Russian GDP Growth Loses Steam in Q1

Bottom Line: Russia's GDP expanded by 1.4% YoY in Q1, the slowest pace of growth since the economy resumed expansion in Q2 2023 driven by military spending, higher wages and fiscal stimulus. The softening of growth figures demonstrates monetary tightening, sanctions, supply side constraints and higher price pressures remain restrictive. We envisage growth to hit 1.5% YoY in 2025.

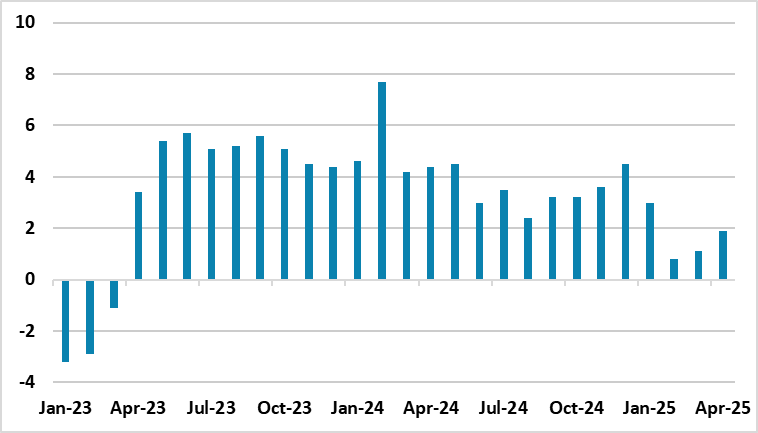

Figure 1: GDP Growth (%, Annual), January 2023 – April 2025

Source: Rosstat

Russia's GDP expanded by 1.4% YoY in Q1, the slowest pace of growth since the economy resumed expansion in Q2 2023 driven by military spending, higher wages and fiscal stimulus. The softening of growth figures demonstrates high interest rates, sanctions, and higher price pressures remain restrictive.

Central Bank of Russia (CBR) chief Elvira Nabiullina said on June 6 that the Russian economy is close to the scenario of balanced growth rates and the CBR does not see excessive cooldown of the economy. Speaking about the over-cooldown risk, Nabiullina highlighted that the risk of economic overheating is materialized in high inflation, and a tight labor market due to the full utilization of available labor resources.

The Ministry of Economic Development of Russia projects annual growth of 2.5% for 2025, while the central bank offers a more cautious outlook, predicting growth between 1% and 2%. The World Bank (WB) recently revised upward its forecasts for GDP growth next year in the June report expecting to see the economic growth by 1.4% in 2025 (up 0.2 ppt against January data), and by 1.2% in 2026. WB considers the slowdown of Russian economic growth is related to toughening of monetary policy of the country. Oil production, according to WB's report, will decline in early 2025 to 9.1 million barrels per day, which is 0.2 million barrels per day smaller than in 2024.

Additionally, president of the Russian Union of Industrialists and Entrepreneurs Alexander Shokhin recently underlined that the key priority at present is to maintain Russia’s economic growth rate at least at 2%, despite the uncertainty introduced by impending new sanctions from the EU and the U.S.

We envisage growth to hit 1.5% and 1.3% in 2025 and 2026, respectively, taking into account that monetary tightening, sanctions, supply side constraints and higher price pressures remain restrictive, which should be closely followed by the CBR in the upcoming months.