Sticky Inflation in Russia Hits 10.2% YoY in April

Bottom Line: According to Russian Federal Statistics Service (Rosstat) data, inflation stood at 10.2% YoY in April after hitting 10.3% in March, remaining well above the Central Bank of Russia’s (CBR) midterm target of 4%, due to surges in services and food prices, huge military spending, and labor force crisis. We think that risks to the inflation outlook continue to remain upside until the war in Ukraine comes to an end.

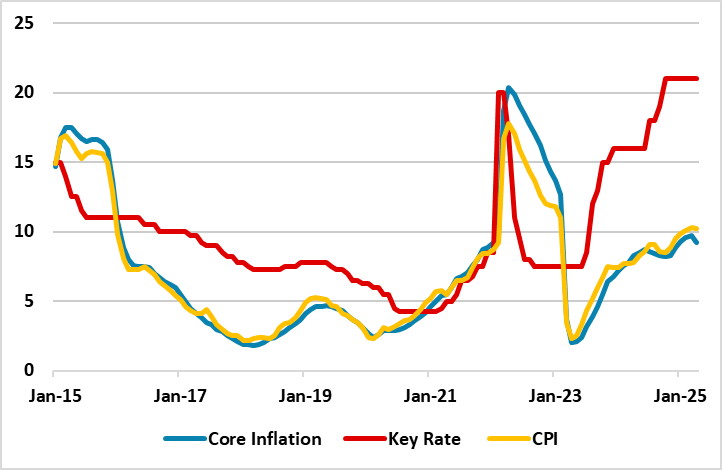

Figure 1: CPI, Core Inflation (YoY, % Change) and Policy Rate (%), January 2015 – April 2025

Source: Continuum Economics

According to Rosstat figures, sticky inflation rate hit 10.2% YoY in April. MoM price growth fastened to 0.4% in April driven by the services and food prices. The prices of food and services soared by 12.7% and 12.8% in annual terms, respectively, in April. The core CPI rose 9.2% on a yearly basis, and increased 0.3% MoM.

According to CBR’s summary of the key rate decision published on May 12, current inflationary pressures eased in Q1, albeit unevenly across various groups of goods and services while the food and services prices continued their rising trend.

CBR also highlighted in its MPC statement on April 25 that the key proinflationary risks are associated with a longer upward deviation of the Russian economy from a balanced growth path and high inflation expectations. A further decrease in the growth rate of the global economy and oil prices in case of escalating trade tensions may have proinflationary effects through the ruble exchange rate dynamics.

Speaking about the inflation, CBR governor Nabiullina recently stated that the importance of maintaining low inflation for the overall economy and added that “What we are saying is that it will be necessary to maintain tight monetary conditions for an extended period of time."

Despite the interest rates remain at their highest level in two decades at 21%, we think this has so far failed to soften rising inflation since the ongoing war in Ukraine exacerbates economic capacity constraints. We think there are no signs of a significant inflation slowdown in the horizon yet, despite favorable base effects can partly change the outlook in June and July.

Under current circumstances, we continue to feel reaching 4% target will be very tough even in 2026 since cooling off inflation will take longer than CBR anticipates taking into account that demand stays elevated and inflation expectations of households and businesses continue to stay high. We foresee a probable Russia-friendly peace deal in Ukraine could ease some pressure on inflation and be a relief for war-torn economy despite it appears the way to a full-scale peace deal will be very bumpy. We think that risks to the inflation outlook will likely remain upside until the war Ukraine comes to an end.