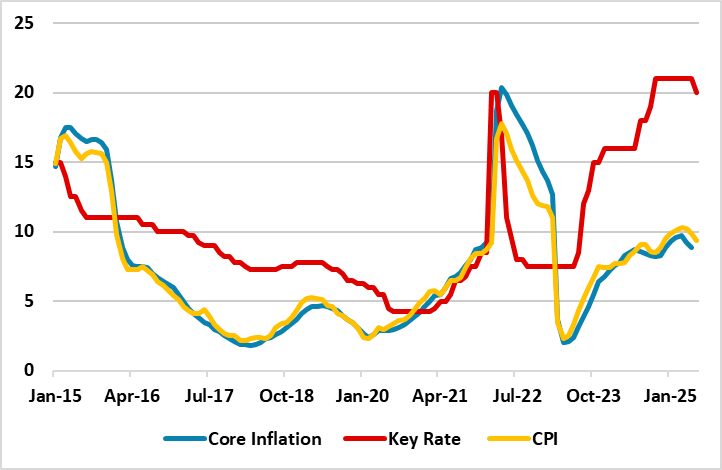

Figure 1: CPI, Core Inflation (YoY, % Change) and Policy Rate (%), January 2015 – June 2025

Source: Continuum Economics

The CBR will hold its next MPC meeting on July 25, and we think CBR will likely reduce the policy rate by 100 bps to 19% due to easing in inflationary pressures, including core and MoM inflation, and softening inflation expectations. (Note: Inflation slowed to 9.4% in June from 9.9% in May partly due to favorable base impacts, recent RUB strengthening and falling oil prices. Prices increased at a slower pace particularly for non-food items demonstrating the lagged impacts of previous tight monetary policy and a stronger RUB. MoM price growth fastened to 0.2% in June over the previous month, marking the lowest hike after August 2024). Of course, the CBR could also consider keeping the policy rate stable at 20% due to global uncertainties, but this is not our major scenario.

In addition to decelerating trend in inflation, the inflation expectations also declined in June to 13% from 13.4% the prior month. We also feel the pass-through of the earlier RUB weakening to prices, which increased in Q1, partly soothed after May. RUB gained about 5.7% of its value against the USD between May 1 and July 15. RUB is expected to remain strong in the short term unless new sanctions by the U.S. as mentioned by president Trump on July 15 or adverse geopolitical developments.

Russian policy makers also expect that CBR will continue its easing cycle on June 25. According to Reuters, deputy governor Zabotkin said late June that "CBR may even consider an interest rate cut of more than 1% on July 25 if labour market, credit activity, actual inflation, and inflation expectations data confirm that inflation is on track to slow down to 4% in 2026."

In addition to this, CBR noted in its last MPC statement that there are signs of economic cooling and easing price pressures emerged, while the monetary policy would remain tight for a long period in order to return inflation to its 4% target. The regulator expects the inflation to stand at 7% - 8% in 2025 and hit the target of 4% in 2026. We believe reaching 4% target will be very tough even in 2026, since cooling off inflation will take longer than CBR anticipates taking into account that demand stays elevated, military spending dominate, and global uncertainties remain strong.

We continue to think a peace deal in Ukraine is the real key to ease some pressure on inflation and alleviate demand-supply imbalances in Russia despite sealing a full-scale peace deal in Ukraine is unlikely in 2025. Taking into account that Russian business people and exporters pressurize CBR to continue cutting rates coupled with softening inflation and inflation expectations, we envisage the rate will be reduced to 19% on July 25.