SNB Preview (Jun 19): Toying With Being Negative?

A further 25 bp cut (to zero) in the SNB policy rate on Jun 19 now looks almost certain. Weak(er) business surveys suggest that the tariff threat is both tangible and growing and this is before key Swiss pharmaceutical exports come under fire. Meanwhile, there is the strong currency where FX intervention on aby major scale could provoke US retaliation against alleged currency manipulators. Both these factors suggest such a further SNB rate cut is likely, especially with zero CPI inflation undershooting even the SNB’s timid expectations. But going under the radar is the fact that the SNB may be judging the inflation undershoot in an even more worrying light as opposed to merely being a part-currency induced fall in import prices. Indeed, domestic inflation has fallen and is running near zero too more recently, suggesting that should further tariffs bring the global disinflation many anticipate then Switzerland may see persistent negative inflation rates. With this in mind the SNB is seemingly justified in not ruling out a return to negative policy rates.

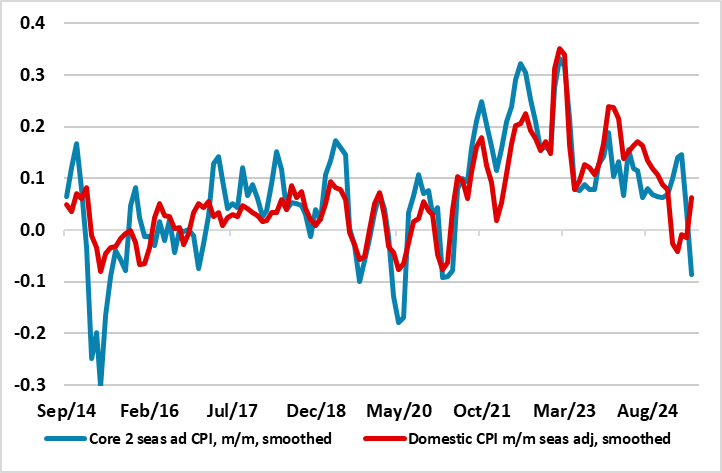

Figure 1: Swiss Disinflation Now Encompassing Domestic Price Weakness Too

Source: SECO, CE

The Swiss economy is very exposed to global trade with exports representing some 68% of GDP and goods exports alone some 48% and where some 2%-plus of Swiss GDP comes from exports to the U.S. Thus the 10% tariff the US has imposed is a clear risk, as is that from the threat of a 25% levy on pharmaceuticals. The latter sector represents some 7% of Swiss GDP (ie a larger share than the infamous financial sector) and where the bulk of pharmaceutical exports are to the U.S. Admittedly, given the clear competitiveness of its exporters (often on matters beyond price), Switzerland’s high value-added exports are likely to be redirected toward other new and existing trading partners, offsetting part of the drop in U.S. exports. As a result, we feel at this juncture that our semi-consensus and below-trend GDP outlook of 1.3% and 1.2% growth this year and next respectively remains valid, albeit with activity suspect to a correction back in the near-term to the huge export surges that have boosted growth in the last two quarters reverse. Even so, Swiss resilience as seen of late will continue in the face of both a tariff threat and tariff reality.

But the tariff threat also poses a clear disinflationary risk both from somewhat more subdued demand but also from displaced exports that would have gone to the U.S. Indeed, it is highly likely that a good portion of the USD 500 bln of Chinese exports to the U.S. may look for a new home with W Europe a clear target and with a lower prices attached to foster the needed demand. The question is whether, faced with a huge influx of imports from China, European consumers and companies would increase their overall, purchases or merely substitute domestic purchase for those from abroad. Either way this is likely to be disinflationary for W Europe.

And for Switzerland, this will merely add to disinflation pressures elsewhere. To many, the strong Franc poses the clearest such disinflation, but this is only partly responsible for imported consumer goods inflation now running below -2% y/y. But perhaps the greater threat, at least now emerging, is from domestic goods inflation. This is running at just 0.8% y/y, having more than halved in the last six months. But as Figure 1 shows this masks even clearer domestic disinflation of late with adjusted m/m data suggesting that it now running at around zero, actually softer than the main core CPI measure. This therefore means that the SNB faces a triple disinflation threat ahead; from abroad from tariffs and the exchange rates but also now and increasingly at home. Admittedly, the SNB’s inflation target offers flexibility in that it merely stipulates inflation n below 2%, but the prospect of persistent negative headline inflation is not one the SNB will take lightly. Even so, negative rates are a risks with a baseline still being rates at zero into 2027!