SNB: Cut to Zero, But Negative Rates an Option

The SNB would probably prefer to consolidate the effects of previous rate cuts, but the low inflation forecast and downside risk to inflation means that a cut to -0.25% is feasible at the September or December meetings. The SNB will also hope that the threat of negative rates restrains the CHF strength and encourages banks to lend, though the FX market is more focused on USD momentum rather than a further rate cut threat.

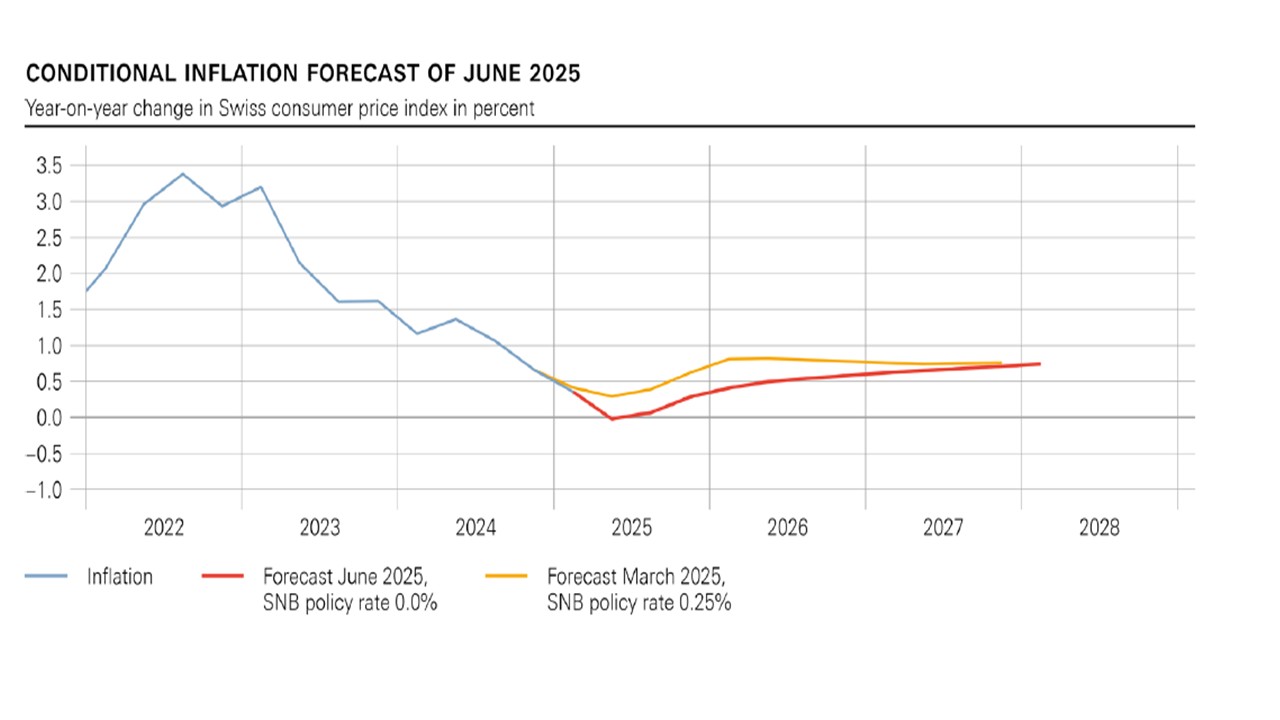

Figure 1: SNB CPI Inflation Projections

Source: SNB

As expected the SNB cut the policy rate from 0.25% to zero at the June meeting. Key points to note

· Inflation forecast. The short-term inflation forecast was trimmed, given the recent soft CPI inflation outcomes. GDP forecasts for 2025 and 2026 at 1.0-1.5% are consistent with market thinking. Though the medium-term forecasts were hardly changed (Figure 1), they still remain low with 2027 inflation at 0.7%. The SNB statement noted that these are consistent with price stability, but the SNB has been cutting with inflation forecasts this low. The SNB thus could have to cut back into negative territory and SNB officials will likely make clear that this is an option.

