Sweden Preview (Jun 18): Riksbank to Cut and Reassess Policy Outlook?

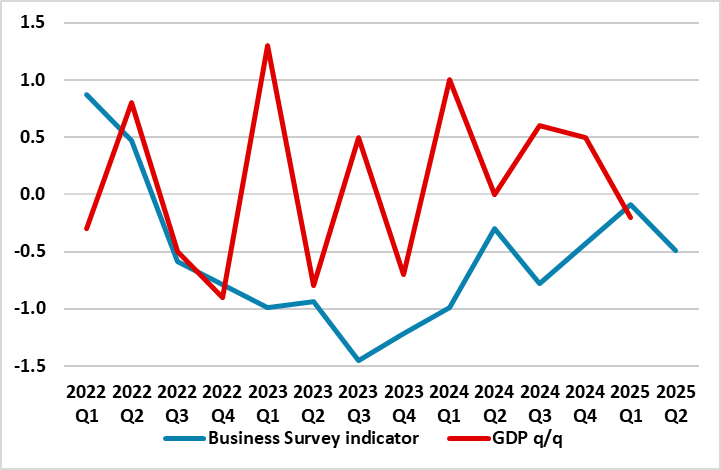

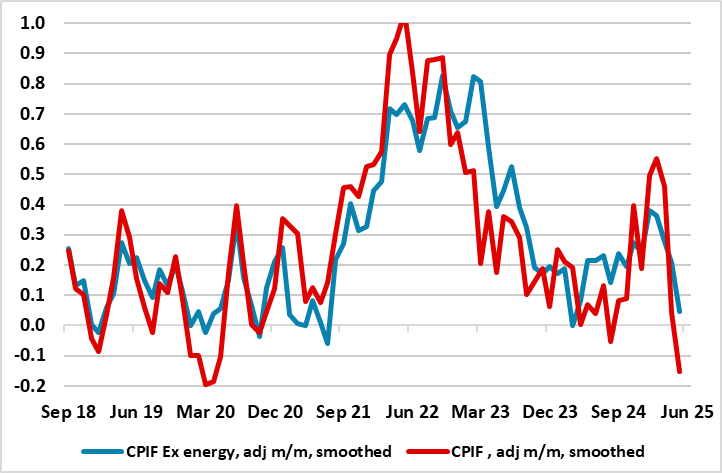

We are even more convinced that the Riksbank will cut further and as soon as the next Board verdict on Jun 18. Moreover, the Board may even then suggest that further moves are possible. This may seem stretched given that the Riksbank has virtually called a halt to the easing cycle, albeit most recently (May 8) suggesting downside risks to its inflation outlook might warrant a slight easing going forward. Our thinking has hitherto reflected both below par survey data (suggesting difficulties in predicting future business conditions) and better inflation outcomes. Indeed, a Riksbank business survey now suggest that what green shoots had appeared have fizzled out (Figure 1) while the latest CPI numbers suggest an absence of inflation (Figure 2).

Figure 1: Riksbank Survey Suggest Weakness Intensified

Source; Stats Sweden, Riksbank, figures are % chg q/q

But this view has been bolstered by fresh GDP data that not only showed a surprise drop in Q1 but hefty downgrades to the 2024 backdrop and where even these may be overstating activity given the much weaker and persistent softer growth picture pained by the Riksbank’s own business survey (Figure 1). Indeed, the survey noted that ‘the economic situation has weakened during the spring, and companies’ view of the economic outlook for the coming months has become significantly gloomier’ .This is important as it does seem as if the Riksbank has dismissed the Q1 GDP data as not indicative of nay need to reassess the economy backdrop. Instead, we suggest that the Riksbank may have to halve what we have for some time suggested was an optimistic 2.2% 2025 growth forecast and, as a result, may have to double its estimate of an output gap, this adding to downside inflation risks.

Regardless, the Riksbank bases policy on an assessment of the inflation outlook and the balance of risks associated with it. Surely an economy that may be more than a full ppt weaker than its existing thinking would suggest added downside price risks. But we think an even softer profile is likely, both as trade tensions and uncertainties persist and given the manner that the jump in exports in Q1 may reverse as it was likely based on anticipating U.S tariffs being imposed from Q2 onwards. As for the tariff threat, it is noteworthy how important the U.S is to Sweden. As a Riksbank research paper notes - the Swedish economy is closely linked to the United States, both directly and through global value chains, and Swedish exports to the United States have increased in recent years. The United States is Sweden's third largest destination for exports of goods with goods export based around tariff threatened motor vehicles, pharmaceuticals and machinery

Figure 2: Core Inflation Running Near Zero?

Source; Stats Sweden, Riksbank, CE – smoothed is 3 mth mov avg

Indeed, on the basis of the updated GDP backdrop, we have revised our 2025 growth rate to just 1% (from 1.5%). The Riksbank may not follow this fully when it updates its own projections next month, but it will have to pare back significantly its above consensus and what we have form time suggested was an optimistic 2.2% projection for the current year to somewhat well below its estimate of current potential (ie 1.8%). As a result, rather than suggesting that Sweden’s output gap may shrink from 1.4% of GDP in 2024 to around 1% this year, it may have to point to a gap nearer 2%. Against this backdrop and outlook, it is not surprising that inflation seems to be buckling afresh, with adjusted core m/m numbers now near zero. To us, this very much necessitates a fresh assessment of the inflation outlook and risks that we think will occur next week, this justifying a fresh 25 rate cut on June 18 and the flagging of possible further moves beyond, although our base case remains the likely 2% outcome persisting into 2027!