Russia GDP Growth Continues to Lose Steam

Bottom Line: According to Ministry of Economic Development figures, Russia's GDP expanded by 1.2% YoY in May following a 1.9% rise the previous month, which marked one of the lowest pace of growth since the economy resumed expansion in Q2 2023, driven by military spending, higher wages and fiscal stimulus. We think softening of growth figures demonstrates monetary tightening, sanctions, supply side constraints and higher price pressures remain restrictive, and we envisage growth to hit 1.5% YoY in 2025.

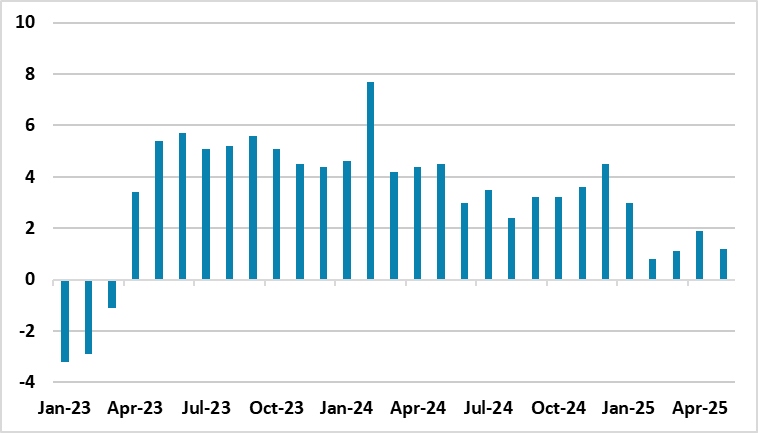

Figure 1: GDP Growth (%, Annual), January 2023 – May 2025

Source: Ministry of Economic Development

According to Ministry of Economic Development’s announcement, Russia's GDP expanded by 1.2% YoY in May, one of the lowest pace of growth since the economy resumed expansion in Q2 2023 driven by higher wages, fiscal stimulus, public spending in war-related industries and construction. The relative softening of growth figures demonstrates high interest rates, sanctions, and higher price pressures remain restrictive.

According to the announcement, the economy grew by 1.5% in the first five months of 2025, which marks a significant slowdown when compared to 4.3% YoY GDP growth in full-year 2024.

Speaking about the growth trend, Central Bank of Russia governor Elvira Nabiullina recently said that “We have been growing at a fairly high rate for two years, but we need to understand that many of resources are now exhausted. We need to think about a new growth model.”

It appears the current signals demonstrate that the economy is facing the biggest economic slowdown since the start of Ukraine war. Despite manufacturing continues to grow, most other sectors do not grow at the same pace when compared to 2024. It is worth noting that S&P Global recently reported that Russia's manufacturing Purchasing Managers' Index decreased to 47.5 in June from 50.2 in May, which marked the sharpest pace of contraction since March 2022. The downturn in new sales was solid overall and the quickest since March, S&P Global said. The fall in new work was attributed by firms to reduced purchasing power at customers and weak client demand, the agency explained.

Despite concerns, the Ministry of Economic Development projects annual growth of 2.5% for 2025, while the CBR offers a more cautious outlook, predicting growth between 1% and 2%. The World Bank (WB) recently revised upward its forecast for 2025 GDP growth from 1.2% to 1.4%. The International Monetary Fund (IMF) predicts growth to hit 1.5% in 2025.

We envisage growth to hit 1.5% and 1.3% in 2025 and 2026, respectively, which are significantly less than 2024 figure, as aggressive tightening cycle is still feeding through, capacity utilization reached its maximum in years, and labor force deficit is unlikely to change in the short term. The key will be how peace negotiations in Ukraine will proceed in H2 2025. A full-scale peace deal in 2025 could have helped Russian economy to feel relief, but we foresee that a peace deal is very unlikely in Ukraine in 2025.