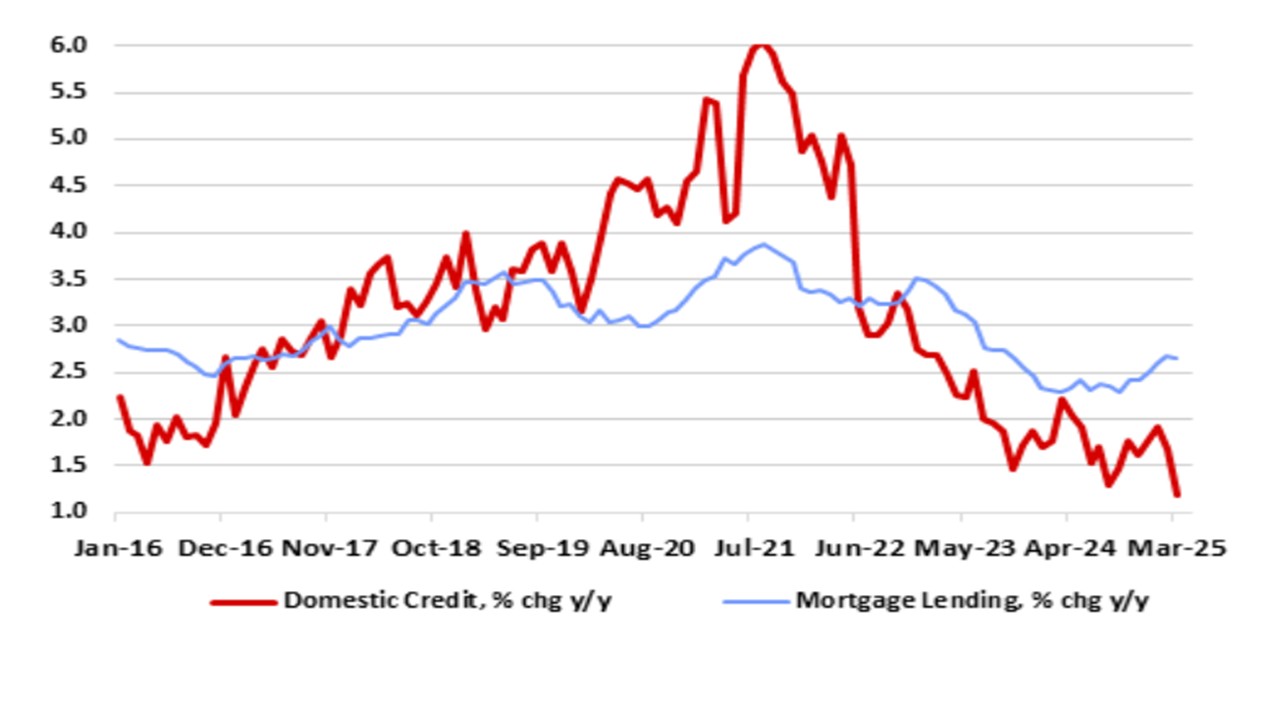

· Disinflation threat and negative rates. The SNB faces a three pronged disinflationary threat from tariffs imposed by the U.S., strong CHF and domestic disinflation. These all produce threats to the downside for the inflation forecast. The U.S. is likely to impose a 25% tariff on pharmaceuticals in the coming months, which would further hit Swiss exports and production. The USD is in a multi-year downtrend, with the CHF being one of the leading edges of the move. Finally, domestic inflation pressure is subdued, with domestic credit growth soft and consistent with low inflation (Figure 2). The SNB would probably prefer to consolidate the effects of previous rate cuts, but the low inflation forecast and downside risk to inflation means that a cut to -0.25% is feasible at the September or December meetings. The SNB will also hope that the threat of negative rates restrains the CHF strength, though the FX market is more focused on USD momentum rather than a further rate cut threat.

· As for the effective 'stealth' negative rate (as sight deposits held at the SNB will be remunerated at the SNB policy rate only up to a certain threshold) may be partly designed to encourage banks to lend given the weakness in private sector credit (Figure 2).

Figure 2: Swiss Credit and Mortgage Lending (% Yr/Yr)

Source: Datastream