Moderate GDP Growth for South Africa in Q1: 0.1% QoQ, 0.8% YoY

Bottom line: South African economy grew moderately by 0.1% QoQ and 0.8% on a year-on-year basis in Q1 2025. According to Department of Statistics of South Africa (Stats SA) announcement on June 3, despite growth in agriculture, transport and finance, a strain on the mining and manufacturing industries continued to drag on growth. We foresee that the growth momentum will continue to be supported by improved consumer sentiment, low inflation, and interest rate cuts despite power cuts (loadshedding), coupled with uncertain global environment and slowing China demand will be important downside risk factors.

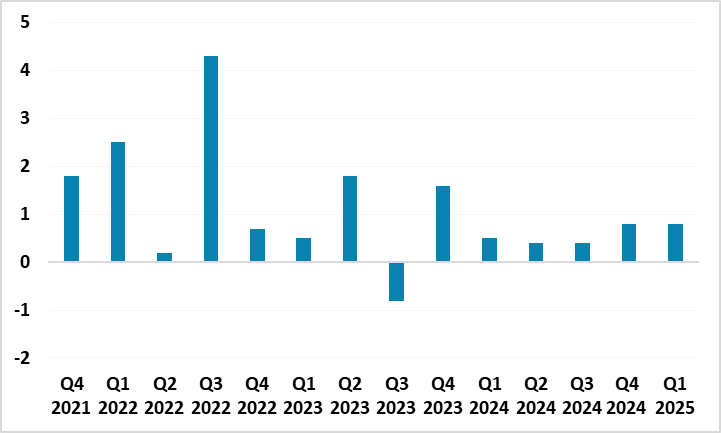

Figure 1: GDP Growth Rate (%, YoY), Q4 2021 – Q1 2025

Source: Continuum Economics

South African economy grew by 0.8% YoY, and 0.1 QoQ in Q1 2025 as Stats SA revised down its estimate of Q4 growth to 0.4% QoQ, from an initial estimate of 0.6%. According to Stats SA, four of the ten industries on the production (supply) side of the economy recorded positive gains, with agricultural production driving most of the upward momentum, expanding by 15.8% on a quarterly basis. Mining and manufacturing were the biggest drags in Q1.

Expenditure (demand) side of the economy was lifted by a rise in household consumption spending. Household consumption expenditure, which accounts for about two-thirds of GDP, grew 0.4% QoQ in Q1 expanding for a fourth consecutive quarter. Despite exports expanded for a second straight quarter and rose by 1.0% on a quarter basis, the imports outscored exports by surging 2.0% in Q1, contributing negatively to economic growth.

Despite the growth was partly fuelled by suspended loadshedding in Q1, the return of the power cuts as of March 2025 is worrisome for the growth trajectory. (Note: Eskom announced on May 13 that Stage 2 loadshedding would be implemented following a Stage 2 loadshedding on April 24, which suggested serious issues). Energy experts warn that the recent power cuts reminded that rolling blackouts are a serious threat. Additionally, it appears unexpected global outlook could pressurize South African growth outlook linked with increasing global trade risks following the additional tariff decisions by the Trump administration, which could be critical if the U.S. implements 30% additional tariffs on imports from South Africa following the 90-day pause.

It is worth noting that SARB revised its GDP growth prediction for 2025 to 1.2% YoY from 1.7% YoY on May 29, signalling that there is a downward trend in growth. We foresee that the growth momentum will continue to be supported by improved consumer sentiment, lower inflation, and interest rate cuts despite loadshedding, coupled with uncertain global environment will be important downside risk factors. We think uncertainty about the U.S. economy, and slowing China demand could cause problems over the growth outlook.