Deceleration in Inflation, Albeit Gradual, Continued in June: 9.4% YoY

Bottom Line: According to Russian Federal Statistics Service (Rosstat) data, inflation stood at 9.4% YoY in June after hitting 9.9% YoY in May, partly due to favorable base impacts, recent RUB strengthening and falling oil prices. We think the recent tariffs hike for electricity, gas, heating and water prices on July 1, increased military spending and global uncertainties continue to pose risks. The inflation outlook will remain upside until the war in Ukraine comes to an end, which is very unlikely in 2025. Our 2025 average headline inflation projection stays at 9.4% due to an overheated economy.

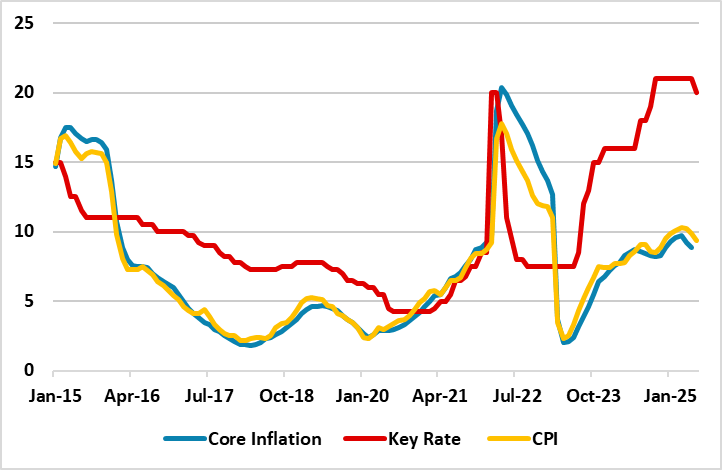

Figure 1: CPI, Core Inflation (YoY, % Change) and Policy Rate (%), January 2015 – June 2025

Source: Continuum Economics

According to Rosstat figures, on annual terms, inflation slowed to 9.4% in June from 9.9% in May partly due to favorable base impacts, recent RUB strengthening and falling oil prices. Prices increased at a slower pace for food (11.9% YoY in June vs 12.5% in May). Nonfood prices ticked up by 4.5% YoY. Service sector inflation has cooled to 12.0% in annual terms, which can be associated with strengthening ruble and a modest slump in consumer demand. MoM price growth fastened to 0.2% in June over the previous month, marking the lowest hike after August 2024.

Despite partial relief, we foresee the recent tariffs hike for electricity, gas, heating and water prices on July 1 could pressurize overall prices in the upcoming months. (Note: The average tariffs increased by 11.9% this year when compared to last year’s 9.8% hike). The inflation risks are still tilted to the upside over the medium-term as the fiscal policy is making a big contribution to domestic demand. High military spending, likely deterioration in the terms of external trade during ongoing trade wars, global uncertainties, and rising wages do not signal a significant permanent inflation slowdown in the horizon yet. Our 2025 average headline inflation projection stays at 9.4% due to an overheated economy.

The CBR foresees 2025 end-year inflation will stand at 7-8%. CBR noted in its last MPC statement that there are signs of economic cooling and easing price pressures emerged, while the monetary policy would remain tight for a long period in order to return inflation to its 4% target. (Note: The central bank expects inflation to be on target by 2026).

Speaking about the course of inflation, CBR governor Nabiullina underscored early July that inflation is slowing faster than the central bank expected, and there are signs of easing in the severity of labour market shortages. Nabiullina added that the RUB’s recent strengthening has contributed to slowing inflation.

We continue to think a peace deal in Ukraine would be key to ease some pressure on inflation and alleviate demand-supply imbalances in Russia despite sealing a peace deal will likely take longer-than-expected, while a deal in 2025 is very unlikely under current circumstances. We believe reaching 4% target will be very tough even in 2026, since cooling off inflation will take longer than CBR anticipates taking into account that demand stays elevated, military spending dominate, and global uncertainties remain strong.